A recent report commissioned by CPA Australia has singled out Ripple’s XRP as a good token on which to possibly build a CBDC.

The report takes a look at Bitcoin and Ethereum as well, and outlines why they are not as attractive a choice for a potential CBDC.

Volatility Not Welcome

The RBA has been see-sawing for a while on the issue of CBDCs – first researching them, then deciding that there is no reason to work on one before stating that they’re continuing their research anyway. In the meantime, other countries have also been carrying out CBDC-related research independently.

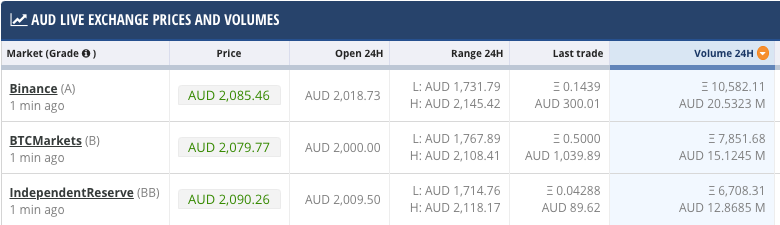

In the new report, CPA states that in their opinion, Bitcoin is far too volatile to ever host a CBDC – which should match the value of current legal tender.

“Despite it not being legal tender, Bitcoin is popular, and it is accepted as a medium of exchange in many places. Bitcoin’s price has been subject to spectacular volatility in recent years and this volatility has resulted in a lack of confidence in Bitcoin as a medium of exchange or as a store of value and raised concerns among central banks as to the viability of cryptocurrencies as CBDCs.”

The report goes on to state that although Ethereum is in a better spot due to its’ capability of hosting smart contracts and the like on its network, Ethereum is too decentralized to be able to be used safely by banks – however, it’s worth nothing that during the RBA’s CBDC experiments, tokens minted on the Ethereum blockchain were used.

CPA’s report appears to take a stance that greatly differs from that of the American SEC regarding Ripple. While the SEC claims that XRP’s more centralized nature could lead to it being more of a security than Ethereum, CPA states that this very centralization makes it a much more viable too for the creation of a CBDC.

CPA are not the only ones to claim that the nature of Ripple could spur on the creation of CBDCs – Banque de France reportedly believes the same thing, as pointed out in the report.