Stealing a march on its American counterparts, Australian Baseball League club the Perth Heat has become the first professional sports organisation in the world to fully embrace Bitcoin for payment acceptance and payroll for both staff and players.

Although Dutch team PSV Eindhoven and English club Southampton FC both signed deals earlier this year to allow football sponsorships to be paid in bitcoin, this is the first time any sports club anywhere has fully adopted the Bitcoin standard.

As part of this sports world exclusive, Perth Heat will:

- pay players and staff in bitcoin;

- accept bitcoin payments for sponsorships, merchandise and ballpark concessions; and

- HODL bitcoin on the club’s balance sheet.

In partnership with bitcoin payments processor OpenNode, the Perth Heat is setting Bitcoin as its new standard for payments and payouts, powered by the Lightning Network.

According to Perth Heat CEO Steven Nelkovski, the club looks forward to “setting the bar” for how much value a sports organisation can bring to a community in the bitcoin age.

We hope our adoption of a Bitcoin standard will inspire others to embrace a monetary system that demands value creation to thrive. The players and organisational staff have fully embraced the opportunities that being paid in bitcoin can provide.

Steven Nelkovski, CEO, Perth Heat

‘The Future of Money Lives on the Bitcoin Blockchain’

Patrick O’Sullivan, the club’s chief bitcoin officer, says Perth Heat is embracing the reality that the future of money and corporate treasuries will live on the Bitcoin blockchain.

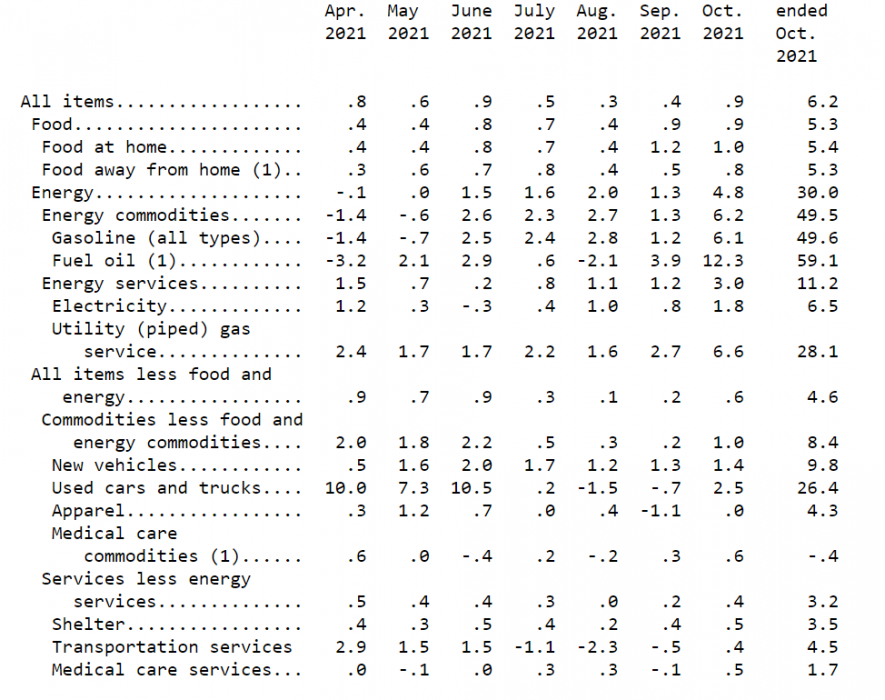

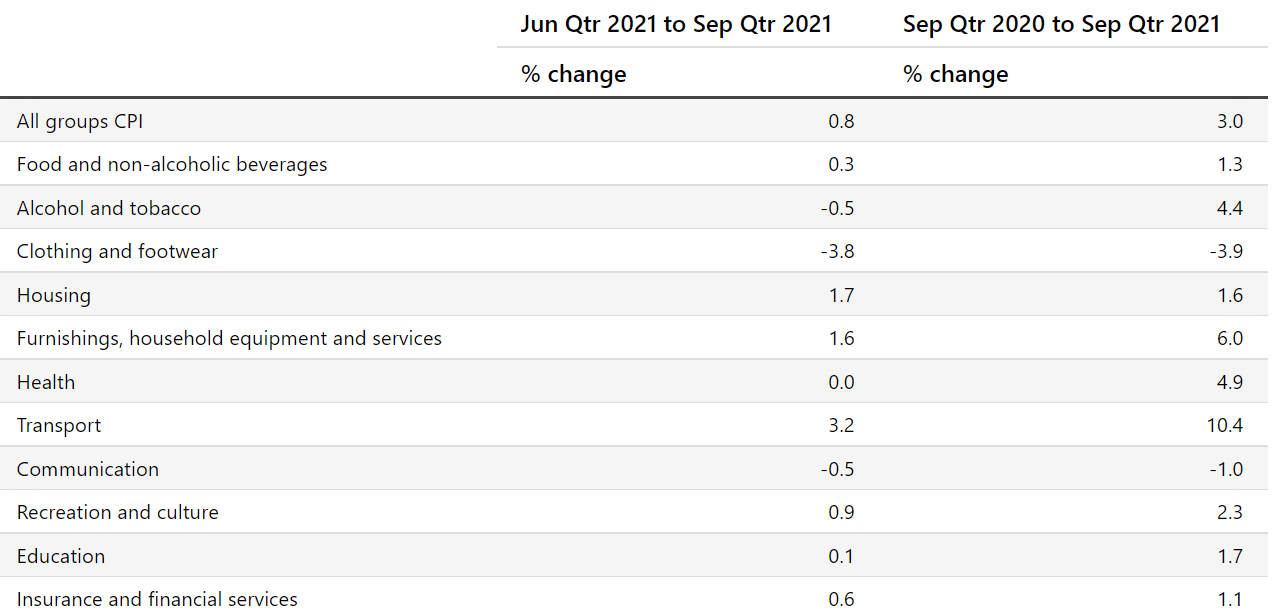

We believe the world has begun to recognise the power of sound money principles and are determined to lead from the front. This is not a one-off purchase to hedge against future uncertainties or inflationary pressures.

Patrick O’Sullivan, chief bitcoin officer, Perth Heat

Possibilities for the club are limited only by imagination. In addition to treasury appreciation, Perth Heat will be ideally positioned to secure better players and deals in the future, outpacing its competitors. The game theory aspects of bitcoin adoption will also, perhaps inevitably, lead other sports clubs to follow its example.