German prosecutors have charged the Australian couple allegedly behind DarkMarket, one of the world’s largest illegal marketplaces operating on the darknet.

DarkMarket was shut down on 11 January and the suspected operator of the marketplace, a 34-year-old Australian man, was arrested near the Germany-Denmark border soon after. It is alleged that his 32-year-old wife was responsible for the design of the website and mediation of customer disputes. The couple, who are living in Australia and cannot be named for legal reasons, have now been officially charged by German prosecutors.

What Was DarkMarket?

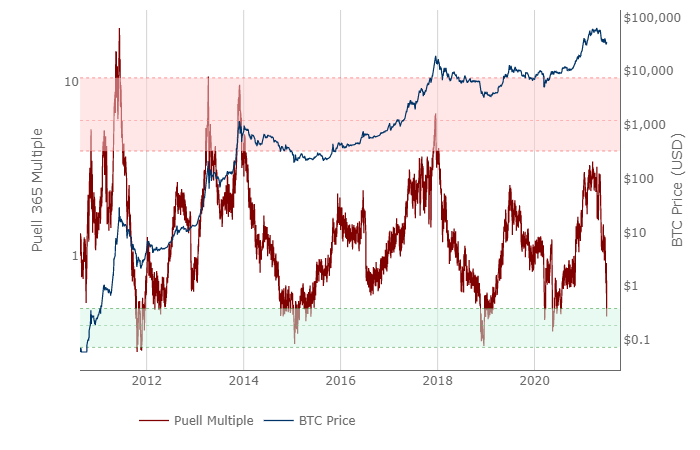

DarkMarket was a virtual marketplace that sold all manner of illegal items. It operated on the darknet and users paid with crypto such as Bitcoin and Monero.

Illegal drugs of all kinds, counterfeit money, stolen or forged credit cards, malware and many other illegal goods were traded on ‘DarkMarket’.

