Binance — the largest cryptocurrency exchange by worldwide volume — announced today that it is joining FinTech Australia, the most influential advocacy body for the FinTech industry in the country.

In an announcement published August 26, Binance stated that Binance Australia, which functions as the Australian affiliate of the Binance platform, will be taking a seat as a FinTech Australia member. The Australian arm of the exchange will be joining other major finance tech platforms such as Square, Stripe, Afterpay, and Transferwise.

FinTech Australia focuses on advocating for the development of next-generation technology-driven financial platforms and services in Australia, connecting different stakeholders in the Australian financial ecosystem in order to challenge existing financial structures and catalyze growth.

Binance Australia CEO Jeff Yew highlighted the strength of the Australian fintech development ecosystem in the announcement, noting the adaptive position the Australian government has adopted regarding the future of fintech in the country:

“We’re excited to be joining the FinTech Australia … As a trusted body and key leader in the digital asset industry, we are committed to working with peers and regulators to drive discussion that supports constructive policy development that advances the financial services sector in Australia”

Advocacy for Supportive Aussie DeFi Ecosystems

In addition to promoting the development of fintech in Australia, FinTech Australia also promotes adaptive regulatory changes in Australia — recently pushing for and achieving the incorporation of several changes to the ASIC’s Enhanced Regulatory Sandbox guidance and notification form, which has a significant impact on the future of blockchain-driven decentralized finance

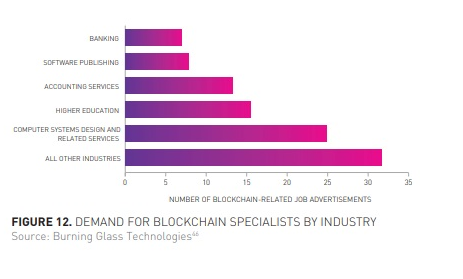

The new collaboration between Binance Australia and FinTech Australia will focus on expanding cryptocurrency adoption, as well as the development of crypto-related markets and industries.

“We aim to bring additional cryptocurrency expertise to FinTech Australia’s membership base. It’s important for us to continually drive awareness and education of cryptocurrencies to increase adoption in Australia. We believe this will lead to more innovation and economic opportunities across the nation.”