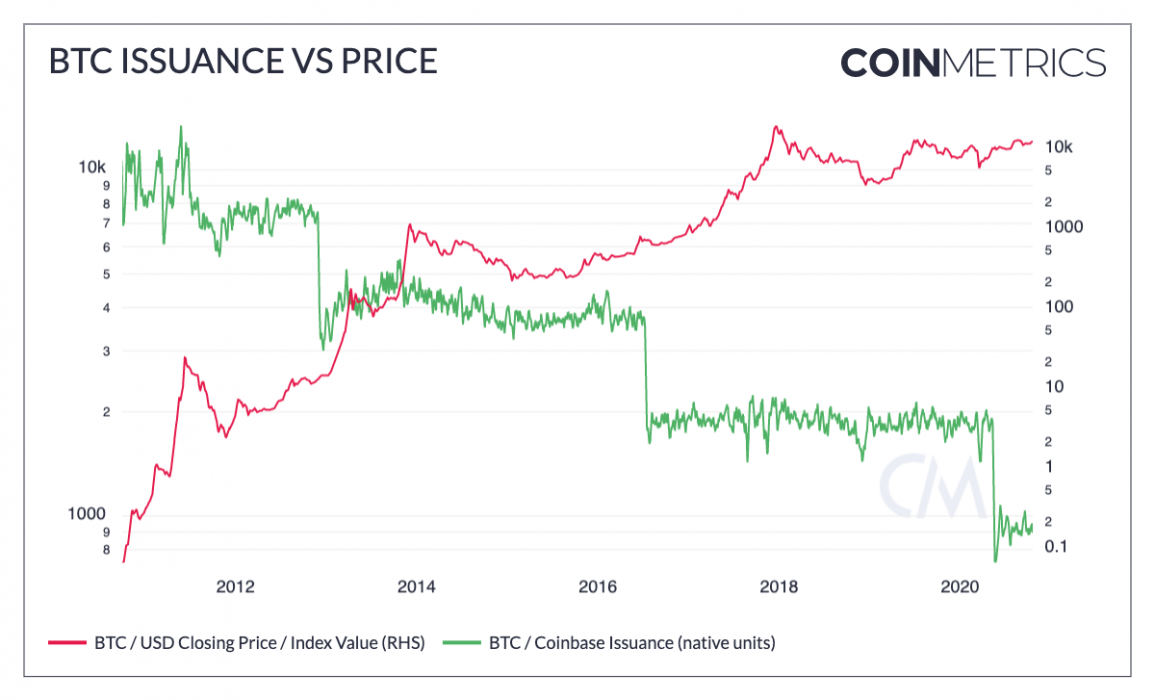

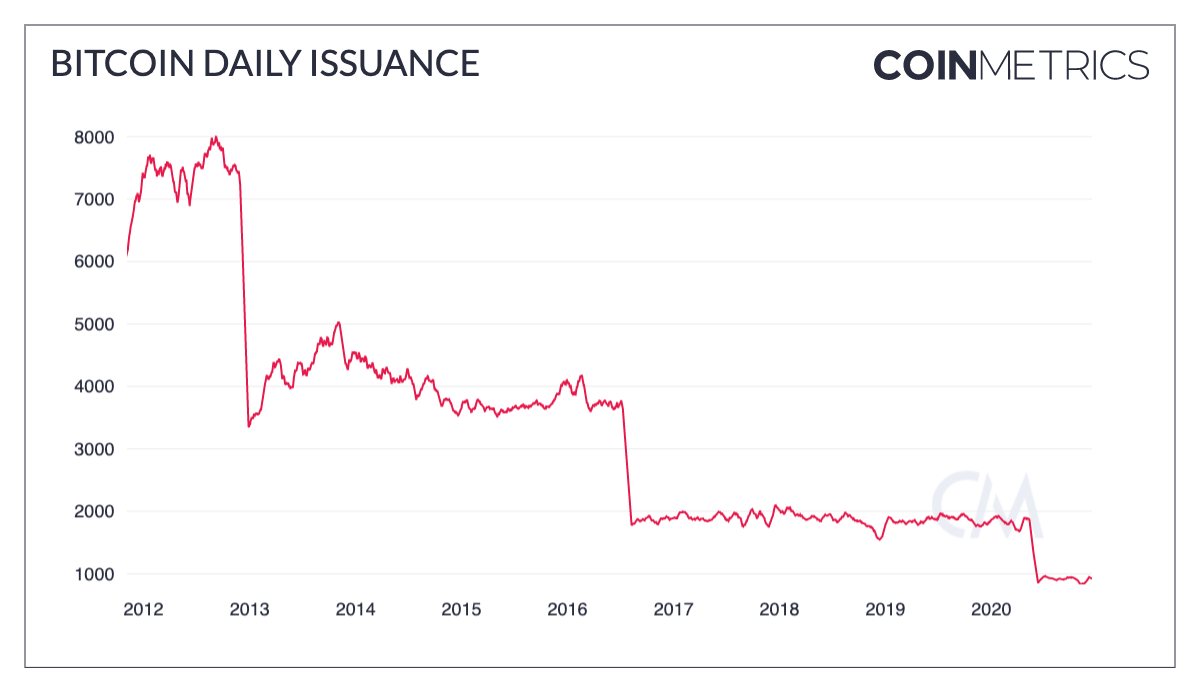

Bitcoin issuance is decreased by 50% every four years. These halvings are also a core part of the Bitcoin protocol, and are predictable well into the future.

New bitcoins are issued every time a new block is mined as a reward for the miner who successfully mined the block. This is the only way that new bitcoins can be created and is a key part of the Bitcoin protocol.

Bitcoin’s current block reward is 6.25, which means 6.25 new bitcoins are issued every time a block is mined. On average, blocks are mined every ten minutes, which typically means about 800-1000 new bitcoins are issued every day. There’s slight variance from day to day due to the unpredictable nature of exactly how often new blocks are mined (Bitcoin’s difficulty adjusts every two weeks to keep the average block time around ten minutes), but over the long term this supply issuance is deterministic and predictable.

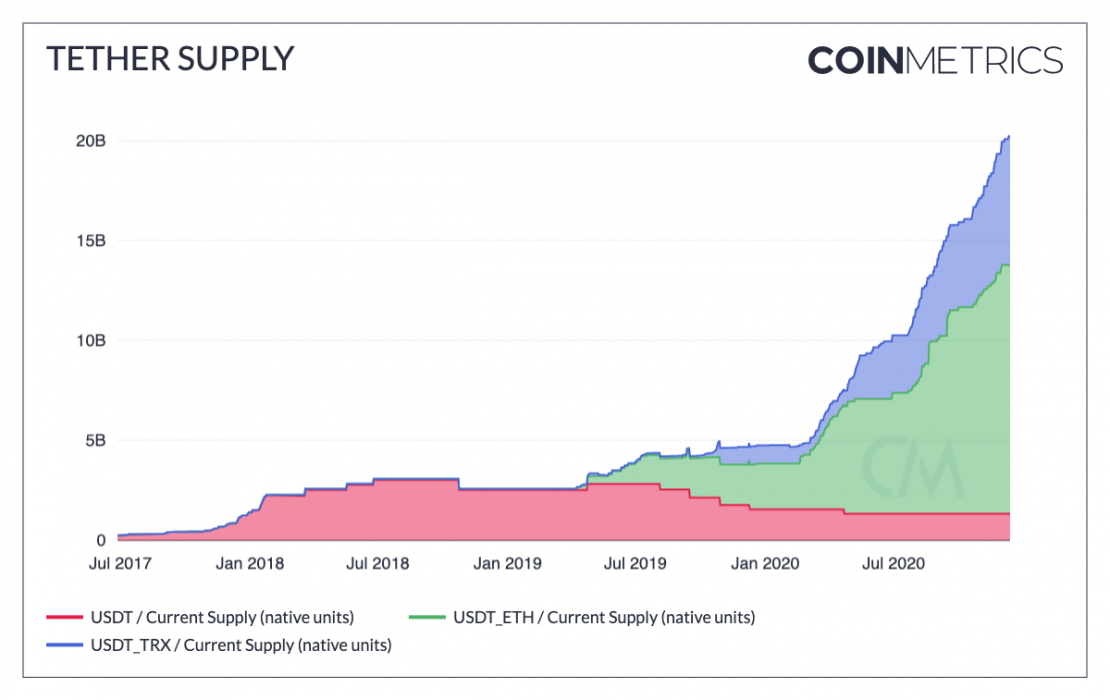

Tether (USDT) Supply Soars

Tether’s total supply has passed 20 billion. After initially launching on Omni, the Ethereum based version of Tether (USDT_ETH) and Tron based version of Tether (USDT_TRX) have both grown rapidly over the last year (see our report “The Rise of Stablecoins” for an exploration of why stablecoins have been exploding). Tether is still the undisputed leader of stablecoins, with over 5x the supply of any other stablecoin. But regulatory action is once again heating up with the recent introduction of the STABLE Act. Tether may once again come under fire in 2021.