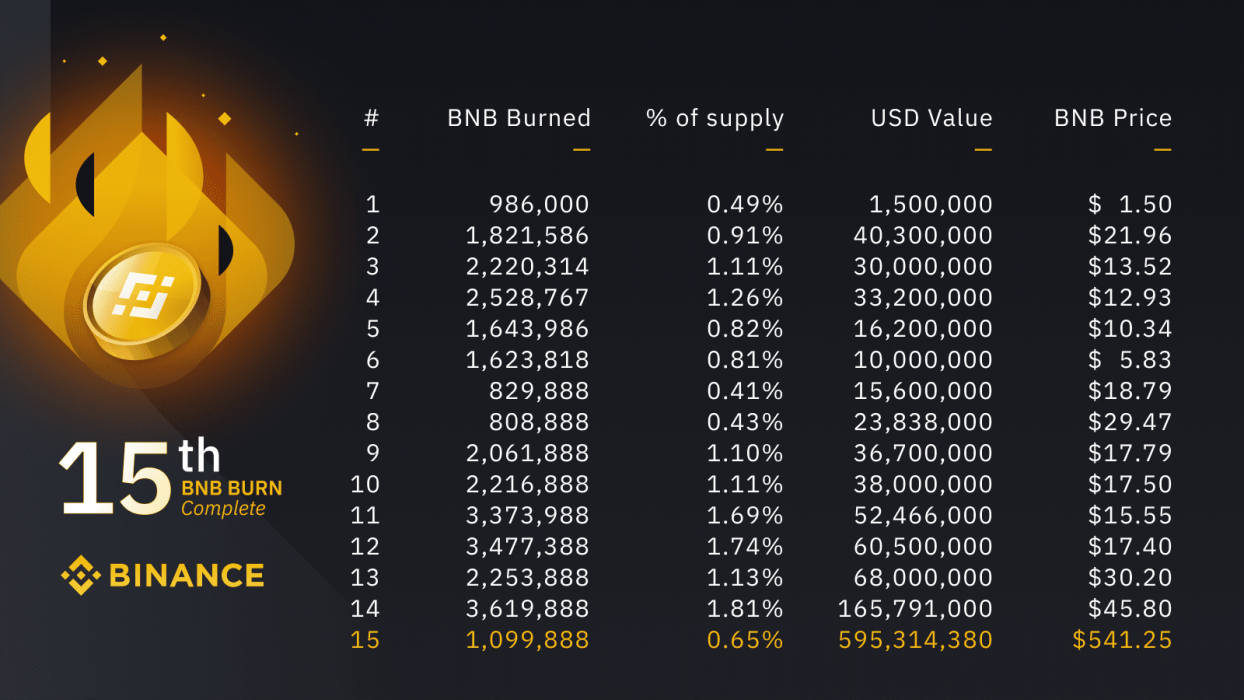

On Friday, cryptocurrency exchange Binance completed another quarterly burn of its native cryptocurrency, Binance Coin (BNB). More than $500 million USD worth of BNB was destroyed in this latest quarterly burn, which is the highest so far in terms of dollar value.

Over 1 Million BNB Destroyed Forever

For the 15th quarterly burn, Binance burned exactly 1,099,888 BNB, which was worth $595,314,380 AUD, during the time of the event. Burning a cryptocurrency is a strategic approach to reduce a coin’s circulating supply. Hence, the crypto exchange just reduced BNB supply from 170,532,825 BNB to 169,432,937 BNB. These coins are destroyed forever and cannot be restored to circulation.

The Binance Coin had a maximum supply of 200 million when it was launched in 2017. However, the exchange committed to reducing the supply by 100 million BNB (i.e. 50 percent of the max supply) through the process of quarterly “burning.” to help preserve the value of the coin.

So far, Binance has destroyed almost 30 million BNB, which represents about 15 percent of the maximum supply of the cryptocurrency. The remaining 35 percent will be completed in the coming years.

What’s The Essence of Burning BNB

Burning BNB is part of the exchange effort to keep the cryptocurrency more relevant in terms of market value. Since this process reduces BNB supply, it creates scarcity for the cryptocurrency. Notably, scarce assets usually gain in value, amidst high demand. Thus, BNB holders and the exchange tend to benefit from this process.

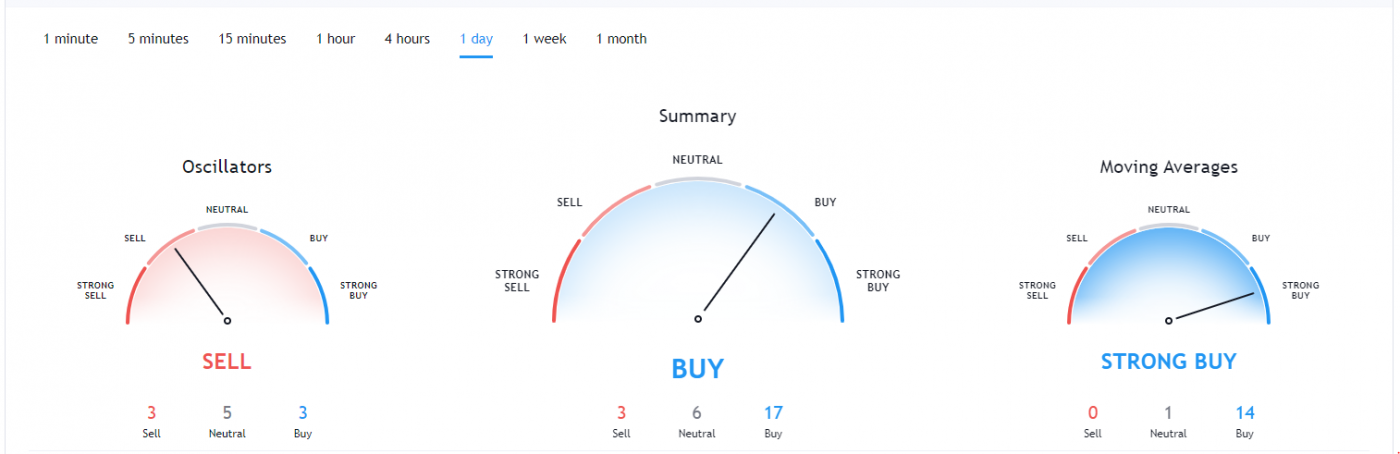

Shortly after the announcement today, BNB briefly increased to $540 USD. At the time of writing, however, BNB was trading at $514 USD on Coinmarketcap, i.e. a 6.68 percent price decrease over the past 24 hours.