Koblenz Prosecutor General’s Office

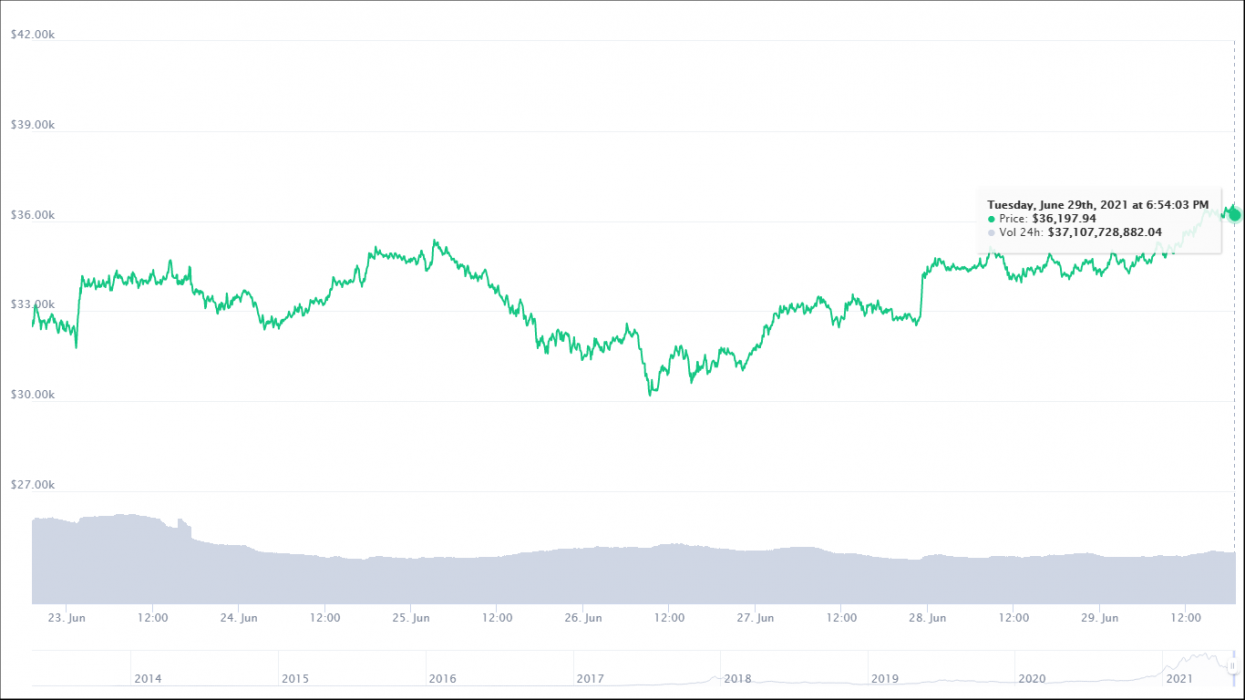

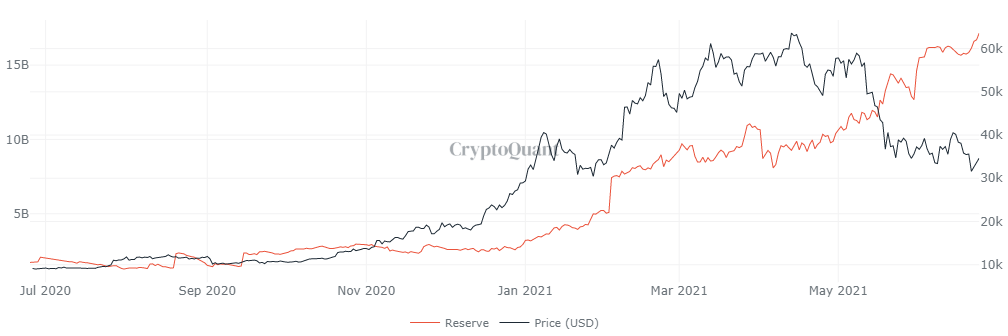

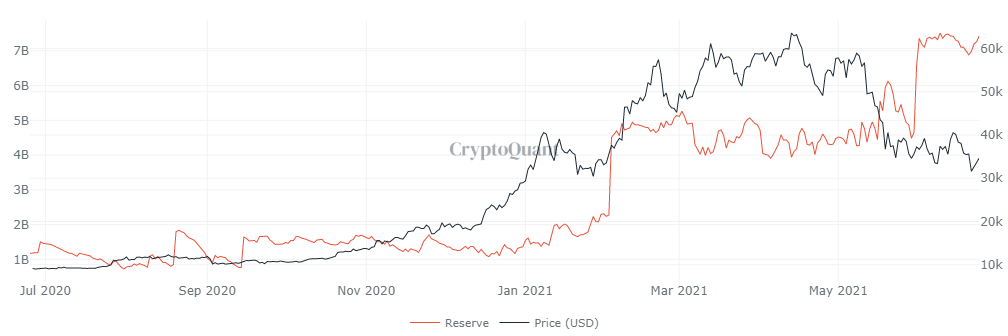

DarkMarket was a huge marketplace with almost 500,000 users and more than 2,400 sellers. Over 320,000 transactions were made during its operation: more than 4,650 Bitcoin and 12,800 Monero were traded (at the current rate, this represents more than €140 million, or A$220 million worth).

Humble Origins … in a Hackathon

DarkMarket’s origins are quite fascinating. In 2014, DarkMarket was one of the winners of the Bitcoin Expo hackathon in Toronto, Canada. The project was described as a decentralised marketplace that could not be shut down. The official Ethererum Twitter account even put up a post congratulating the team:

Crypto Crackdown Goes Global

Of late, there appears there to be an increased global crackdown on those using crypto for nefarious purposes.

At the start of the month, Chinese police arrested 1,100 people for crypto-related money laundering charges. And in April, a Swedish-Russian citizen was arrested for operating a darknet Bitcoin website, Bitcoin Fog, and was accused of laundering over US$366 million.