It’s been an impressive week for the Binance ecosystem. Starting with the Binance Coin (BNB), the-now third-largest cryptocurrency caught many people by surprise following the massive increase in the price to slightly over US$300 during the time of writing. On that value, the BNB coin had a market capitalization of over US$46 billion.

Following the boom in Binance Smart Chain (BSC) also, one of the leading cryptocurrency exchanges in Australia, Swyftx, has announced plans to list the native digital currency of two projects running on the BSC.

Swyftx to List PancakeSwap and DODO token

As the crypto exchange tweeted on Friday, it’s set to launch the native cryptocurrency of PancakeSwap (CAKE) and DODO (DODO) on its platform, extending support for the Binance ecosystem to Australia. The exchange didn’t mention any trading pairs for the cryptocurrencies. However, once they are listed, the users will be able to purchase and sell these cryptocurrencies right from the Swyftx exchange.

The CAKE and DODO tokens are also seeing an increase in market value. During the time of writing, the CAKE token was trading at the value of US$17.47 on Coinmarketcap. CAKE has a circulating supply of over 119 million and a market capitalization of $2.079 billion. At the same time, the DODO token was trading at $US5.94, which represents over a 28 percent increase on a 24-hour count. It has a circulating supply of 95,459,184 DODO and a US$567 million market cap.

What’s With Binance Smart Chain

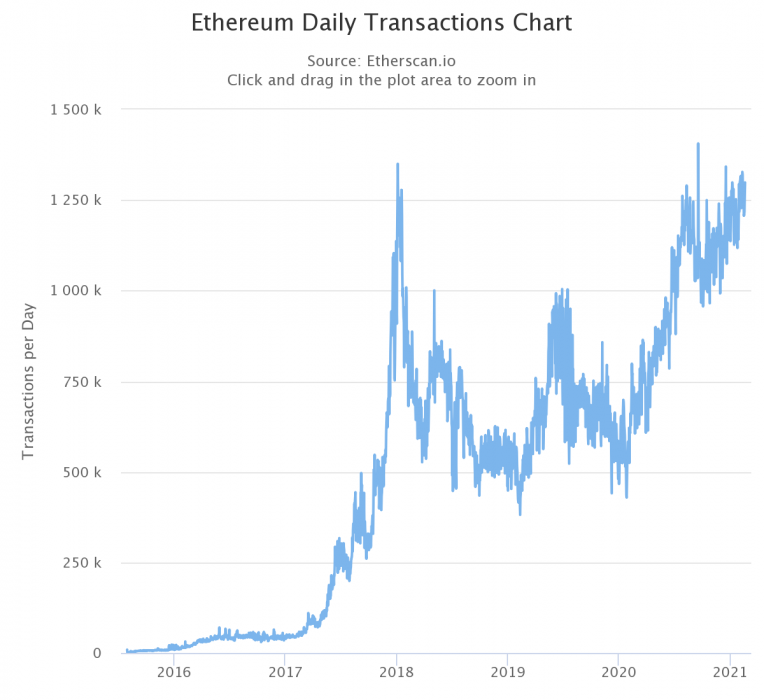

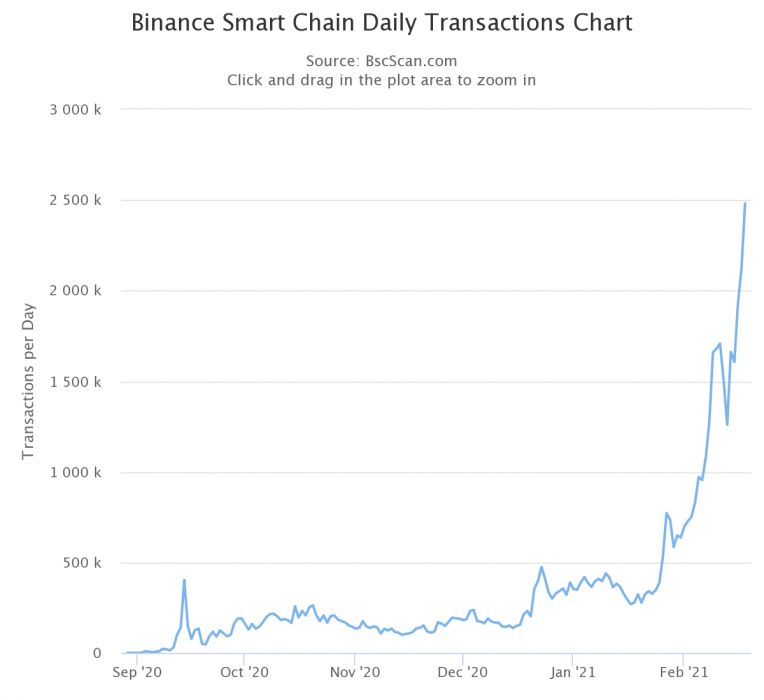

The boom in BSC is coming as the transaction fee on the Ethereum blockchain is hitting the roof. Many people are diverting to BSC due to the low transaction cost, for instance, DODO. Interestingly, the Binance Smart Chain now records more transactions than Ethereum, which is considered a major flippening.