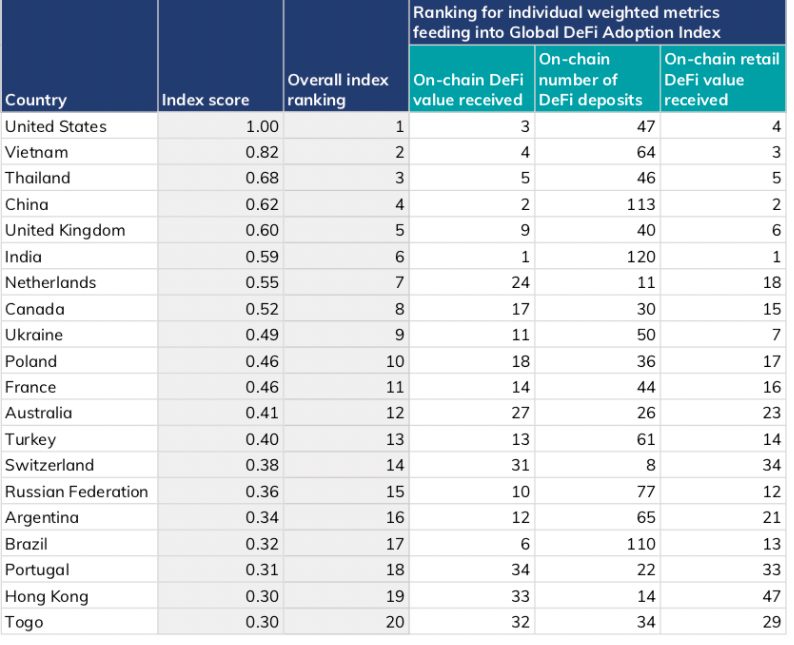

A newly published Global DeFi Adoption Index by Chainalysis ranks countries in terms of their grassroots DeFi adoption. The index includes the top 20 nations that have embraced DeFi along with key players and transactions driving interest in DeFi.

According to the index, Australia ranks 12th out of 154 countries.

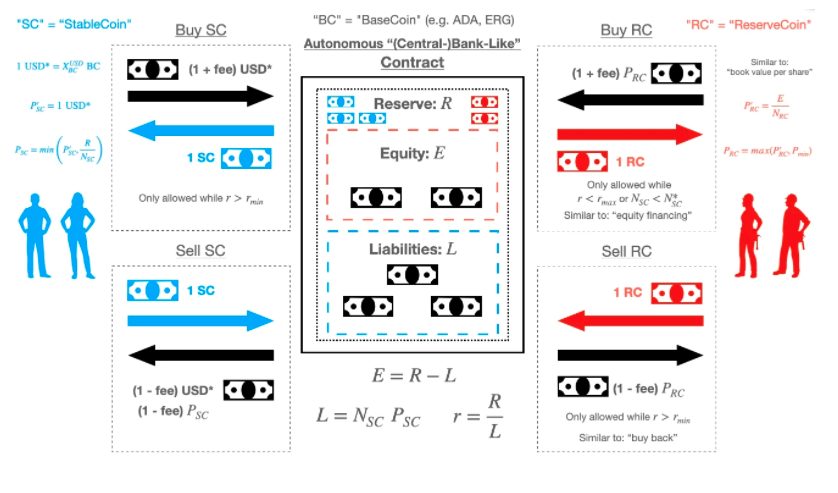

DeFi (decentralised finance) platforms, otherwise known as protocols, are built on top of smart contract-enriched blockchains, mainly on the Ethereum network. The protocols can fulfill specific financial functions according to the smart contracts’ underlying code.

Popular types of DeFi protocols include decentralised exchanges and lending platforms. While concerns remain around DeFi’s safety and compliance obligations, it represents one of the fastest-growing and most innovative sectors of the cryptocurrency economy. Similar to our Crypto Adoption Index, the DeFi Adoption Index is designed to highlight countries with the highest grassroots adoption by individuals, rather than those sending the largest raw values of funds.

Chainalysis Global DeFi Adoption Index

DeFi has featured heavily in crypto news this month due to a series of cyberattacks in which millions were stolen. While the safety of DeFi platforms remains a concern, business is booming. At the time of writing, the DeFi crypto market cap was sitting comfortably at over US$121 billion with a total trading volume of US$10.7 billion.

Inaugural Index Works on Three Metrics

The index, the first of its kind, ranks countries according to three different metrics that aim to balance DeFi activity by wealthier individuals and richer countries. The ranking indicates that DeFi adoption is popular in countries where there are high levels of crypto adoption and use among traders and investors.

Countries are ranked according to each of the three metrics. The geometric mean of each country’s ranking in all three metrics is calculated and then the final number is normalised on a scale of 0 to 1 to assign each country a score that determines its overall ranking. The closer a country’s score is to 1, the higher its rank (see chart below).

The data shows that large transactions make up a much bigger share of DeFi activity, suggesting that DeFi is disproportionately popular for bigger investors compared to cryptocurrency as a whole. Transactions above US$10 million accounted for over 60 percent of DeFi transactions in Q2 2021, compared to under 50 percent for all cryptocurrency transactions.

Chainalysis data extrapolation

New Protocols Drive Rise in DeFi Projects

Data reveals that the majority of top-10 DeFi projects gained more than 20 percent in the past 30 days, with some such as THORChain (RUNE) realising gains of over 115 percent.

The surge in DeFi can be attributed to the arrival of new protocols such as DinoSwap, and the rise of Ethereum-network competitors such as Avalanche (AVAX). Both DinoSwap and Avalanche saw users flock to their networks to escape high fees on the Ethereum network.

‘Significant’ DeFi Growth in Australia

Although the DeFi sector in Australia has proven significant growth, hesitation still exists. Crypto News Australia recently reported how a Melbourne-based crypto fund outperformed Bitcoin on its year-to-date profits, returning 119 percent compared to Bitcoin’s 19.96 percent growth.

The fund has indicated that it avoids DeFi projects, citing an investment strategy in which audited code is a must. Many DeFi projects such as Whalefarm, which uses an unaudited code, quickly crashed to zero after showing much promise. Fears over hacking due to weaknesses in code are also proving a big risk.

Despite DeFi sector growth in Australia, projects are seen as partnerships or unincorporated associations for which the Australian regulatory framework remains unclear.

Yet Australia is is proving itself a worthy adversary in DeFi, with ThorChain and Synthetix.io two of the more successful Aussie DeFi start-ups.

By Jana Serfontein, Crypto News Australia Guest Author