Let’s take a closer look at today’s altcoins showing breakout signals. We’ll explain what the coin is, then dive into the trading charts and provide some analysis to help you decide.

1. Cardano (ADA)

Cardano ADA is a proof-of-stake blockchain platform that says its goal is to allow “changemakers, innovators and visionaries” to bring about positive global change. The open-source project also aims to “redistribute power from unaccountable structures to the margins to individuals”, helping to create a society that is more secure, transparent, and fair.

Cardano is used by agricultural companies to track fresh produce from field to fork, while other products built on the platform allow educational credentials to be stored in a tamper-proof way, and retailers to clamp down on counterfeit goods.

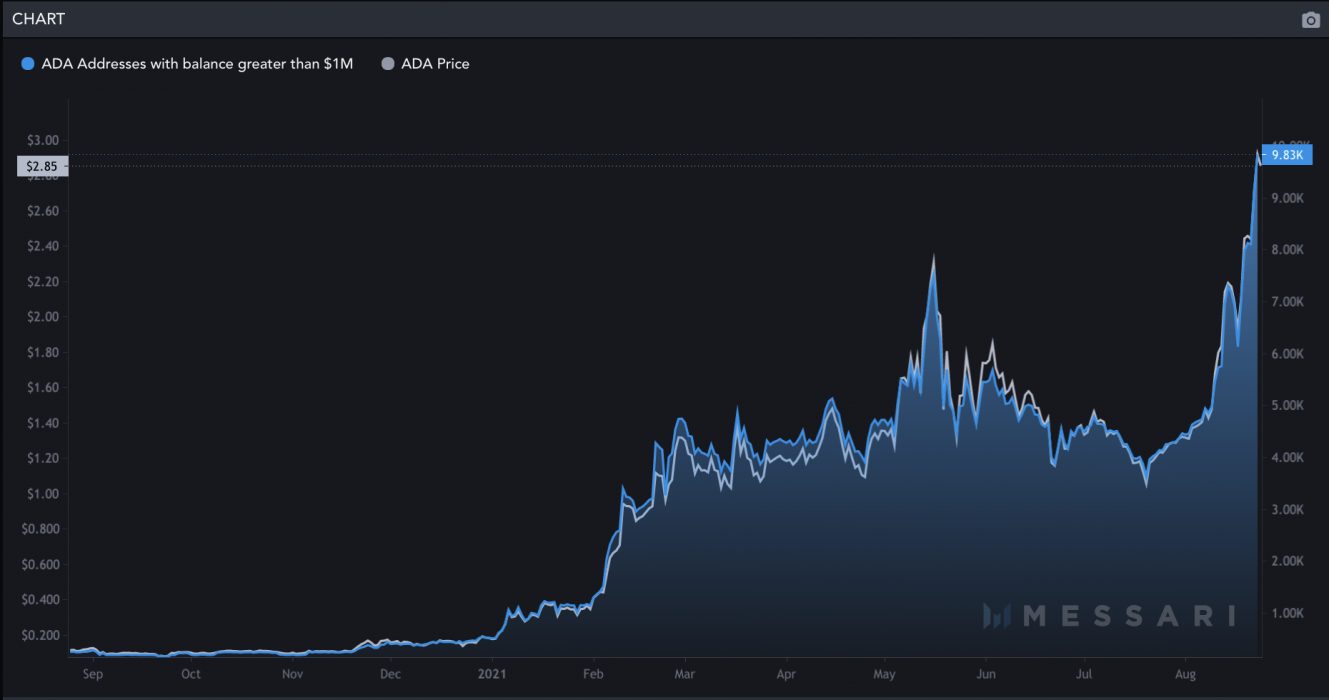

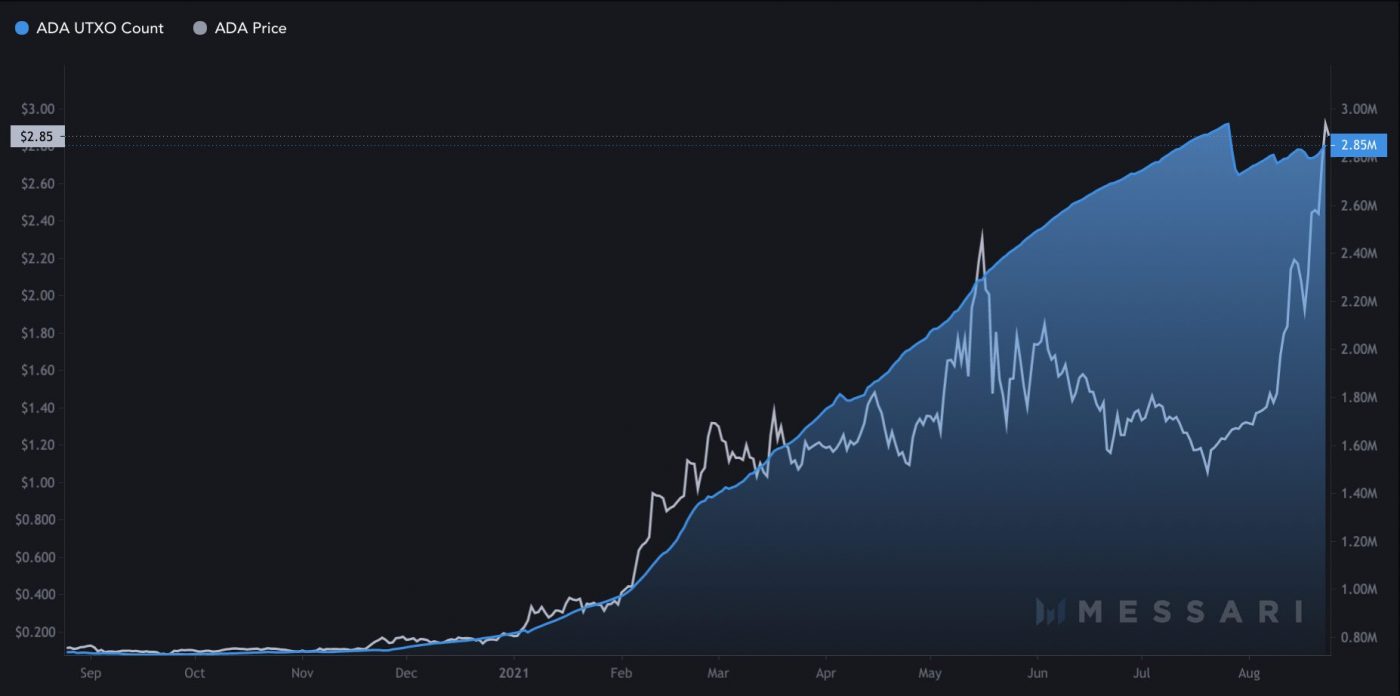

ADA Price Analysis

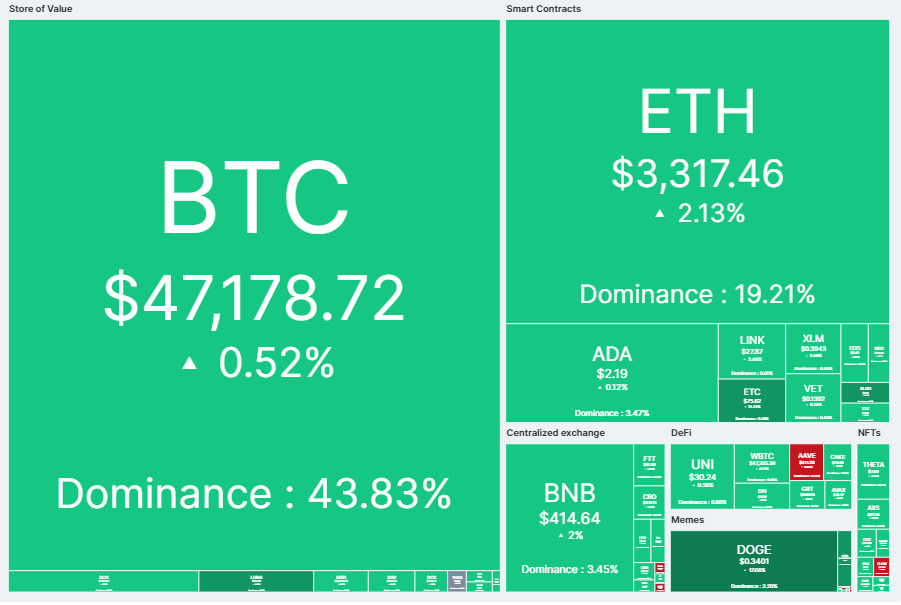

At the time of writing, ADA is ranked the 4th cryptocurrency globally and the current price is A$3.08. Let’s take a look at the chart below for price analysis:

ADA‘s nearly 47% retracement from its late August high found a low near A$2.93 in late September.

The price is currently approaching resistance at a swing high near A$3.15. If this level breaks, bulls might target the swing highs near A$3.23, A$3.29, and potentially up to A$3.34. Resistance near A$3.39 and A$3.46 could cap this move.

If the market remains bullish for the near term, bulls might buy at A$3.10. However, a stop run into A$2.91 could offer a higher probability entry. A steeper drop could reach below the swing low into possible support near $2.85.

