Hive is trading in an uptrend, like many other Altcoins. The cryptocurrency HIVE just went up +65% in a single day by breaking a falling wedge pattern with strong buying volume on multiple exchanges and surges over +92% in a week.

What is HIVE?

Hive is a decentralised information sharing network with an accompanying blockchain-based financial ledger built on the Delegated Proof of Stake (DPoS) protocol. Hive supports many different types of information sharing applications. Myriad dapps, APIs and front-ends contribute to a general and straightforward accessibility of data, transactions and records, so that this existing diversity and utility ensure that the ecosystem is welcoming to content creators, consumers, investors and builders.

HIVE Price Analysis

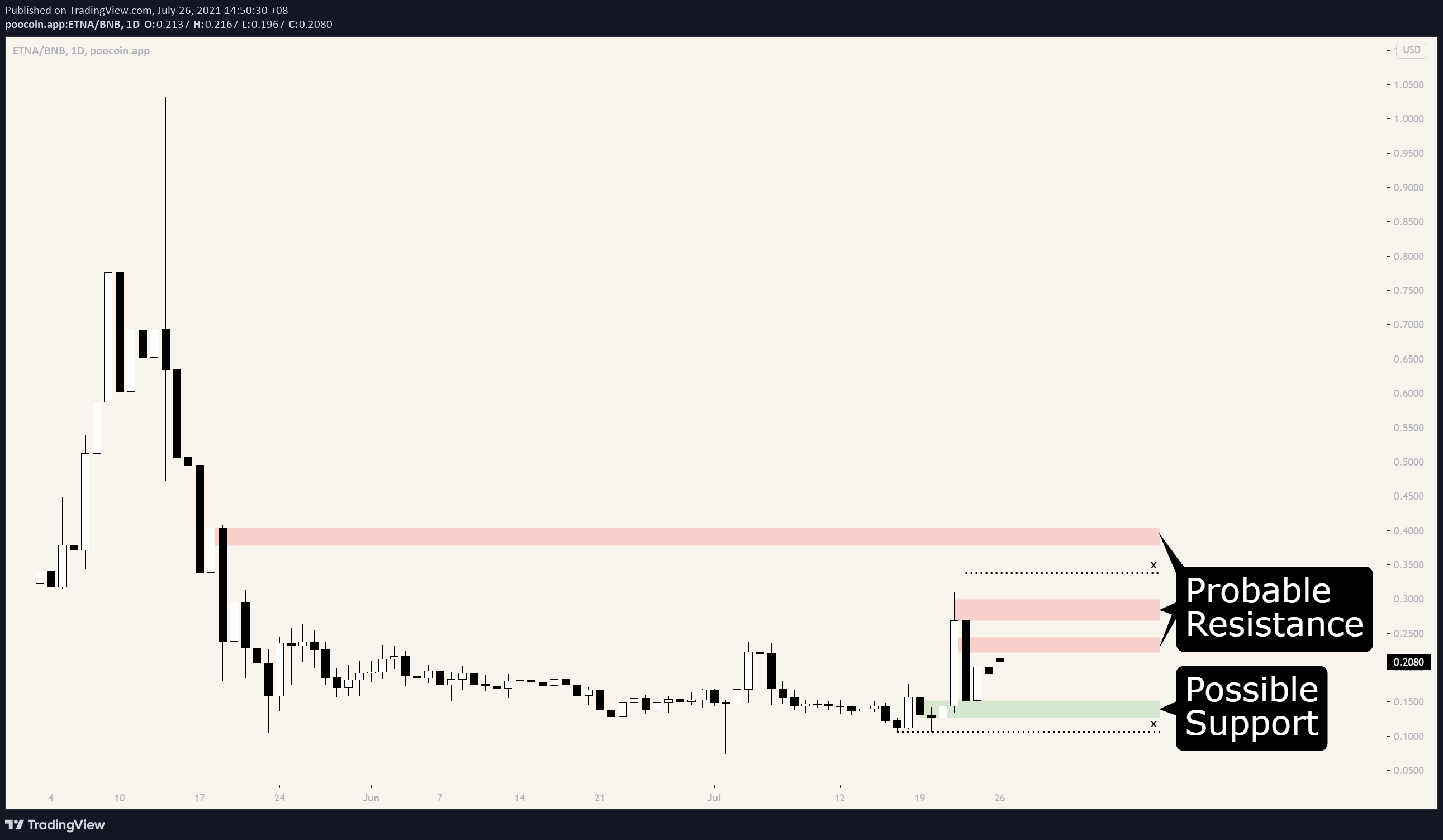

At the time of writing, HIVE is ranked 154th cryptocurrency globally and the current price is A$0.6775. This represents a +92% increase since July 23, 2021 (seven days ago), as shown in the chart below.

