Coinbase will soon offer the option of employees’ paycheques being paid directly into their accounts on the crypto exchange. Customers will be able to deposit “as much or as little” of their salary as they like when the feature rolls out in the next few weeks.

Until recently, this option had been available only to a handful of people, such as celebrity athletes and employees at crypto companies. But this is changing. On September 27, Prakash Hariramani, senior director of product at Coinbase, announced a new “get paid in crypto” service that will allow almost everyone in the US who is paid by direct deposit to receive all or part of their wages in dollars, bitcoin, ethereum or other cryptos.

Both options will be free with no service fee, but Coinbase will earn a small profit in the form of a spread for those who opt to be directly paid in crypto.

The “Future of Payroll”

Coinbase calls this new feature the “future of payroll”, and explains exactly how the service will work:

You can set up a direct deposit in just a few steps without leaving the Coinbase app. Find your current payroll company or employer and we’ll automatically update your paycheque allocation. If you’d prefer to set up a direct deposit manually, we’ll provide instructions on what to share with your HR department or employer payroll website.

Coinbase

Earn Cryptos Faster and More Efficiently

Citing “time-consuming and inconvenient” frequent transfers as part of the reason for offering this new service, Coinbase says that direct deposits will allow users a faster and more efficient way of earning crypto rewards.

Having already partnered with US-based firms such as Fortress Investment Group, Nansen, SuperRare Labs and M31 Capital to roll out direct deposits for “employees throughout the creator economy and financial services”, the exchange hopes more will come.

As you begin to do more with your crypto from staking to spending to sending, we’re also making it easier for businesses to pay their employees in crypto.

Prakash Hariramani, senior director of product, Coinbase

Last year the exchange announced that the Coinbase Card had been connected to the Visa network, allowing users to shop just as they would normally with the difference that their purchase would be funded through cryptos. The use-value of this card is still a contested subject as crypto purchases trigger tax headaches and are associated with transaction fees, in this case running at 2.75 percent.

To address these issues, Coinbase offers a reward system that pays 1 percent in BTC on each purchase and up to 4 percent back in some other cryptos.

Coinbase Abandons the Lending Ship Following SEC Threats

The move from Coinbase comes only a week after the exchange announced it would no longer be pursuing its crypto lending program, Lend. Initially intended to offer partial returns on deposits of the stablecoin USDC, the exchange has had to abandon the plan after the US Securities and Exchange Commission (SEC) threatened the company with a lawsuit. The SEC issued an immediate warning saying the product is seen as a “security”.

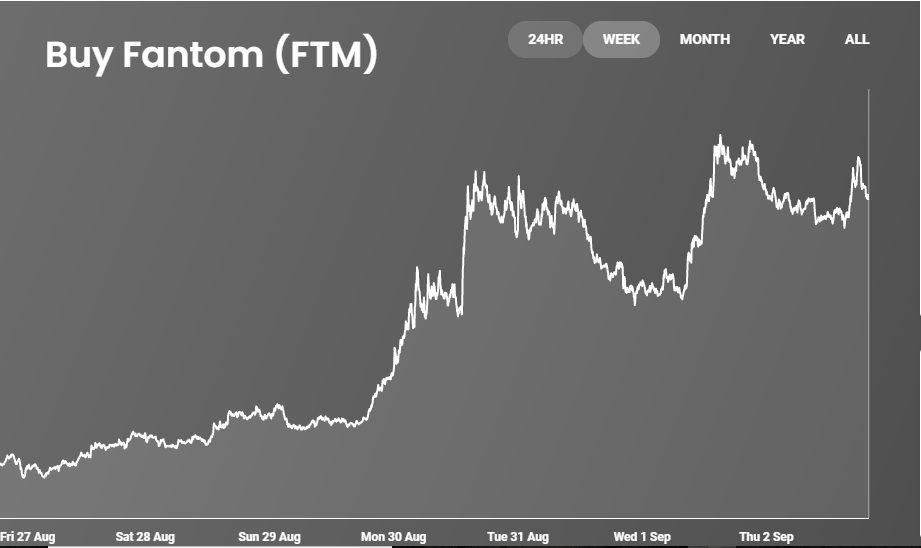

Users of the exchange welcome the news in light of recent issues experienced on the platform. For example, Coinbase failed during the market dip on September 7, delaying or even cancelling transactions issued during that time.

The company is also facing a class-action lawsuit relating to claims it apparently failed to disclose relevant information before being listed on the NASDAQ in April this year.