2. Chromia (CHR)

Chromia CHR is an open-source public blockchain conceived of by Swedish company Chromaway AB. The Chroma token (CHR) was launched in May 2019. The technology behind the Chromia blockchain is adapted from an earlier technology called ‘Postchain’, a solution provided by Chromaway AB for enterprise clients. Chromia is a standalone Layer-1 blockchain and EVM compatible Layer-2 enhancement for Binance Smart Chain and Ethereum. It is designed to enhance existing dApps and allow for the creation of next-generation dApps by providing scalability, improved data handling, and customisable fee structures.

CHR Price Analysis

At the time of writing, CHR is ranked the 318th cryptocurrency globally and the current price is A$0.4771. Let’s take a look at the chart below for price analysis:

CHR‘s chart paints a different picture than those of many other altcoins, with August’s high leading to a massive range before setting a low near A$0.3544 in September.

The beginning of October makes immediate bids questionable. However, the price may be finding support near A$0.3862 and possibly near A$0.3421. Since the price swept the impulse’s high at A$0.4859, bulls might be waiting to enter near the swing low and gap near A$0.4166, or slightly lower near A$0.3698.

Little resistance lies overhead, although some resistance might exist between A$0.5273 and approximately A$0.5622, just above the current price. A sweep and rejection of the high near A$0.6107 would make most areas of possible support highly suspect and could mark the end of the bullish trend.