After looking at the above 1-Day candle chart, we can clearly see that HIVE was trading inside the falling wedge pattern on the HIVE/USDT pair. The first resistance was on the A$0.4755 price levels which HIVE broke with a strong bullish trend buying volume and is now heading towards the previous monthly high price at A$0.7428. Seeing that many Altcoins are holding a strong position this week after the recent bitcoin price recovery, HIVE may continue to increase in the uptrend if traders keep buying with high volume.

The chart seems to be in an cup and handle pattern, and the crypto market looks to be gearing up for something big again. First target is based on a fib, second is the cut and handle pattern, and the third is the golden fib.

“The Falling Wedge is a bullish pattern that begins wide at the top and contracts as prices move lower. This price action forms a cone that slopes down as the reaction highs and reaction lows converge.”

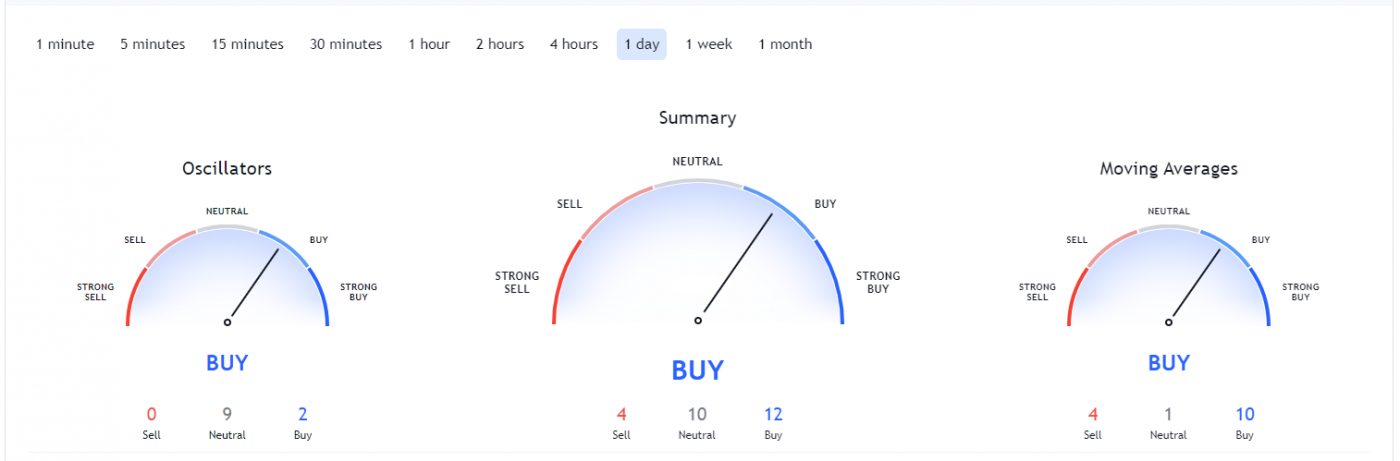

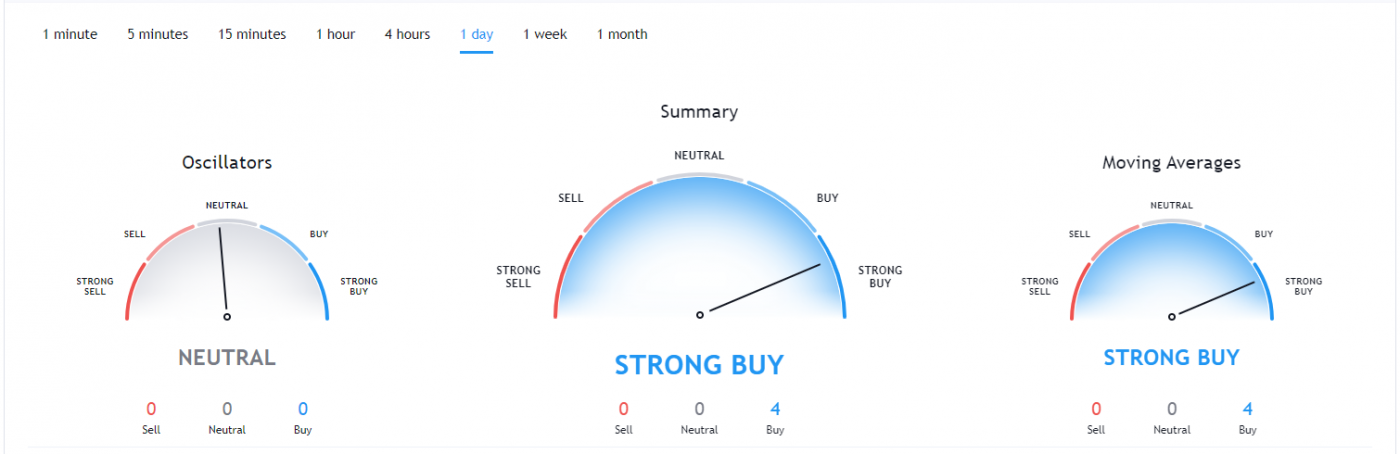

What Do the Technical Indicators Say?

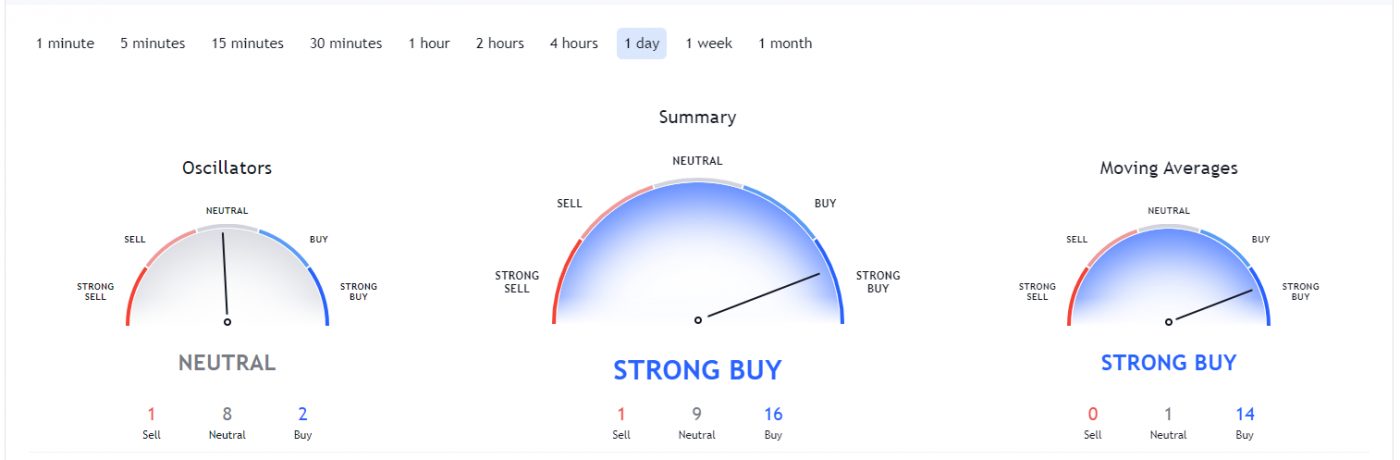

TradingView indicators (on the one-day window) mainly suggest HIVE as a Strong Buy, except the Oscillators which indicate HIVE as a Neutral.

So Why Did HIVE Breakout?

General market sentiment seems to suggest cryptos are hopefully turning back bull run season after recent massive price corrections. Another reason for this sudden pump in price could be whales secretly buying HIVE for the next Altcoins rally. Recent news was also announced regarding CryptoPlug on the Block Event.

Where to Buy or Trade HIVE?

Hive has high liquidity on the Binance exchange, which could help for trading HIVE/BTC or HIVE/USDT pairs. Instead, if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is a popular choice in Australia. However, you can also buy these coins from different exchanges listed on Coinmarketcap.