Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Avalanche (AVAX)

Avalanche AVAX is the fastest smart contracts platform in the blockchain industry, as measured by time-to-finality, and has the most validators securing its activity of any proof-of-stake protocol. Avalanche is blazingly fast, low-cost, and green. Any smart contract-enabled application can outperform its competition on Avalanche. AVAX is the native token of Avalanche. It is a hard-capped, scarce asset that is used to pay for fees, secure the platform through staking, and provide a basic unit of account between the multiple subnets created on Avalanche.

AVAX Price Analysis

At the time of writing, AVAX is ranked the 10th cryptocurrency globally and the current price is US$78.44. Let’s take a look at the chart below for price analysis:

AVAX‘s 60% gains during Q1 ended with an almost 25% retracement as the rest of the altcoin market dropped in early April. Bulls stepped in near the 50.8% retracement of Q2’s move, creating a consolidation that ended with last week’s bullish impulse to resistance near $97.35.

With the 9, 18 and 40 EMAs stacked bullish and a bullish higher-timeframe trend, it’s reasonable to anticipate retracement to possible support before further bullish expansion.

Near the 40 EMA, a broad zone from $73.15 to $68.45 could see interest from bulls before further expansion. If this level fails, bears might capitalise on any sharp moves down in Bitcoin, aiming for possible support near the 65% retracement, at $64.70, and potentially lower to a higher-timeframe support zone between $60.42 and $57.80.

If the higher-timeframe bullish trend resumes and the current resistance near $99.35 breaks, the wicks near $120.84 and the new monthly highs might see profit-taking.

2. Elrond (EGLD)

Elrond EGLD is a blockchain protocol that seeks to offer extremely fast transaction speeds by using sharding. The project describes itself as a technology ecosystem for the new internet, which includes fintech, decentralised finance, and the Internet of Things. Its smart contracts execution platform is reportedly capable of 15,000 transactions per second, six-second latency, and a $0.001 transaction cost. The blockchain has a native token known as eGold, or EGLD, that is used for paying network fees, staking, and rewarding validators.

EGLD Price Analysis

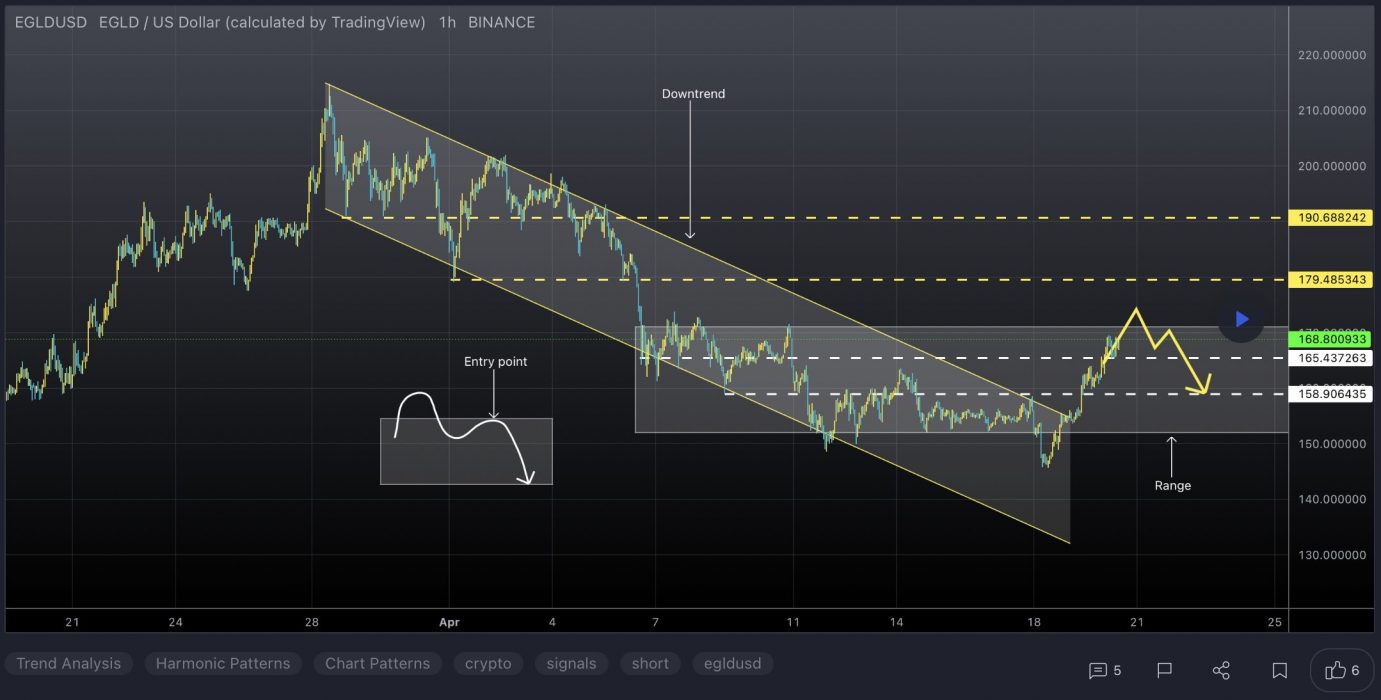

At the time of writing, EGLD is ranked the 39th cryptocurrency globally and the current price is US$162.73. Let’s take a look at the chart below for price analysis:

EGLD‘s 60% rally during March reversed with many other coins in April, retracing nearly 35%.

Just above the current price and near the April weekly open, $190.68 could provide resistance before a downward move. This level has confluence with the 18 EMA.

Bears might consider $169.94 as a higher probability resistance to hunt shorts for a longer swing downward. However, higher-timeframe charts suggest that the price could reach $153.45 at the top of an inefficiently traded area before any future bearish breakdowns.

Resistance might also rest near $210.45, above the 2022 yearly open. However, the price is less likely to reach this level unless the overall market starts a bullish swing.

The price is finding support between $150.44 and $143.586. This zone might continue to hold, while overlapping higher-timeframe levels from $138.44 to $135.81 could provide the most substantial support inside this area.

3. THORChain (RUNE)

ThorChain RUNE is a decentralised liquidity protocol that allows users to easily exchange cryptocurrency assets across a range of networks without losing full custody of their assets in the process. The native utility token of the THORChain platform is RUNE. This is used as the base currency in the THORChain ecosystem, and is also used for platform governance and security as part of THORChain’s Sybil resistance mechanisms – since THORChain nodes must commit a minimum of 1 million RUNE to participate in its rotating consensus process.

RUNE Price Analysis

At the time of writing, RUNE is ranked the 44th cryptocurrency globally and the current price is US$9.14. Let’s take a look at the chart below for price analysis:

RUNE abruptly rallied after retracing nearly 83% from its November highs, climbing 128% from its late February low.

Bulls are currently taking profits in a contested area between $9.28 and $9.13. This area saw inefficient trading on higher timeframes. It could serve as support if the price trades through its high end and retests it – or as resistance if the price breaks back below.

The closest support rests just below, near $8.31. The old high at this level could support a rally into resistance near $9.52.

A move through the closest resistance might target the consolidation midpoint near $10.40, near the 27% extension of the current rally. If this level breaks, bulls might target an inefficient area near $12.38 and beyond.

If the price rejects from this level and breaks the closest support, it could find support near the midpoint of the current range and 2022 yearly open, near $7.98. The price might also find support slightly below near the 61.8% retracement level, around $7.28.

Learn How to Trade Live!

Join Dave and The Crypto Den Crew and they’ll show you live on a webinar how to take your crypto trading to the next level.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.