3. ICON (ICX)

ICON is a decentralised blockchain network focused on interoperability. With ICON’s “blockchain transmission protocol”, independent blockchains like Bitcoin and Ethereum can connect and transact with each other. This opens up cross-chain use cases that are impossible without an interoperability layer like ICON. The ICON blockchain is powered by loopchain, a blockchain engine designed by ICONLOOP.

ICX Price Analysis

At the time of writing, ICX is ranked the 75th cryptocurrency globally and the current price is A$3.08. Let’s take a look at the chart below for price analysis:

Like many other altcoins, ICX set a high in early April before retracing 83% to the low at A$1.27 in June.

Price broke through resistance near A$2.89, which may mark an area of possible support on a retracement. If this support fails, bulls might also step in near A$2.76. However, a drop this far increases the chances of a stop run to A$2.70 and possibly into support near A$2.66. For now, continuing bullish market conditions could help A$2.85 become support.

The swing high around A$3.14 gives bulls a reasonable first target, with A$3.20 also likely to draw the price upward. Higher-timeframe resistance beginning near A$3.27 or A$3.30 could cap the move or trigger consolidations. If bullish market conditions continue, bulls might test probable resistance near A$3.38.

Where to Buy or Trade Altcoins?

These coins have high liquidity on Binance Exchange, so that could help with trading on AUD/USDT/BTC pairs. And if you’re looking at buying and HODLing cryptos, then Swyftx Exchange is an easy-to-use popular choice in Australia.