Tether is one of the most successful cryptocurrencies in the world. It’s currently the fourth largest crypto in terms of market capitalisation, and the top-rated stablecoin currently in circulation. Its market cap is more than $10,000,000,000, with a 24-hour trading volume of almost $29,307,000,000 at the time of writing. In fact, this trading volume makes it the most widely traded cryptocurrency of all – beating even Bitcoin to the top spot!

Whether you’re considering investing in Tether or simply want to know more about this stablecoin, read on. In this article, we’ll be guiding you through the threemain benefits of Tether from a trader’s point of view.

1. Tether is a stablecoin

What is a stablecoin?

Have you come across the term ‘stablecoin’ online but aren’t sure what it means? A stablecoin is an alternative form of cryptocurrency which was developed to bring traders the benefits of crypto with the security of fiat currency. (Fiat currency is a type of currency that maintains its value in the form of money, generally by government regulation. An example of this would simply be the Aussie dollar, US dollar, British pound, or Japanese yen).

More ‘traditional’ forms of cryptocurrency are infamously volatile. You’ve probably seen reports of Bitcoin’srecord volatility levels, which hit a staggering 8% in 2017. It’s this volatility which often puts people off from investing in digital assets – even experienced traders who follow the markets carefully.

Stablecoins are an innovative solution to this problem. Instead of deriving their market value from the number of traders, exchanges, and coins in circulation, stablecoins are tied to a fiat currency. This means that their value is designed never to fluctuate from a fixed amount – for example, 1 AUD or the price of a stable commodity.

What is the value of Tether?

Tether (USDT) takes its value from the US dollar. According to the company which owns the stablecoin, Tether Holdings Ltd, 1 USDT will always be equal to $1, with an additional $1 held in reserve. This means it’s nowhere near as volatile as Bitcoin and other cryptos, making it a far safer investment.

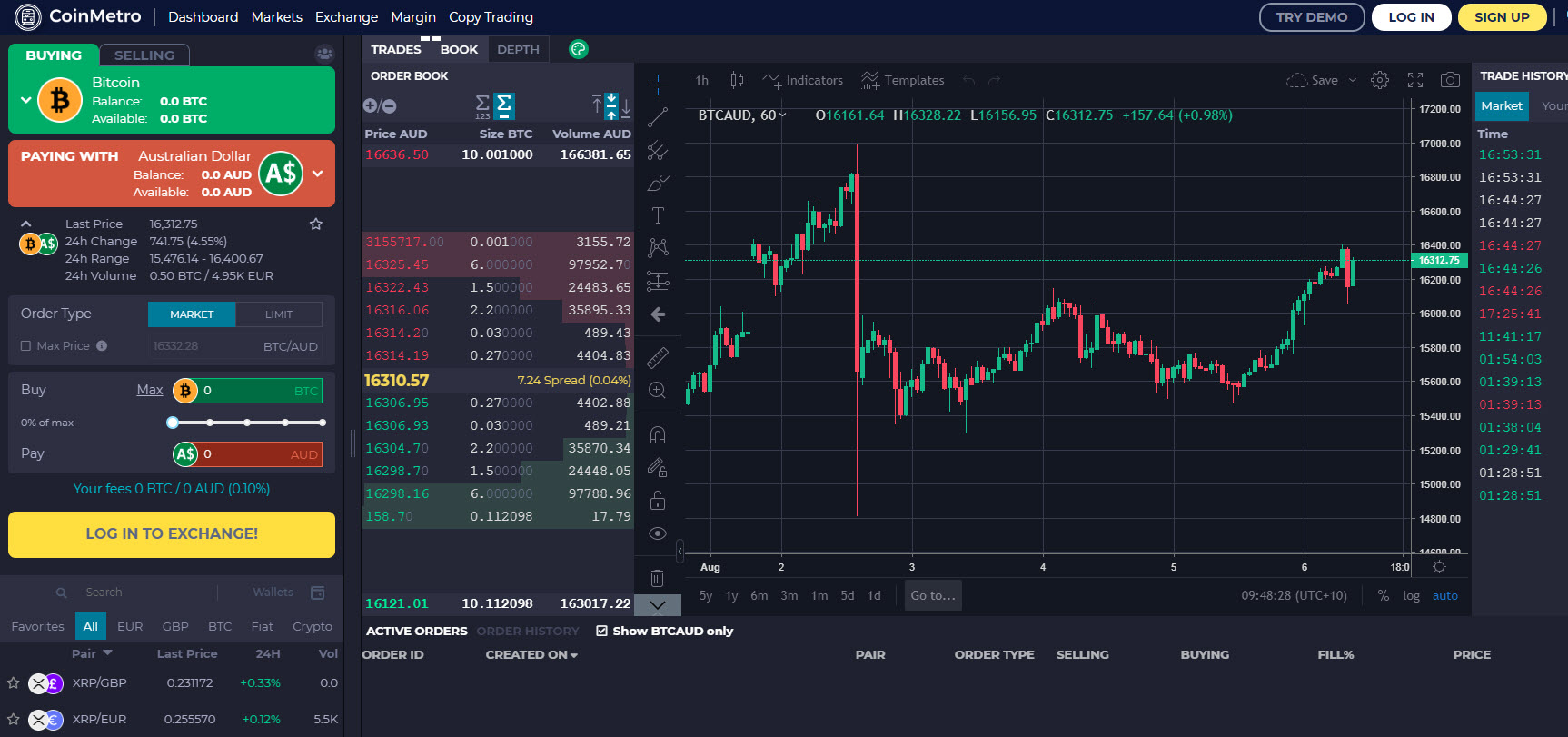

Tether can be easily exchanged

As a stablecoin, another benefit of Tether is the fact that it can be easily exchanged. Although this hasn’t always been the case, it’s currently possible for Tether investors to exchange each Tether token in their wallets for $1, making it simple to convert their digital assets into ‘real’ money.

Tether is ‘the digital dollar’

For this reason, Tether is often known as ‘the digital dollar’ and a ‘digital-to-fiat currency’. Because its value is relatively consistent in comparison to cryptos such as Bitcoin, Litecoin, or Ethereum, many traders treat it straightforwardly as an alternative form of fiat currency. This makes it a convenient intermediary stage between other cryptocurrencies and hard cash. Simply exchange your Bitcoin reserves for Tether, then convert it into dollars.

There is no fixed number of Tether tokens

For many people, one of the most confusing aspects of Bitcoin is the fact that the total number of Bitcoin tokens is fixed. There can only ever be 21 million tokens in circulation. This might sound like a lot, but reserves seem a lot thinner when you consider that there are already roughly 18,500,000 in circulation, just over 10 years after the launch of Bitcoin in 2009 – and that this number is predicted to change every 10 minutes.

Bitcoin halving

To help regulate the circulation of Bitcoin, a process known as ‘Bitcoin halving’ occurs every four years. This is when the price of Bitcoin is cut in half, happening most recently in May 2020. Before this point, miners earned 12.5 Bitcoin (BTC) per ‘block’. They now earn 6.25 BTC.

Because the value of Tether is fixed, the number of Tether tokens in circulation makes no difference to its worth. This arguably makes it a more secure long-term investment than Bitcoin, which has an inevitable expiration date.