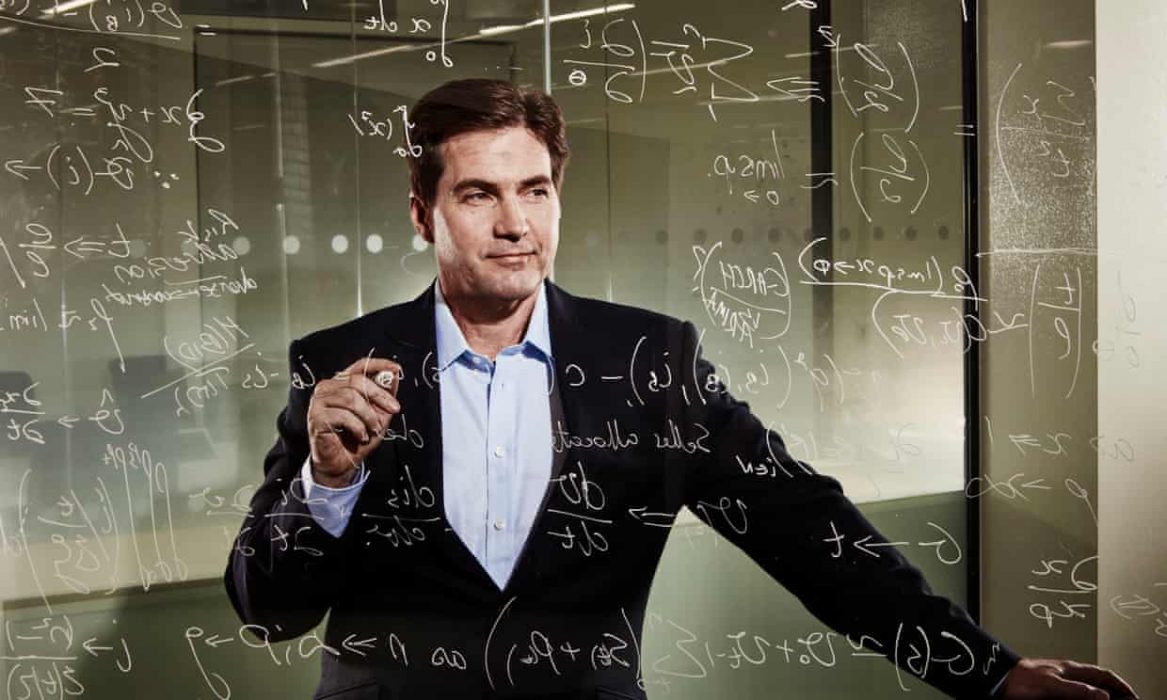

Craig Wright is in the news again, this time with his ongoing court case to get access to 111,000 Bitcoin (over $7 Billion AUD) held in two digital addresses – he claims the private keys were “stolen” earlier this year.

The Australian computer scientist who now lives in the UK, claims he is Satoshi Nakamoto who created Bitcoin, and has launched a London high court lawsuit against 16 Bitcoin Core software developers in an effort to secure his “lost” Bitcoins.

“Our client has always maintained that he created Bitcoin to operate within existing laws and that in the event of loss or theft, where legitimate ownership can be proven, the developers have a duty to ensure recovery,”

Paul Ferguson, lawyer representing Wright

The case is largely centred on who wrote Bitcoin’s whitepaper, which first outlined the vision of Bitcoin and was published under the pseudonym Satoshi Nakamoto in 2008.

It does seems odd, that a person so deliberately private and anonymous would suddenly feel the need to burst into the spotlight and claim the title as the great Creator of Bitcoin.

Reached by email, Cobra from Bitcoin.org said:

“We’ve been threatened to take down the Bitcoin whitepaper by someone who obviously isn’t the inventor of Bitcoin (if he was, that would make him the 25th richest person in the world, which he obviously isn’t).

Cobra

It remains to be seen if the courts will decide in favour of these seemingly absurd and highly controversial claims. It smells a bit like the old classic, “the dog ate my homework”. If you can’t prove it, then you don’t own it. The true power of the blockchain is that it is so beautifully open and transparent.

If Craig Wright really is Satoshi Nakamoto, could he retrace the breadcrumbs and provide real evidence to back up his claims?

Stay tunes to see how this court battle pans out.

Related news: