After bitcoin languished behind the alts for what might have felt like an eternity, the winds appear to have shifted favourably towards the king of crypto as it soared past US$55,000, reaching a five-month high and reclaiming its status as a US$1 trillion asset.

Supply Squeeze At All-Time High

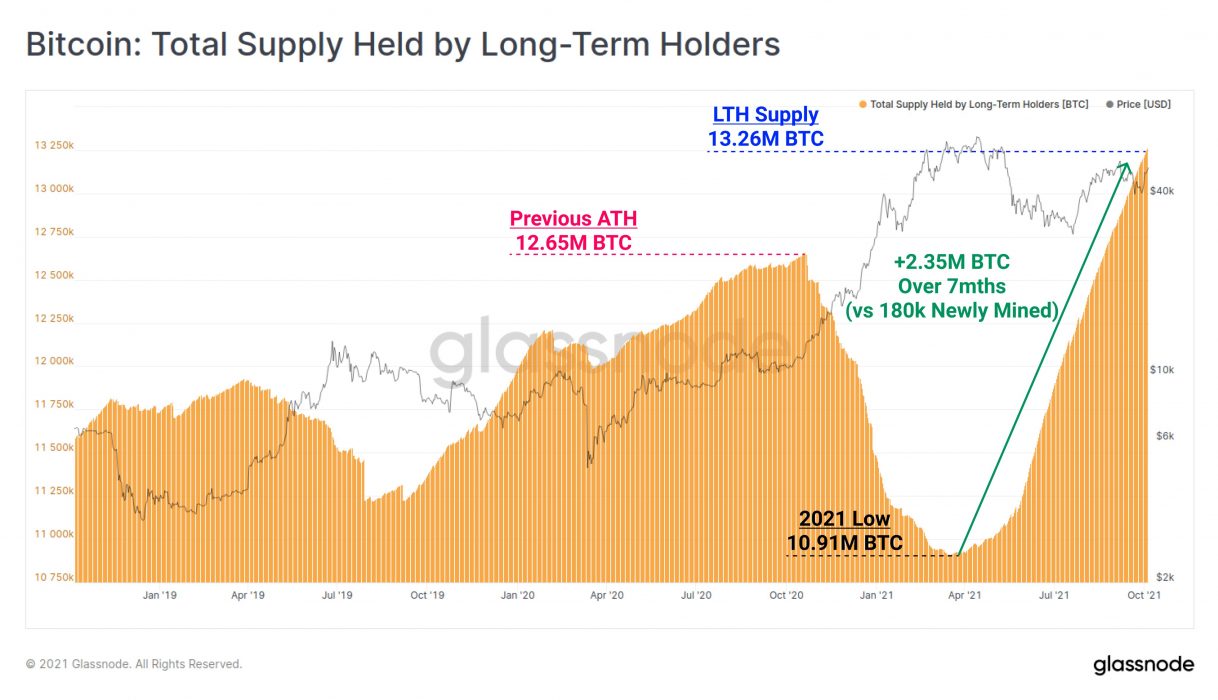

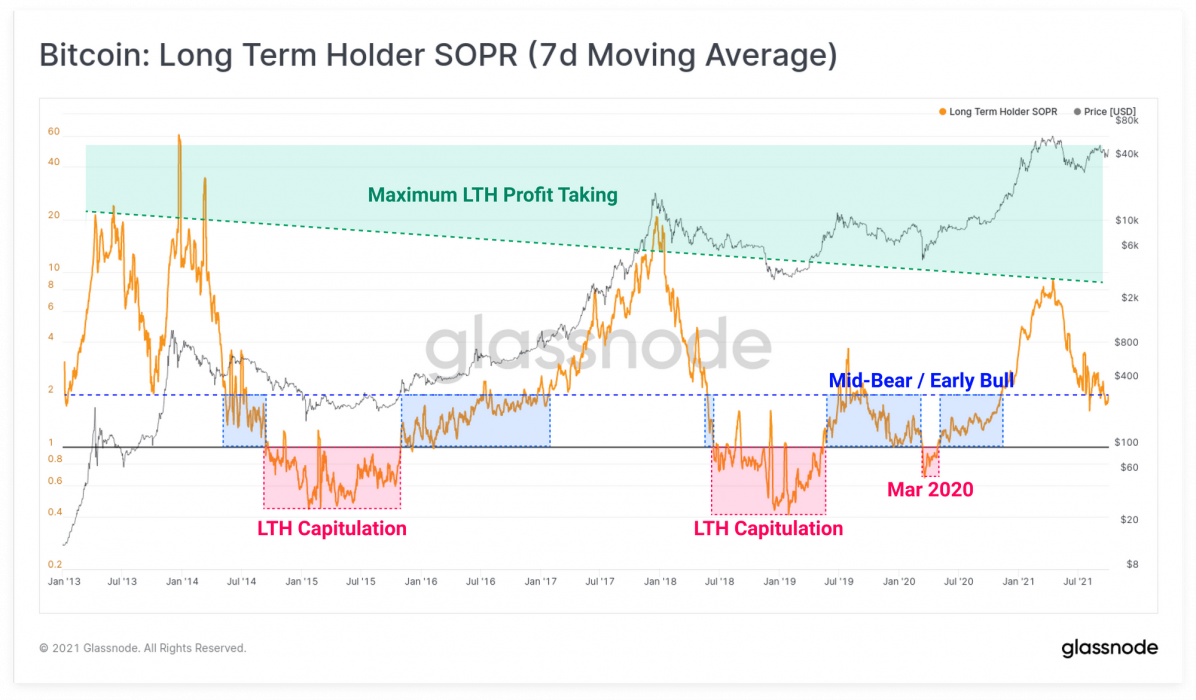

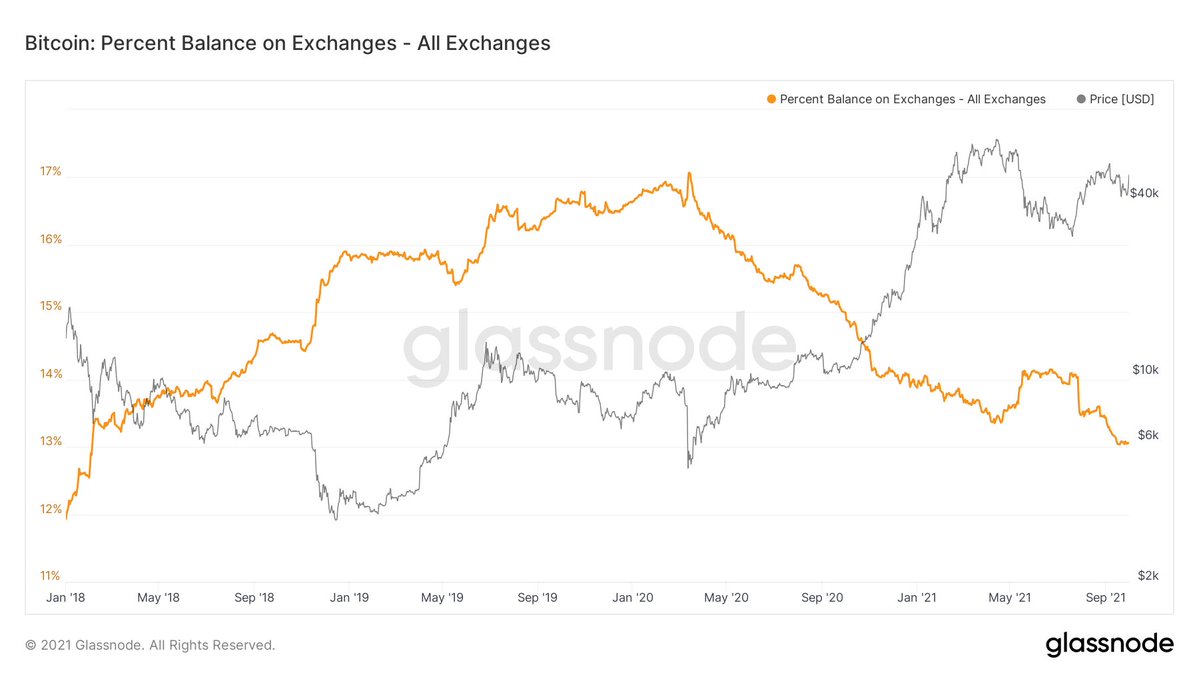

Based on Glassnode data, the current bitcoin balance on exchanges is at its lowest level since January 2018.

