A 25-year-old man from Massachusetts in the US has been sentenced to eight years’ imprisonment for selling illicit drugs for cryptocurrencies on the dark web. In addition, he also had to forfeit US$2.3 million worth of bitcoin after starting “EastSideHigh” on the darknet.

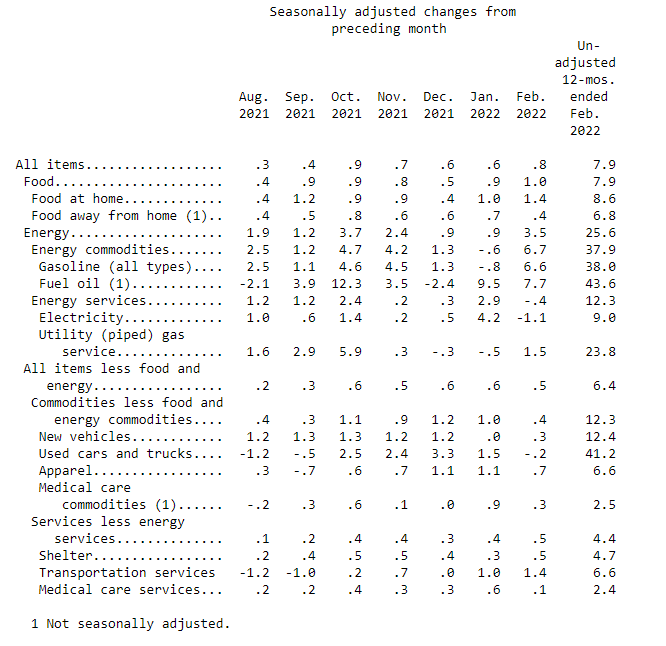

At the age of 22, Binh Thanh Le set up “EastSideHigh”, a storefront on the Wall Street Market illegal marketplace on the darknet, selling illicit drugs such as Xanax, ecstasy (MDMA), and ketamine. Le’s illegal business netted him a profit of 59 bitcoin, which was originally seized in March 2019. At the time the funds were worth US$200,000, but now amount to a whopping US$2.3 million.

Le and Two Associates Arrested with 20+ kg of Ecstasy

Along with his bitcoin, Le also held over US$114,000 in cash and another US$42,000 generated from a sale of a car. He was indicted in June 2019 with two other people for conspiracy to manufacture and distribute drugs. At the time of his arrest and seizure, law enforcement officials found over 20 kilograms of ecstasy, approximately 6.8 kilograms of ketamine, and more than 10,000 Xanax pills in Le’s possession.

After serving his prison sentence, Le will be supervised on release for a further three years. US District Attorney for Massachusetts Rachel Rollins said: “This sentence sends a clear message to dark web criminals – the federal government is entering this space. We will find you and we will hold you accountable.” She added:

Thanks to the incredible work of our law enforcement colleagues, there is one less cybercriminal hiding in the shadows.

