Crippled crypto lending platform Celsius, which filed for bankruptcy in July, appears to be in an even worse financial position than previously thought, with papers filed this week revealing it may run out of money completely by October:

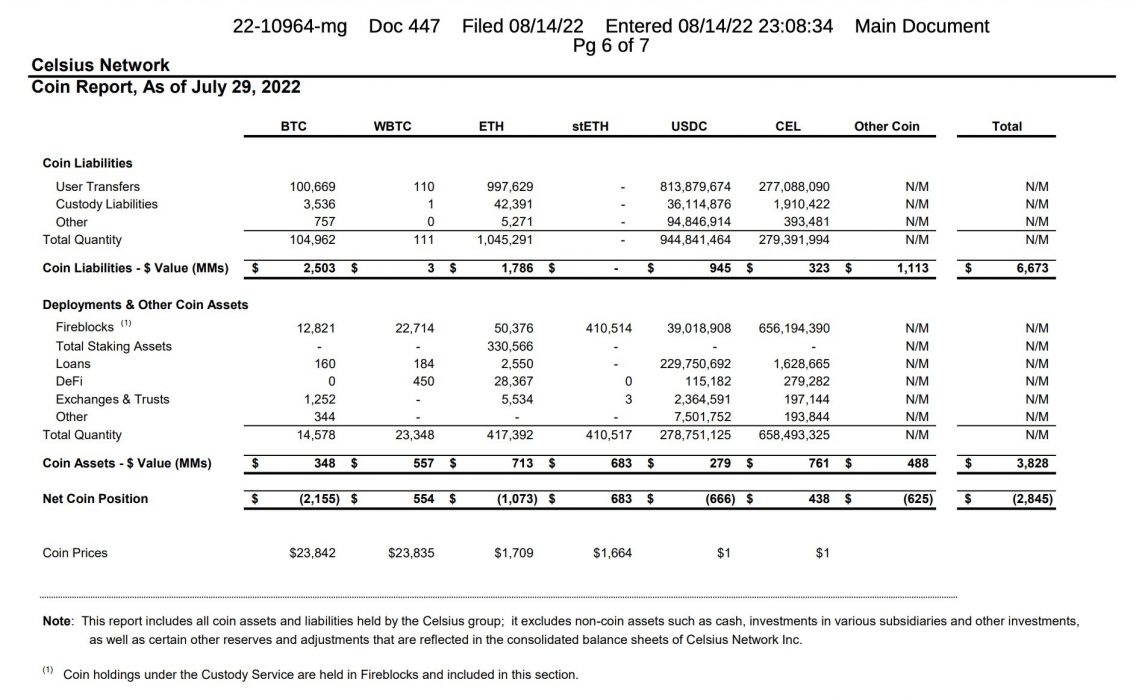

The papers filed in the US Bankruptcy Court for the Southern District of New York also showed that the lender holds US$2.8 billion less in crypto assets than it owes to depositors, leaving many users of the platform worried they may lose their deposits.

Celsius’ Books Don’t Make For Pleasant Reading

Celsius’ latest financial disclosure showed it had an opening cash balance of just under US$130 million in early August. The filing forecasts operating expenses and other costs to run to US$137 million over the next three months, meaning the lender will be in the red by the end of October.

The filing also showed that Celsius’ crypto liabilities to depositors exceed US$6.6 billion, while it only actually holds US$3.3 billion in crypto assets.

The US$2.8 billion shortfall is largely due to deficits in the lender’s holdings of BTC, ETH and USDC. According to its financial disclosure, Celsius is more than US$2 billion short of BTC, over US$1 billion short of ETH and US$666 million short of USDC. These deficits are partially offset by its holdings of stETH, WBTC and its governance token, CEL:

Could Celsius Sell CEL to Help Itself?

Celsius’ financial disclosure shows the lender holds 658 million of its CEL token of which 279 million are owed to customers, which leaves the lender with 379 million tokens.

In the document CEL is valued at US$1 but the token has recently been the target of a social media-driven short squeeze, resulting in its price increasing significantly. According to CoinGecko, CEL was changing hands at US$2.45 at the time of writing – meaning Celsius’ CEL assets are notionally worth a lot more than the filing suggested.

So, what’s stopping Celsius selling its CEL tokens to help raise funds to pay its liabilities? Well, almost all circulating CEL is locked on Celsius itself. If the lender were to sell large quantities, the token’s value would likely collapse, leaving Celsius’ books in an even more dismal state.

In a cynical twist, crypto security firm Arkham Intelligence has evidence that it believes shows Celsius CEO Alex Mashinsky sold sizeable quantities of CEL via multiple transactions throughout May and August of this year. If true, this would mean the Celsius chief executive was actively dumping against the community-driven short squeeze to serve his own interests.