Bankrupted crypto lender Celsius has filed a lawsuit against a former investment manager, alleging he cost the platform tens of millions of dollars through a combination of incompetence and theft.

The complaint, which was filed in New York’s Manhattan bankruptcy court on August 23, alleges that Jason Stone, through his company KeyFi Inc, falsely presented himself as an experienced and highly skilled digital asset manager, but was in fact negligent and “extraordinarily inept” at devising and implementing profitable crypto investing strategies.

Celsius Alleges DeFi Manager Used NFTs, Tornado Cash to Siphon Funds

The filing states that Stone worked with Celsius for about seven months up to March 2021 and was given access to a Celsius-controlled wallet for the purposes of managing the lender’s DeFi investing strategy.

Celsius alleges that rather than managing its assets as requested, Stone instead invested heavily in NFTs – including CryptoPunks and Bullrun Babes – to the tune of 1070 ETH. Allegedly, Stone later sold some of the NFTs for 1071 ETH before funnelling the funds through crypto mixing service Tornado Cash to his own private wallet rather than back into the Celsius-controlled wallet.

Celsius claims Stone had no authorisation to purchase NFTs as part of his role and suggests he might have done so because he was aware it was difficult for Celsius to track NFT purchases through its internal systems, making the theft harder to notice.

In addition to what it claims was intentional theft, Celsius claims Stone also cost the lender over US$50 million through his ineptitude, saying he proved himself “incapable” of investing profitably in cryptocurrencies.

Stone, responding to these accusations through his lawyer, Kyle Roche, claims all of the investments he made on behalf of Celsius were authorised by the lender’s CEO, Alex Mashinsky.

Claims Follow Previous Suit From KeyFi Against Celsius

These complaints come six weeks after Stone’s company, KeyFi, filed suit against Celsius, claiming it was operating a Ponzi scheme and that it owed Stone hundreds of millions of dollars in unpaid compensation.

Stone claims Celsius ran out of money because it relied on attracting new customers by offering excessively high rates of return, and because it failed to adequately manage risk by hedging its investments. He also says he generated over US$800 million in profit in seven months for the lender, further claiming that he’s entitled to 20 percent of this profit – over US$200 million.

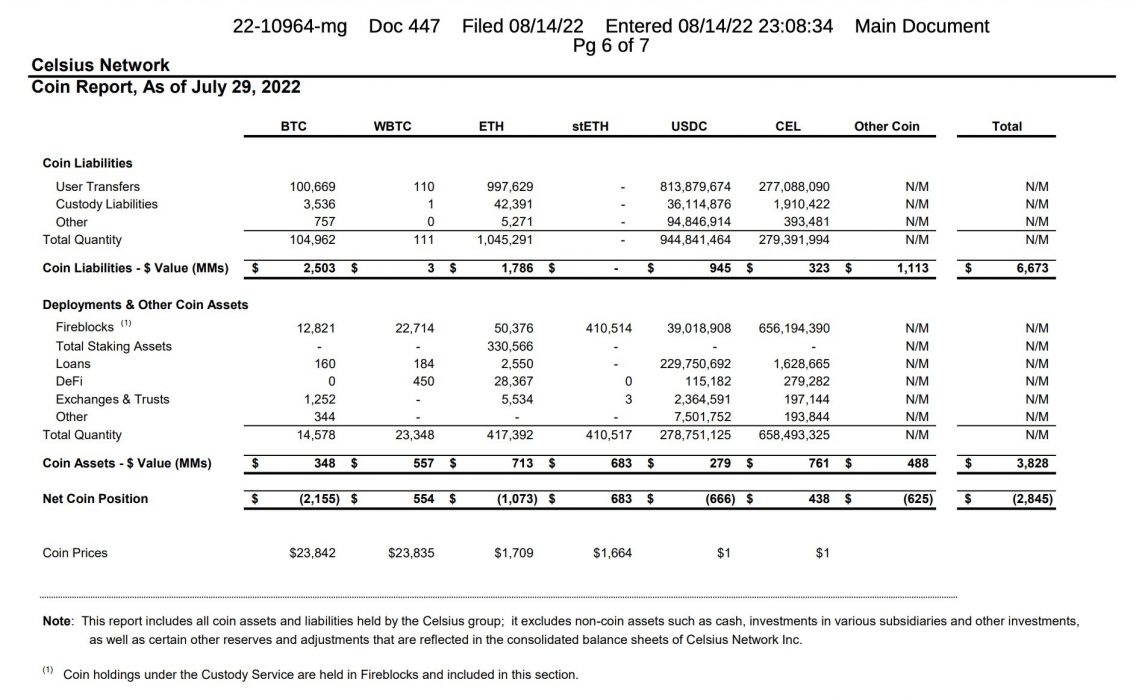

Financial documents filed by Celsius last week as part of its bankruptcy hearing show that the lender has a US$2 billion hole in its books and could be completely out of cash by the end of October.