Rachel Rollins, US District Attorney for Massachusetts

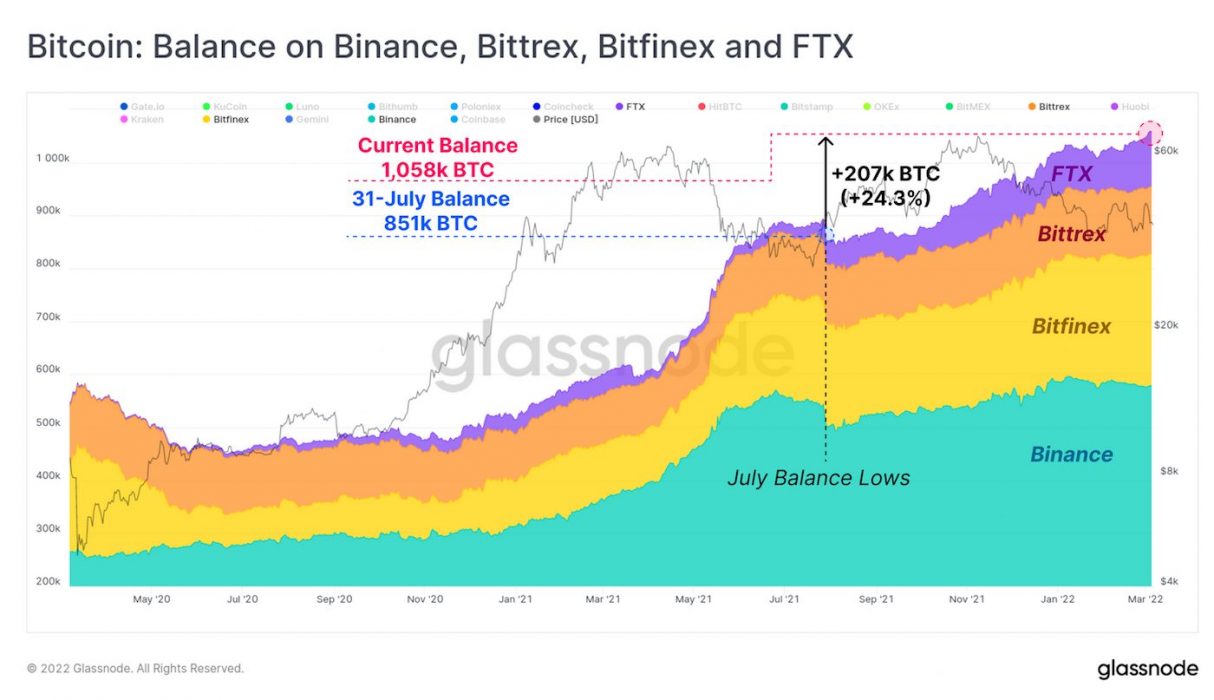

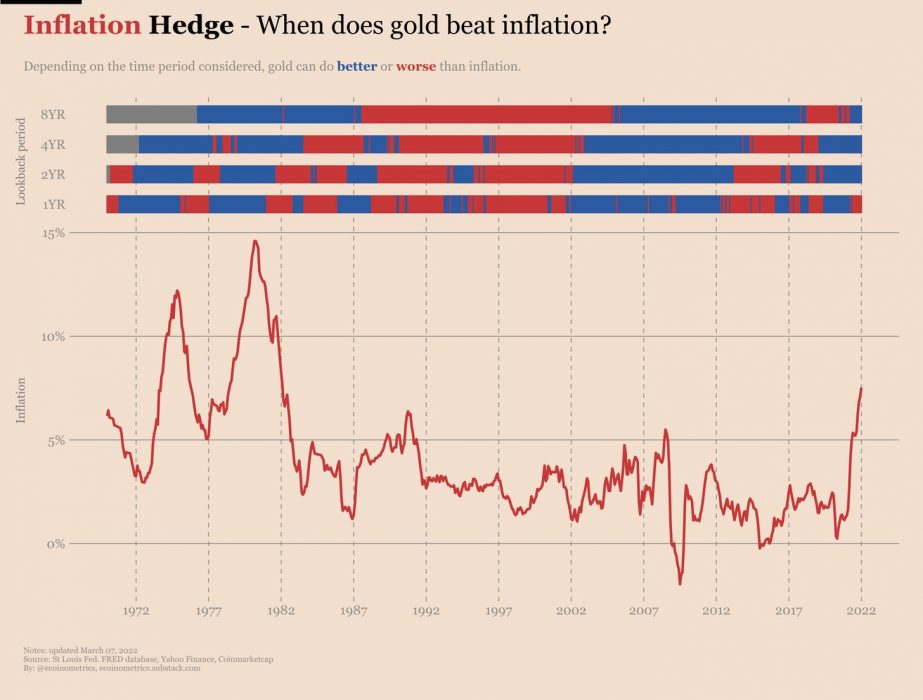

Crypto Seizures Add Up to Massive Numbers

Recently, the US Justice Department impounded US$3.6 billion in bitcoin and arrested a wannabe rapper and her husband for conspiring to launder the funds. A January report also revealed that US$33 billion had been laundered via crypto by cybercriminals over the past five years.