In response to growing environmental, social and governance (ESG) concerns related to Bitcoin mining, leading digital asset management firm CoinShares has produced a report suggesting that the network is responsible for less than 0.05 percent of global carbon emissions, a figure CoinShares described as “inconsequential”.

Key Takeaways

According to CoinShares, sensationalist commentators riding the ESG wave continue to pronounce on Bitcoin’s energy use, often with poorly supported arguments.

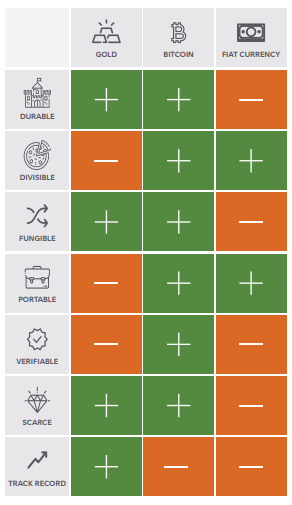

While Bitcoiners’ retorts typically relate to either the question of energy cleanliness or the necessity of proof-of-work for an open monetary system, CoinShares has instead focused on carbon emissions, using a detailed exploration of quantitative data. This is in contrast to the qualitative, and often anecdotal, evidence offered by critics.

CoinShares echoes the sentiments of Bitcoiners who argue that the “systemic distortion of price signals caused by costless and arbitrary monetary inflation creates malinvestment, economic inefficiencies and waste on a scale that would dwarf Bitcoin’s approximate 0.05 percent share of global energy consumption”.

The argument, then, is straightforward – whether you think Bitcoin has utility or not, its energy use is minuscule when compared to the prevailing financial system.

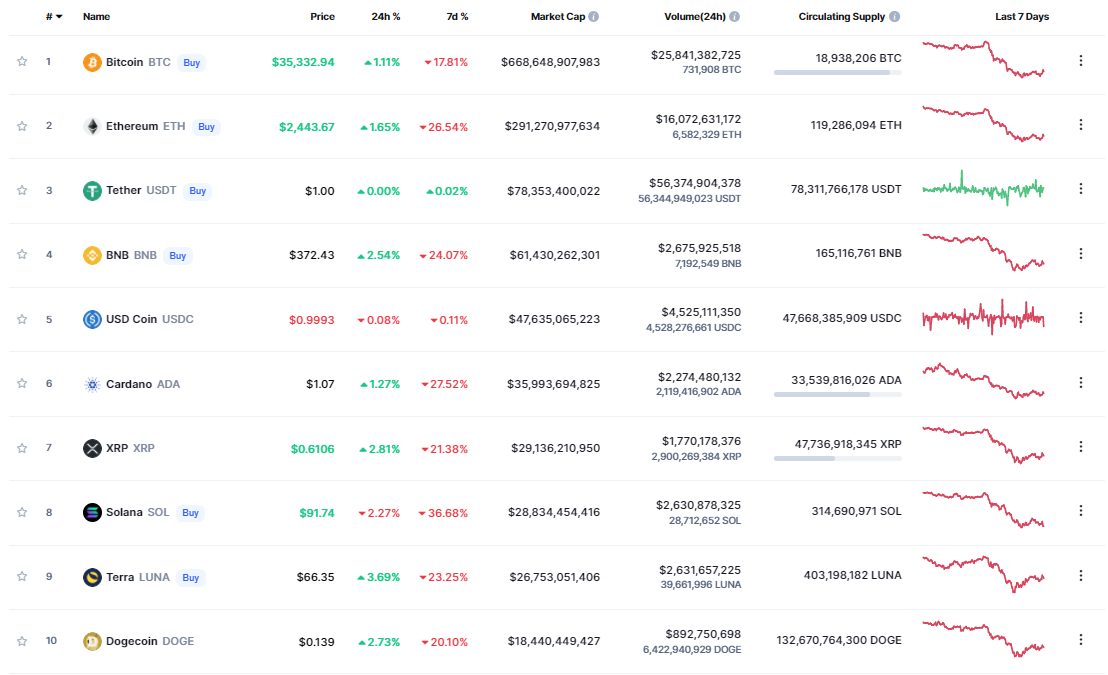

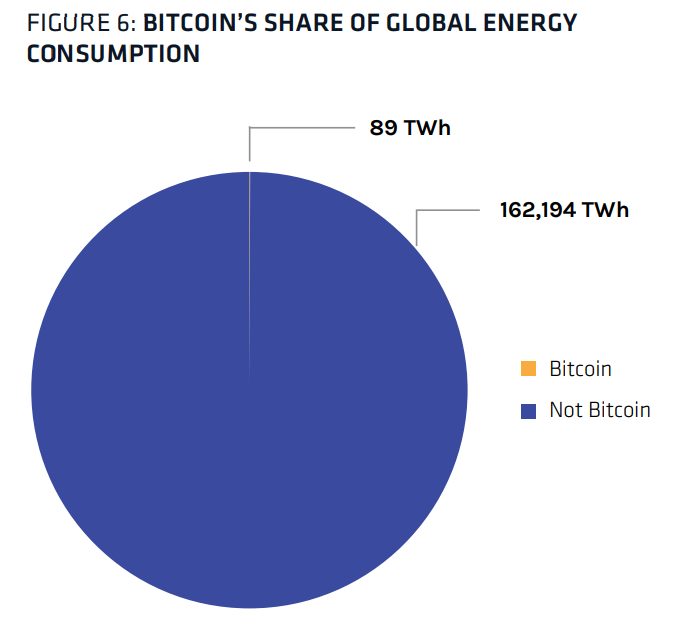

As a point of reference, total global energy consumption (not production, which is considerably higher) in 2019 has been estimated at 162,194 TWh. At an annual energy draw of 89 TWh, the Bitcoin mining network uses approximately 0.05 percent of the total energy consumed globally. This strikes us as a small cost for a global monetary system, and on the global energy balance sheet, it amounts to a rounding error.

