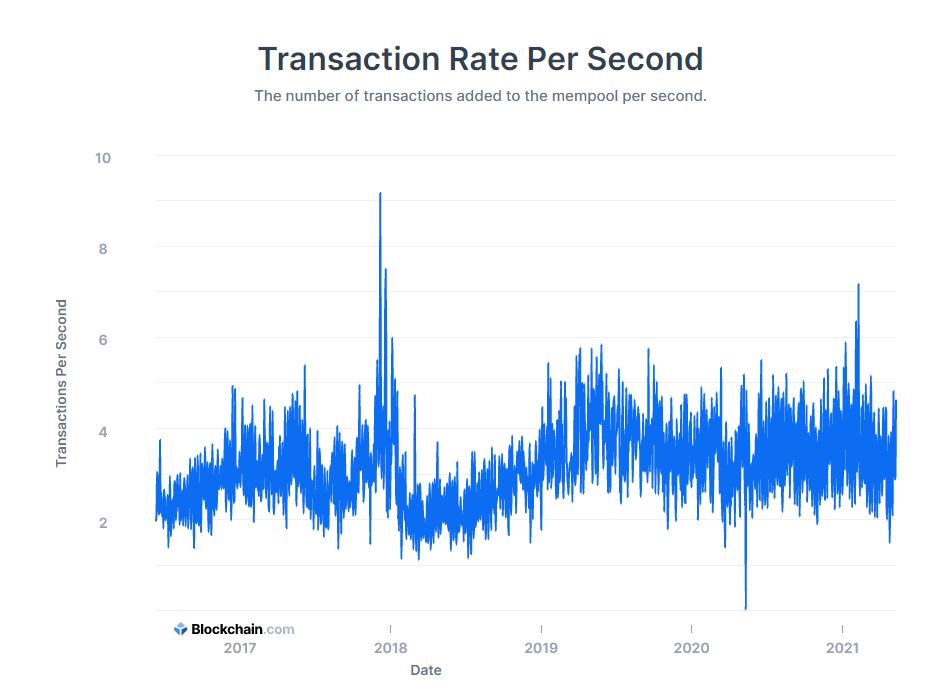

Following Tesla’s suspension of Bitcoin payments due to energy implications, there have been many responses from the industry showing that the network can be operated in a more sustainable way.

After pinning the suspension of Bitcoin payments to its excessive power consumption in a tweet, the announcement sparked a Bitcoin (BTC) sell-off that dropped close to 13% of its value in 24 hours.

