As reported by Bloomberg, software giant Google has reportedly formed a division focused on blockchain technology, appointing Shivakumar Venkataraman as the new executive to lead the unit.

What Will the Blockchain Division Do?

Venkataraman, an engineering vice-president for Google, says the new division will focus on “blockchain and other next-gen distributed computing and data storage technologies”.

The new division comes under the umbrella of Labs, an incubator created by Google that focuses on long-term projects regarding emerging technologies such as virtual reality. Venkataraman will also become the “founding leader” of Labs.

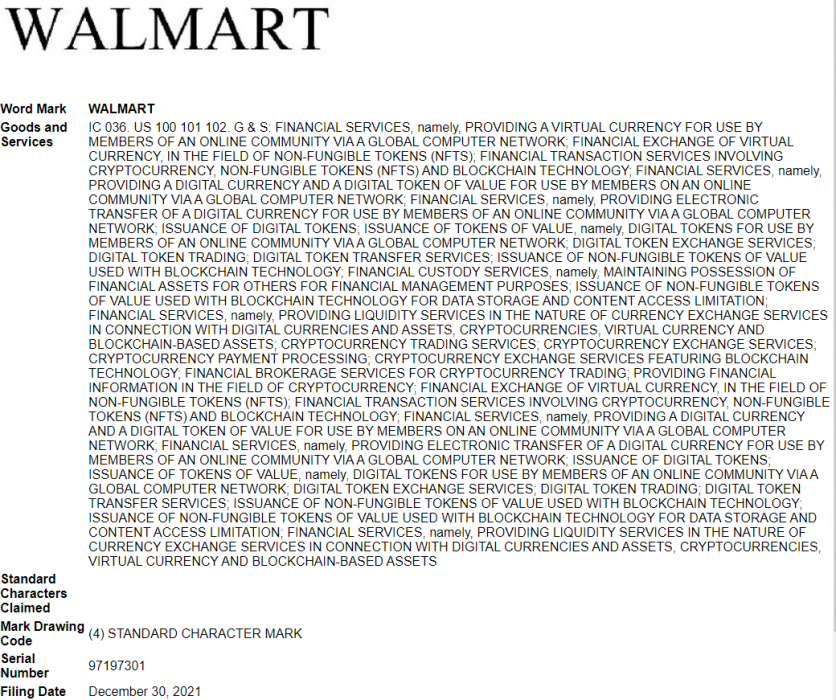

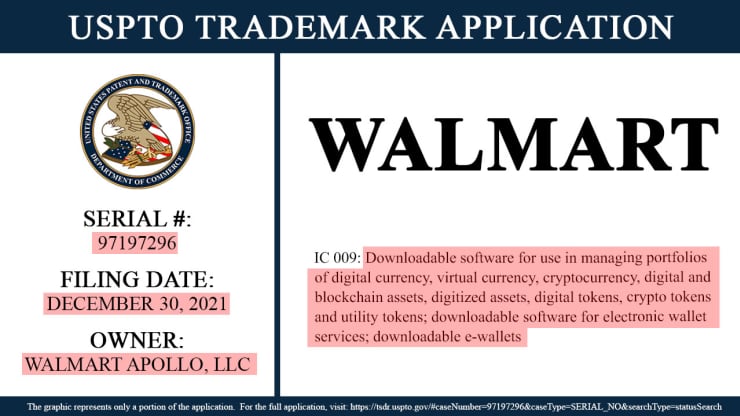

Not much is known about the group apart from the information obtained by Bloomberg. This is probably a response to other tech giants integrating emerging technologies, such as Meta (formerly Facebook) and Instagram, both exploring NFTs (non-fungible tokens).

Will Google Integrate Crypto into Its Business Model?

While it’s still not known if Google will integrate digital assets like Instagram and Meta plan to do, this could be its jumpstart for exploring crypto assets and their foundational technology.

Google has alleviated the pressure on cryptocurrency promotion by lifting its advertising ban last August, allowing crypto companies to place ads on its search engine and sites that are part of its platform.

Another tech giant focusing on the rise of NFTs and Web3 is Microsoft, which has followed Facebook/Meta into the metaverse by launching 3D avatars and immersive meetings.