CoinShares research report

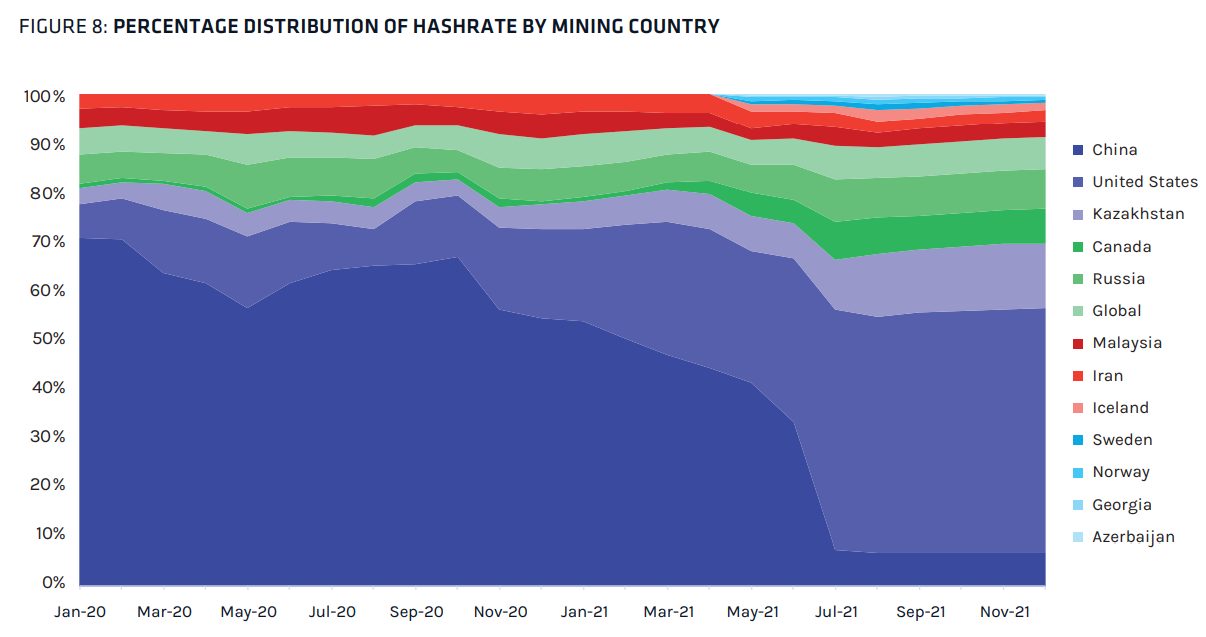

Noting the dramatic decline in hash power out of China following its latest ban, the shift in power from East to West is an obvious one, with the US now having an estimated 49 percent of hash power.

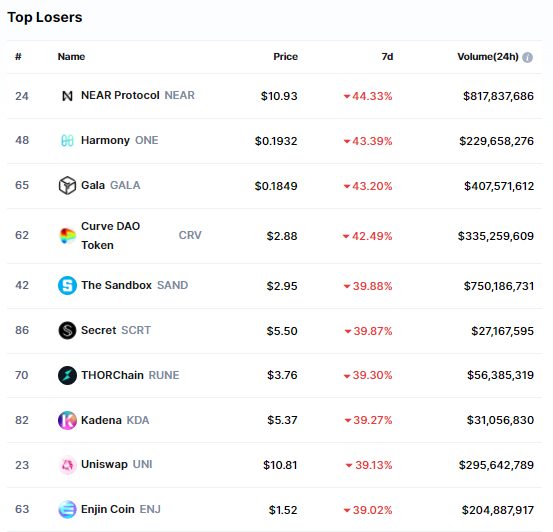

The report added that contrary to what many people thought, the miner migration out of China actually increased carbon emissions, since a significant amount of Chinese hash power relied on overbuilt, centrally planned hydroelectric power facilities. CoinShares added that as of December 2021, the estimated relative contribution of various sources of energy were as follows:

- Coal – 35 percent;

- Gas – 24 percent;

- Hydro – 21 percent;

- Nuclear – 11 percent; and

- Oil, solar and other renewables like geothermal – 5 percent.

While these figures are a little way off the Bitcoin Mining Council’s estimates of renewal energy comprising 58 percent, CoinShares is of the view that focus should instead be directed toward building renewable power generation.

While it is clear that there currently are emissions created as a result of bitcoin mining, these emissions are not only insignificant on a global scale, but they are in no way necessary in and of themselves. Bitcoin will be 100 percent renewable as soon as our electricity generation is 100 percent renewable. Our focus should be on building out renewable power generation, not on stifling the development of monetary technology.

CoinShares research report

This would appear to align with OG Bitcoiner Andreas Antonopoulos’ view, which is common sense to those properly informed:

Bitcoin is neither good nor bad. It’s simply a demand for energy, and if it’s matched with politics that are environmentally friendly, then bitcoin mining is essentially green. Bitcoin isn’t the villain here.

Andreas Antonopoulos