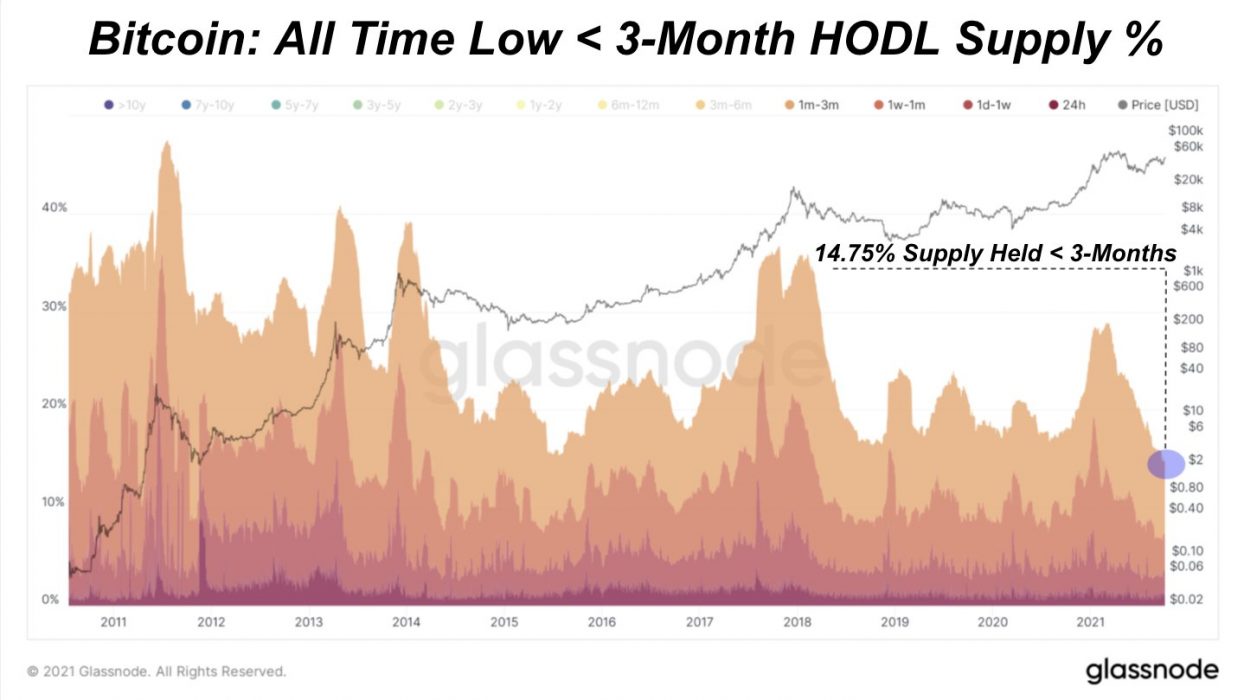

In addition, the three-month HODL supply is at an all-time high. Over 85.25 percent of coins have not moved in three months. This is typically a bullish signal as strong hands continue to accumulate on the expectation of further gains.

Who is Driving the Supply Squeeze?

