Australia’s On the Run (OTR) petrol stations and convenience stores will be accepting crypto payments as soon as July 2022. The move comes as Peregrine Corporation, a South Australian group of companies, teams up with global exchange giant Crypto.com to introduce cryptocurrency payments in all its OTR stores:

Move Makes Peregrine the Largest Australian Business to Accept Crypto Payments

Peregrine is the largest privately owned company in South Australia and is best known for its OTR convenience store/petrol station outlets, of which it has more than 170 across South Australia and Victoria. This move will allow customers to pay for fuel, snacks, and even Subway in more than 30 different cryptocurrencies. Once the system is finalised in July, Peregrine will become the largest business in the country to accept in-store crypto payments.

Peregrine is working with Singapore-based exchange Crypto.com to implement its Pay Merchant service as its payment settlement layer. Datamesh, a Sydney-based payments systems provider, will roll out point-of-sale terminals allowing shoppers to pay via the Crypto.com application with their crypto holdings.

Yasser Shahin, executive chairman of Peregrine Corporation, said:

The growth and mainstream acceptance of cryptocurrency adoption in Australia and the rest of the world have been phenomenal and has offered us a clear opportunity to tap into the momentum of this fast-growing space for the benefit of our customers.

Yasser Shahin, executive chairman, Peregrine Corporation

Karl Mohan, Crypto.com general manager Asia and Pacific, describes the deal as a “landmark partnership”, adding that it enables the crypto company to “walk the talk on what we set out to do when we first launched in Australia – support our customers to pay with cryptocurrencies at real-time market prices and avoid the cost and hassle of fiat conversions”.

Australia’s Foray into Crypto Retail Payments

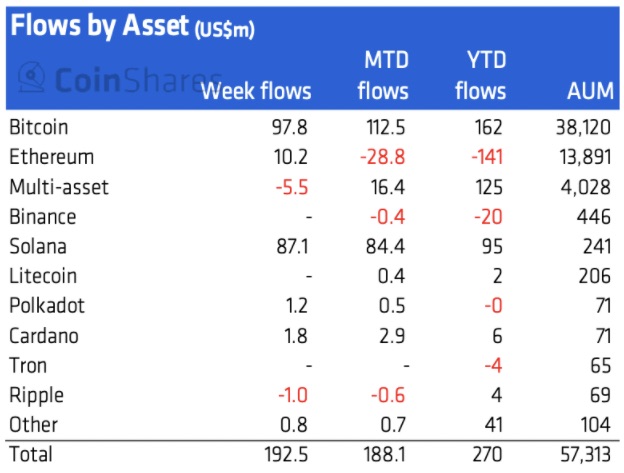

Last year, Crypto News Australia reported that Australian companies were starting to accept Bitcoin as a payment option for their services. Companies from various industries are getting in on crypto payments; they include NBN Internet RSP Luantel, Queensland Solar and Lighting, Broadwater Build Perth Building Company, Dream PC Australia, and Pet Parlour Australian Online Pet Shop. However, in a new report published this year, it was found that Bitcoin payments have declined while other cryptos surged in payment usage.