The Australian and New Zealand Banking Group (ANZ) wants to extend the usage of its cash-backed stablecoin, A$DC, amid demand for access to it from its institutional customers. It also seeks to target additional use cases through a pilot program with the federal government and extensive engagement with regulators.

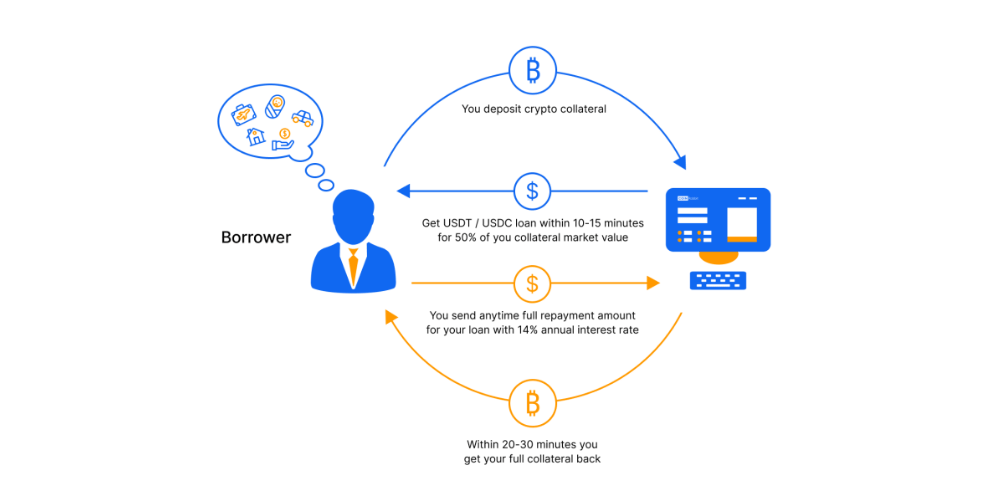

A$DC was launched by ANZ in March and has so far been used primarily to ease crypto trading for one of its major corporate clients, Victor Smorgon Group. It’s a fully collateralised stablecoin, unlike the recently collapsed Terra-based UST which was an algorithmic stablecoin.

Stablecoin to be Extended to More Institutional Customers

Speaking to the Australian Financial Review, ANZ executive Nigel Dobson said the bank was looking to extend the use of A$DC to a wider number of institutional customers, driven largely by customer demand:

Are we going to extend it [the A$DC]? Yes, absolutely we will. And this will be based on our institutional customers’ demand, as they reveal, increasingly, their own tokenisation strategies.

Nigel Dobson, ANZ executive

Increasingly, real-world assets, such as real estate and art, are being tokenised and traded on blockchains. Dobson believes this trend will continue and will provide several advantages over the way these assets have traditionally been traded:

“We believe that tokenised assets can be inexorably developed to deliver greater efficiency, speed, transparency, and value for customers over time,” Dobson said.

Pilot to Collect Excise Tax, Plans for Carbon Credits

A$DC is also being used in a pilot program, in cooperation with the federal government, designed to ease the collection of excise tax in the distilling industry. The program uses smart contracts to facilitate the collection of excise – according to KPMG, this single-use case could result in the recovery of at least A$45 million per year in lost tax revenue.

Another application on the horizon is the use of stablecoins to increase liquidity in carbon credit markets, an area in which ANZ sees huge potential for growth:

We think that’s going to have exponential growth over the next 10 years, and the elements of tokenisation that can be applied to that marketplace to make it much more efficient, more global and, frankly, more available to a wider range of consumers but certainly to institutional investors.

Nigel Dobson, ANZ Executive

As part of its push for increased usage of its stablecoin, ANZ has been working closely with several regulators, including the Australian Prudential Regulation Authority (APRA), the Securities and Investments Commission (ASIC) and financial intelligence agency AUSTRAC, to develop a framework for the use of stablecoins in the Australian economy.

Dobson said that so far, the conversations with regulators have been positive, explaining that “it is nice to see APRA, ASIC and AUSTRAC all on the same virtual call together. We’ve got this kind of coalition of the curious going on at the moment, which I think is wonderful, and you know, the integrated interactions have been incredibly constructive.”

ANZ into NFTs, Crypto Not So Much

ANZ seems to be focused more on the potential of tokenised assets and NFTs rather than cryptocurrencies such as bitcoin. The bank sees its role primarily as providing a stablecoin that can streamline transactions and simplify the sale and purchase of assets.

“We believe stablecoins form a very important element of the settlement value and the settlement process,” Dobson said.

Initially A$DC will only be offered to institutional customers, but in the longer term, retail customers may well gain access to the coin to simplify crypto trading and the purchase of both metaverse-based digital assets and tokenised real-world assets:

We think that the growth area is not going to be so much in crypto, but in NFTs. NFTs are already in the market around sports memorabilia and [can extend to] anything digitally created.

Nigel Dobson, ANZ Executive

ANZ Bank has had an interest in developing stablecoins and CBDCs for some time; last September, the bank was one of 15 finalists in the Monetary Authority of Singapore’s Global CBDC challenge, which attracted more than 300 submissions from 50 countries.