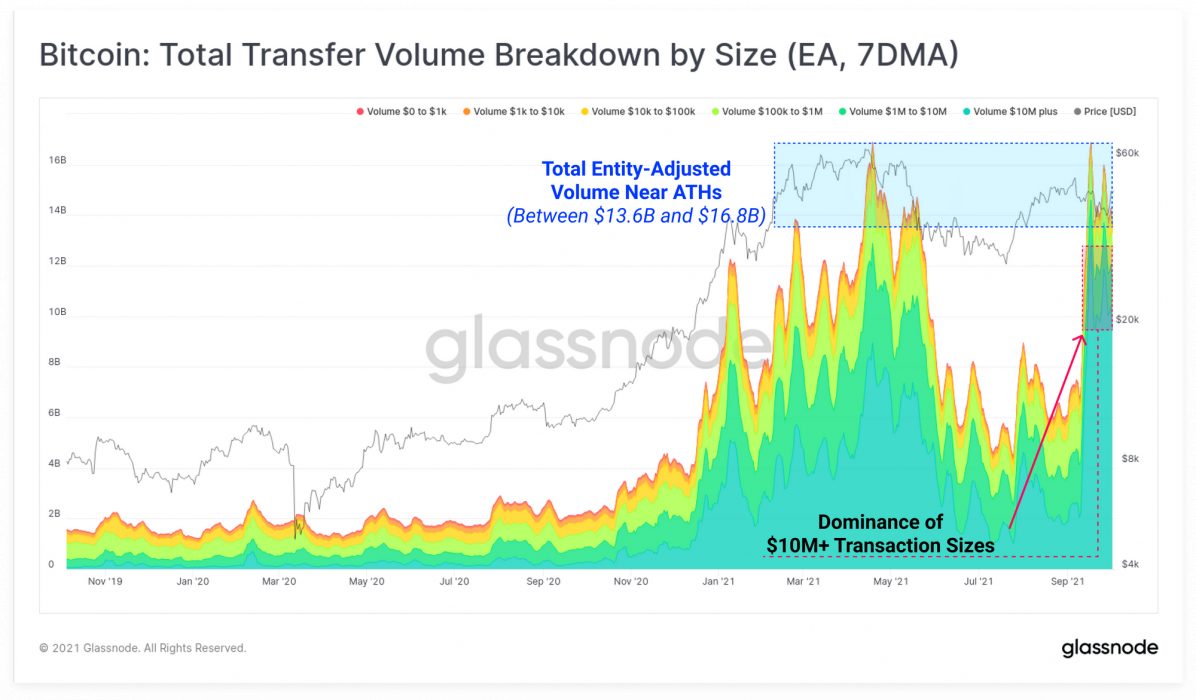

According to South Korea-based blockchain data firm CryptoQuant, whales purchased US$1.6 billion worth of bitcoin on the spot market:

Crypto analytics firm Santiment noted that October 6 was the single largest day of bitcoin accumulation by whales in over two years:

The firm highlighted the positive momentum in the market, commenting:

#Bitcoin dominance has been on a major rise the past couple days, and $54.6k has been breached for the first time since May 12. Our NVT Token Circulation model is indicating October is the first month we’re seeing a bullish divergence since February.

Santiment

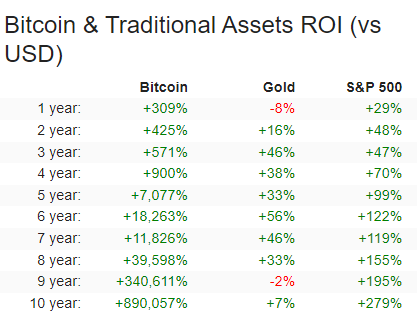

As the “digital gold thesis” continues to gain momentum, signals are in that Q4 may be bitcoin’s best performing quarter in 2021.