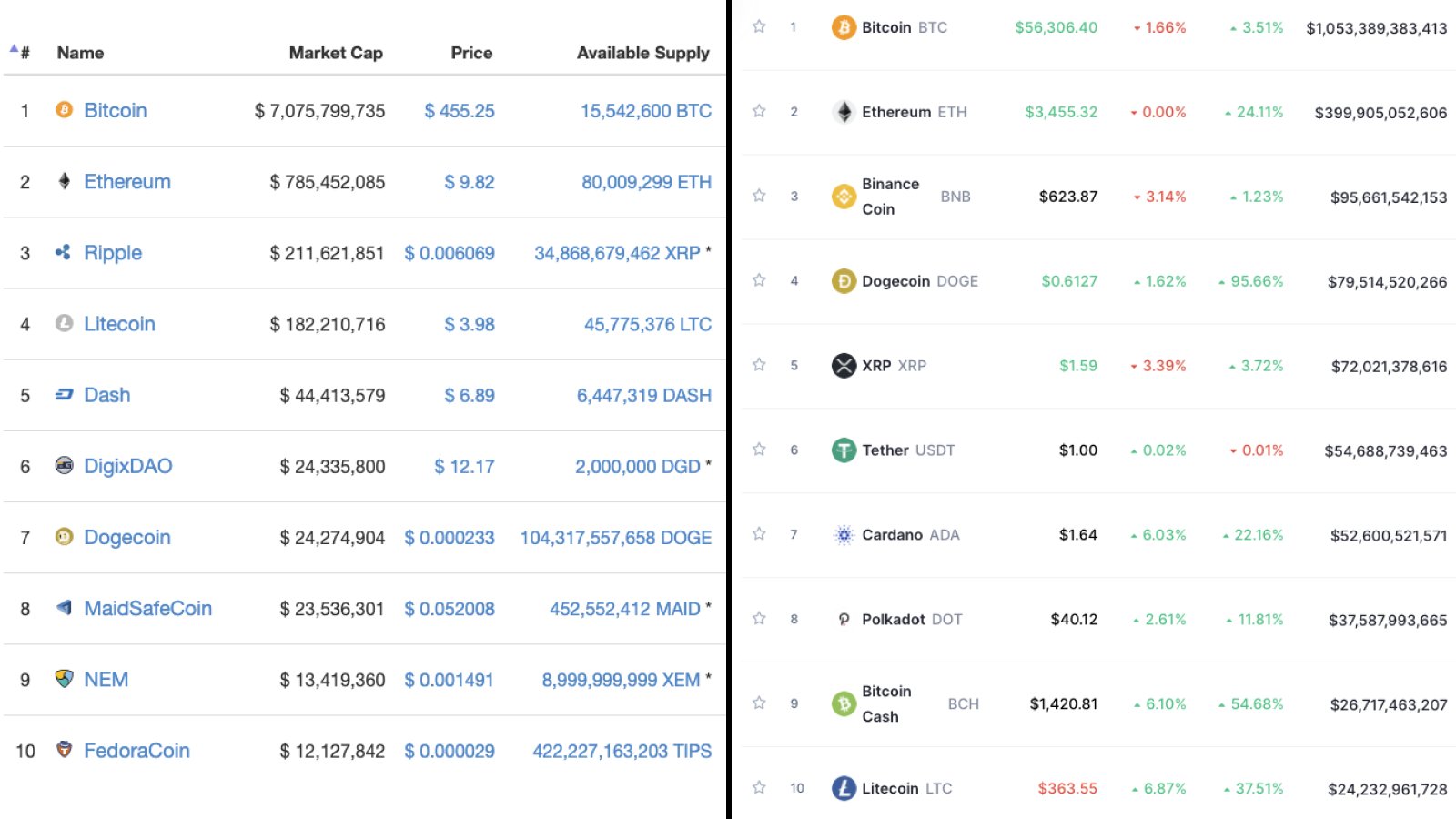

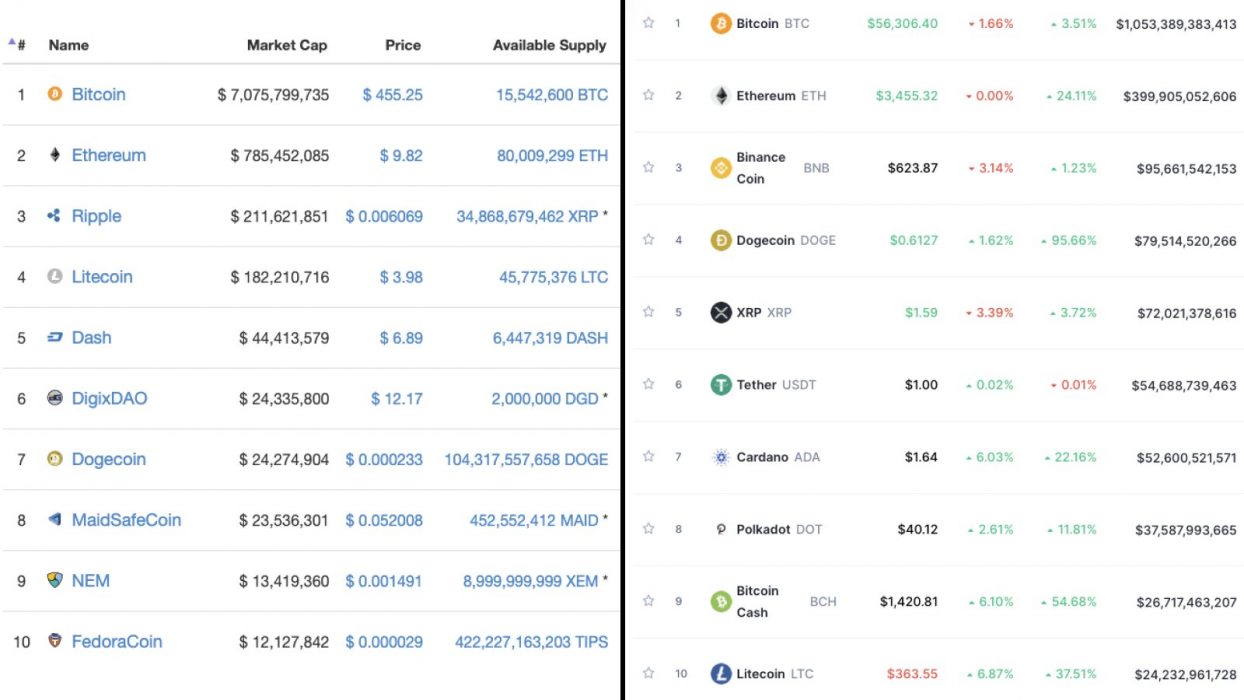

This could raise questions affecting the image of cryptos in the public eye, so various players in the industry have come forward to show that Bitcoin and cryptocurrencies can be more environmentally friendly. For starters, the energy required to mine does not necessarily come from non-renewable sources. There are also other cryptocurrencies that use less electricity than Bitcoin (even at scale), thanks to Proof-of-Stake (PoS) or other consensus algorithms needing less computational power to function.

Green Changes Submitted To Enhance Bitcoin’s Proof-of-Work Algorithm

Michael Dubrovsky, co-founder of Siphox and Powx, revealed that the nonprofit Powx has drafted a Bitcoin Improvement Proposal (BIP) that aims to produce a “durable, low energy” Bitcoin Proof-of-Work (PoW) system.

The paper details how the algorithm, dubbed “Optical Proof-of-Work (OPOW)”, could greatly reduce energy dependency by leveraging photonics.

There are changes that can be implemented to the Bitcoin protocol to make it less energy-hungry however, due to its decentralised nature, upgrading it can be a lengthy process.

Bitcoin Mine in New York Going Carbon Neutral

Greenidge Generation, a New York-based bitcoin mining operation, has announced that they will be carbon neutral by the start of June following the media storm that concerned many people about the environmental impact of cryptocurrency mining.

Greenidge’s real estate is 150 acres in size and has an on-site and a power plant capable of generating over 100MW of clean energy an hour. The plant uses natural gas to generate electricity running at high levels of thermodynamic efficiency, thus lowering the cost of producing power.

We are demonstrating we can provide the same critical transaction verification and processing services to secure the bitcoin network while maintaining a fully carbon neutral footprint. We call on others to join us in significantly reducing greenhouse gas emissions now.

Jeffrey Kirt, CEO of Greenidge Generation Holdings [source]