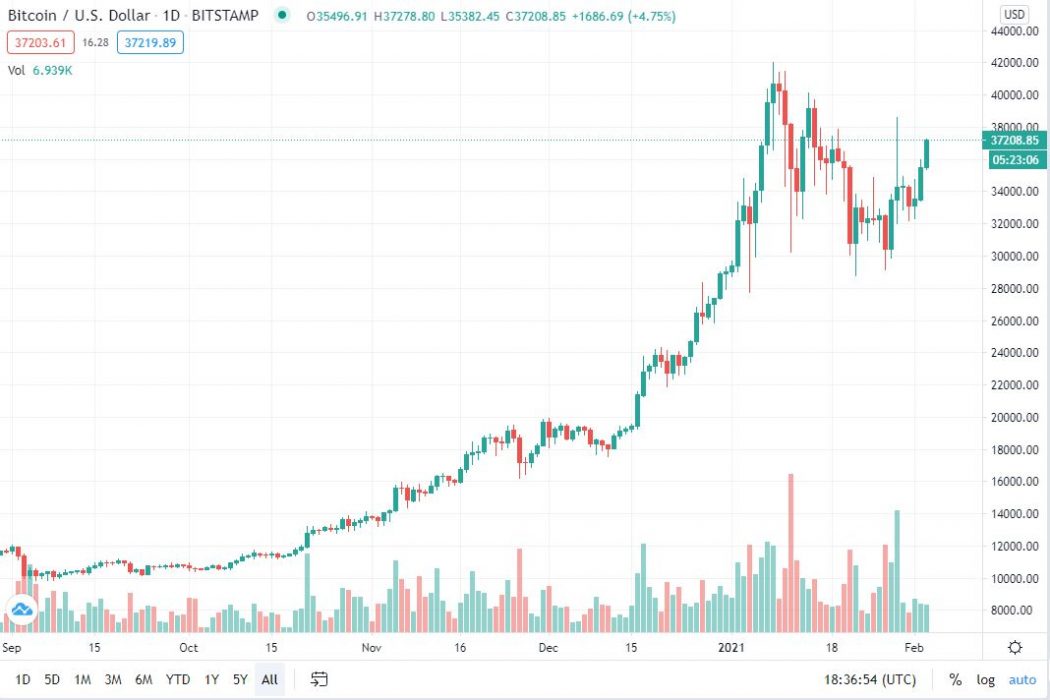

It looks like Bitcoin’s new All-Time High has outage several exchanges including Kraken and Binance. For its part, Kraken has suspended sign-ups due to immense demand from traders and massive traffic on its platform.

As stated on the Kraken platform, sign-ups are temporarily suspended, and —not surprisingly— other exchanges are struggling to keep up with massive traffic. The new bull run driven by Tesla’s $1.5B investment has injected Fear Of Missing Out —FOMO— among other traders who are now desperate to jump in on the recent action.

Sign-ups are temporarily disabled due to extremely high demand. Our engineers are still working to resolve the issue and we will share any updates as soon as they become available.

Binance also experienced the setbacks that the new BTC ATH brought, like massive traffic, lag, and auto-scaling.

Bitcoin to the Moon?

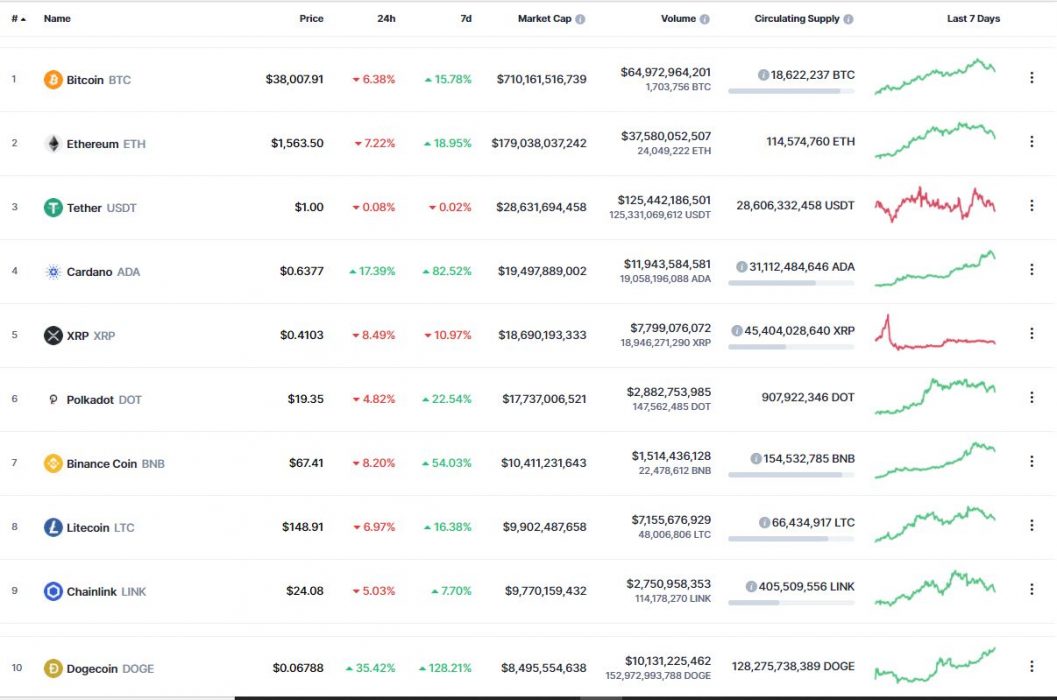

Much has been said about the future of Bitcoin and what price can it reach in 2021. January was a month full of extreme volatility, reaching $42K, and then dropping and surging more than 15-20% from both sides every week. But as more institutions jump in, JP Morgan’s prediction of $145K for BTC isn’t that far away.

JP Morgan, a top investment bank in the United States, referred to Bitcoin as the “Digital gold for Millenials” that could reach more than $100,000. But Australian analyst Mark Rodda believes that BTC still has a long road to reach $100K.

More Challenges for Exchanges

It has become usual that exchanges struggle to keep up with the fast and heated pace that comes amid a new bull run on major cryptocurrencies, especially Bitcoin. But now, Bitcoin could reach higher ATH at the end of this year.

Bill Miller, an American investor and fund manager has taunted the crypto-community with a new filing from the Securities and Exchange Commission —SEC—. Accordingly, the hedge fund manager is seeking indirect exposure through Grayscale’s Bitcoin Trust.

The demand for Bitcoin could spike an even greater outrage and Foul Plays calls from the crypto-community if exchanges are not prepared to meet the increasing demand.