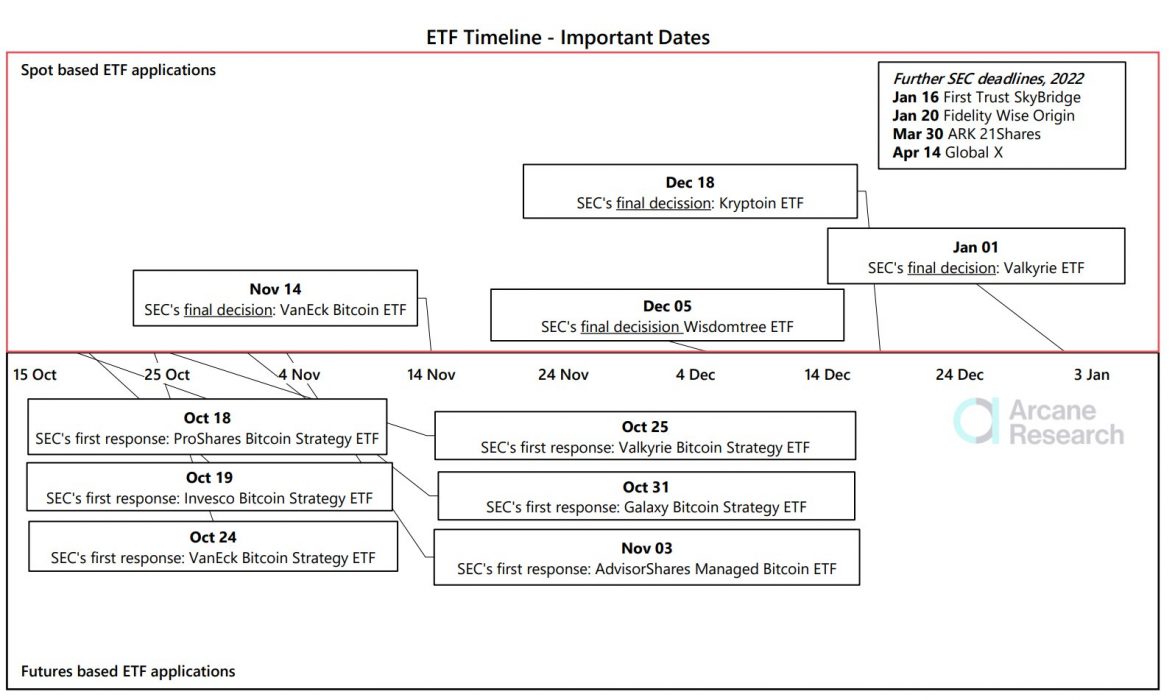

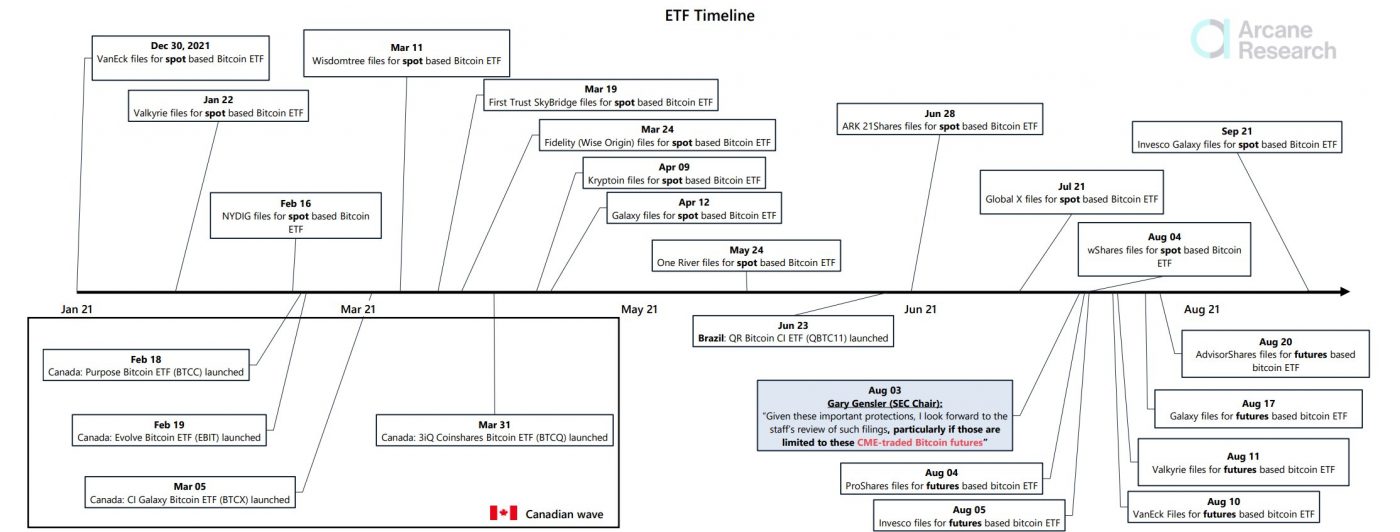

There are a few indicators suggesting that a range of new participants are likely to enter the fray in this last quarter. As Raoul Pal noted on Anthony Pompliano’s The Best Business Show:

So who is the next big buyer of bitcoin? Well, it’s pretty clear to me. It is the ongoing institutions … and secondly it is the coming ETF … I have a very strong feeling it comes over the next October, November, December period. And finally, we’re starting to see some noise from the sovereign wealth funds…

Raoul Pal, The Best Business Show podcast

With the whales goggling up supply, what are the plebs left to do? Bitcoiners would tell you to simply stack sats.

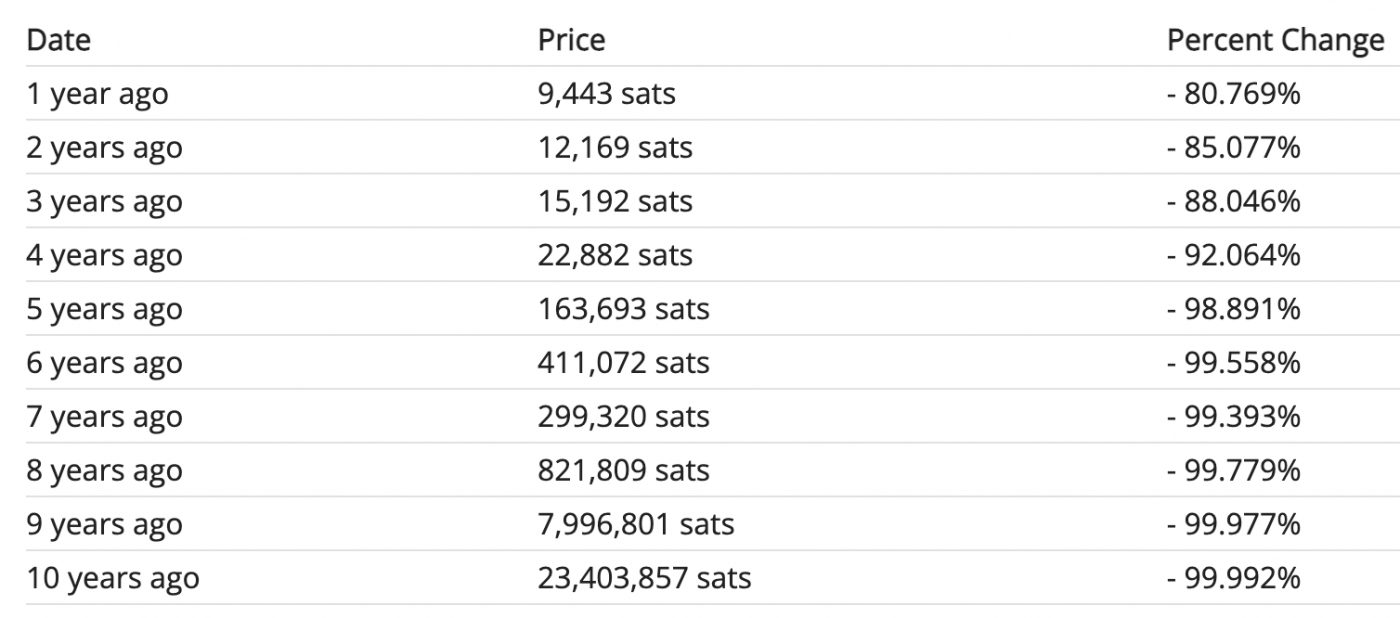

Looking at the value of $US1 in sats, if you’re looking to preserve purchasing power, stacking sats would appear to be the rational thing to do.