Diversifying your risk is an old-school rule that helps keep an investment portfolio safe, and the same applies to a crypto portfolio. So says Richard Galvin, co-founder and CEO of Digital Asset Capital Management (DACM), who has been at the helm of the world’s highest-ranked, long-only crypto fund for almost five years:

About 800,000 Australians own cryptocurrencies, a 63 percent increase from 2020, according to the commonwealth Treasury. Data from the Australian Taxation Office (ATO) suggests that A$227 million worth of crypto assets are held by self-managed superannuation funds, or 0.03 percent of the net assets.

Given that Bitcoin makes up 42 percent of global crypto assets, it is likely that the largest and oldest of them all is best represented in the portfolios of Australian investors, and according to some professional crypto investors that is a problem.

According to Galvin, “Our view is that only holding bitcoin as your crypto exposure would be like buying BHP as your Australian equity exposure. We wouldn’t say it is a good or a bad idea in and of itself, but the opportunity set is far, far wider in our view.

“Our Global Digital Asset Fund usually holds eight to 12 key active positions in different coins or tokens, and we feel confident that this will outperform bitcoin and [second-largest coin] ethereum as single holdings over time.”

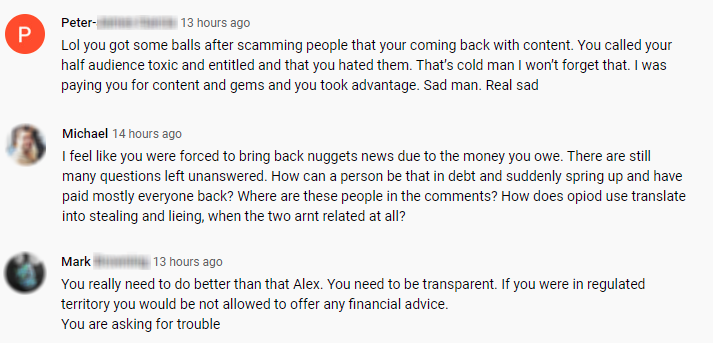

Crypto differs from traditional assets in many respects, including the decentralised legal structures underpinning tokens and highly controversial methods of valuation. A long list of critics believe the asset class should not be invested in because of the inherent volatility and prevalence of scams and cybercrimes. But, according to the Treasury data, many people are unfazed by the risks.

Traditional Principles of Finance Still Apply

Galvin argues that despite the potential risks associated with crypto investing, the same old rules of traditional portfolio construction need to be applied, including diversification. This means that investors need exposure to “altcoins” – the thousands of digital coins other than bitcoin.

Cody Harmon, a financial adviser, says diversification matters and notes that it does not mean crypto investors need to go too far down the rabbithole deploying their money to strange altcoins, often referred to as “shitcoins” by critics.

Galvin acknowledges that the regulatory environment around certain crypto investments remains uncertain, and says that DACM’s holistic approach has helped it deliver superior returns: “[This is because] we avoided a lot of that kind of flash-in-the-pan hype stuff and bought more fundamental assets that’ve been able to weather the insane volatility better than others.”

Galvin concurs with Australian fund manager Hamish Douglass in his view that cryptocurrencies should have a broader role in investment portfolios, but they will “either be asset-backed or they will be central government-backed. So maybe there is some truth in gold coin after all.”