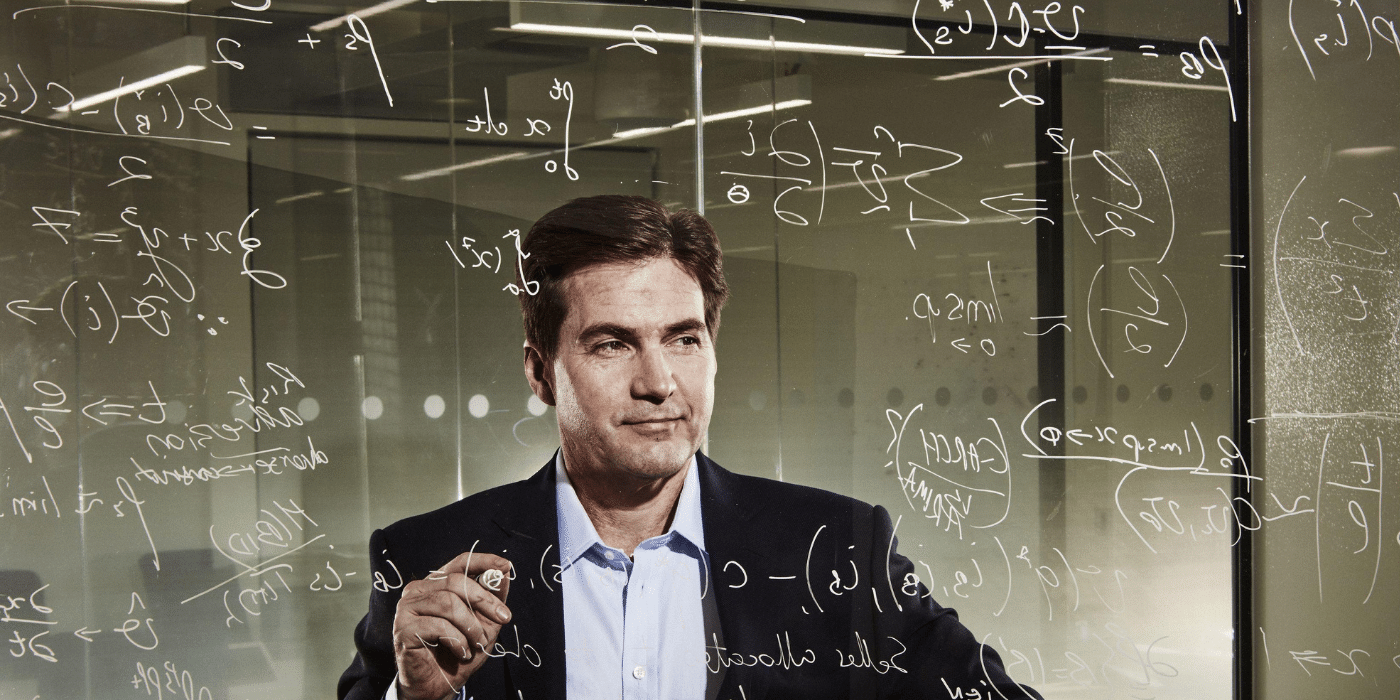

Australian businessman Dr Craig Wright is a much derided figure within the Bitcoin community who infamously claims he is the creator of Bitcoin. Following his lawsuit filed earlier this year, the London High Court has granted default judgment for copyright infringement against “Cøbra”, the pseudonymous operator and publisher of the bitcoin.org website.

Did “Cøbra” lose the case on the merits? Not quite; he didn’t even bother defending it.

Wright Sues for Copyright Infringement

Earlier this year, Wright obtained permission to sue “Cøbra” for copyright infringement for unlawfully publishing the Bitcoin Whitepaper “Bitcoin: A Peer-to-Peer Electronic Cash System”.

In his claim, the self-described student, researcher, lawyer, banker, economist, pastor, coder, investor and mathematician argued that he owned the copyright to the seminal document under the moniker “Satoshi Nakamoto”. Although he currently claims that Bitcoin is a ponzi, his legal team was quick to point out that:

Dr Wright does not wish to restrict access to his White Paper [which is freely accessible on his blog, https://craigwright.net/bitcoin-white-paper.pdf] but does not agree that it should be used by supporters and developers of alternative assets, such as Bitcoin Core, to promote or otherwise misrepresent those assets as being Bitcoin, given that they do not support or align with the vision for Bitcoin as he set out in his White Paper.

Ontier LLP, Source: https://www.ontier.net/ia/wright-v-cobra-ontier-press-release.pdf

Wright Claims a “Win” in His Lawsuit

In legal proceedings, there are two types of quick wins – summary judgment and default judgment. Summary judgment is awarded when the defendant has filed a defence but the court finds there is no prospect of success. Default judgment, however, is when the defendant doesn’t file a defence in the first place.

In the case against “Cøbra”, default judgment was awarded together with legal costs in the amount of £35,000 (US$48,400). In other words, the defendant didn’t even try to mount a defence, as it was considered “a waste of time”.

Aside from legal costs, the order also required that “Cøbra” remove the Whitepaper and put a notice on the website informing visitors of the default judgment for a period of six months.

In an underhand jibe directed at Wright, “Cøbra” issued the following statement on Twitter:

In a post, “Cøbra” noted that the Bitcoin Whitepaper located at https://bitcoin.org/bitcoin.pdf wouldn’t be accessible to UK-based visitors, but that ultimately, he hoped that the truth would prevail.

What Are the Odds That Wright Created Bitcoin?

Most Bitcoiners will tell you “no chance”, but if you were feeling charitable, you could argue the odds are marginally higher than zero.

Despite his credentials, Wright is largely discredited in crypto circles. Entire websites have been created to disprove his claim that he created Bitcoin, and even the otherwise reserved Ethereum founder, Vitalik Buterin, has called Wright a “fraud“. Most recently, he commented:

I view Craig Wright as being kind of like a Donald Trump figure and that, like, he’s not very intellectual. I think he gets a big audience because he says things that like to play to the resentments that people have.

Vitalik Buterin on the Lex Friedman Podcast

It’s not often that proponents of Bitcoin and Ethereum agree. The fact that they agree on the topic of Dr Wright is in itself revealing.

Wright’s litigious nature suggests the saga is not likely over. At the time of writing, he was still embroiled in court proceedings demanding access to 111,000 bitcoins held in two addresses which he claims were “stolen”.