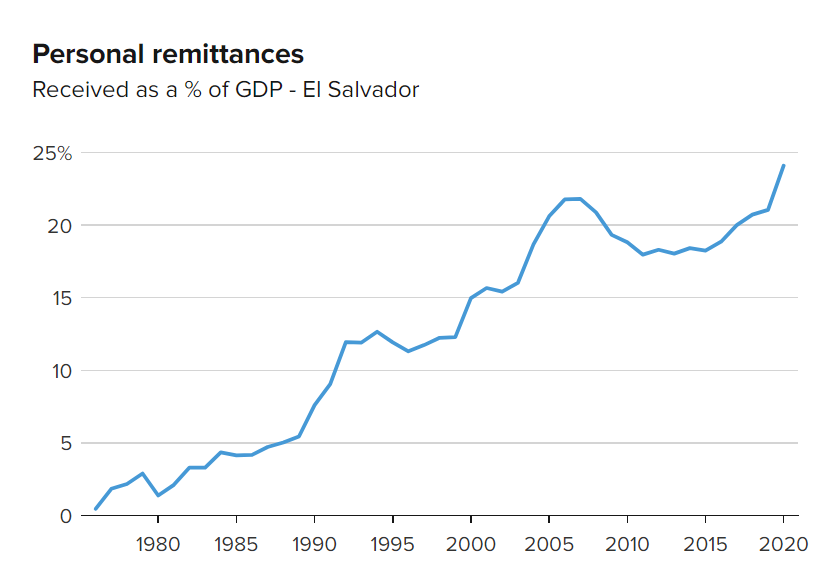

One of the purported reasons El Salvador adopted bitcoin was that it was “for the benefit of its people“. Specifically, President Nayib Bukele referred to international remittances which account for almost a quarter of El Salvador’s GDP.

Costly Remittances

Bitcoin became legal tender in El Salvador this month and, unsurprisingly, things are moving fast. Its citizens have started spending money while the government has added some 550 bitcoins to its balance sheet.

Despite critics slamming bitcoin’s volatility, few have recognised the plight of everyday Salvadorean citizens’ woes when it comes to remittances. Being a developing nation, many of its citizens rely on remittances from family members who work in the US.

In 2020, El Salvador received nearly US$6 billion in remittances, which accounted for about 23 percent of its GDP. It’s been suggested that up to 70 percent of the Salvadorean population receives remittance payments. The average monthly remittance transfer is US$195, and for the households that receive remittances, they account for 50 percent of their total income.

Remittances are one area where the status quo in our legacy financial system is terrible, with extraordinarily high fees levelled at populations that can ill afford them.

Matt Hougan, chief investment officer, Bitwise Asset Management

Western Union Set to Lose Out

Close to 60 percent of cash received is via remittance companies and 38 percent through banking institutions. Fees vary by company but typically, the smaller the payment, the higher the percentage that goes to fees. For instance, it costs US$3.24 to send US$10 to San Salvador from the US – almost 33 percent commission is payable to Western Union.

Rather than relying on third parties, waiting in lines at money changers or several days to receive their money, Salvadoreans now have the ability to send and receive cheap instant payments worldwide through the lightning network. This saves citizens from having to physically travel to the money services’ office and the worry of gangs who tend to hang around them.

Receiving remittances at the speed of light with almost no costs, compared to the slower and more costly fee structures of money services such as Western Union, means that El Salvador’s bitcoin adoption could cost the company US$400 million a year in lost commissions for remittances.

At the end of the day, using the lightning network over traditional remittance services means that more money ends up in the pockets of Salvadoreans – something you’d imagine that bitcoin critics and supporters alike would agree is a good thing.