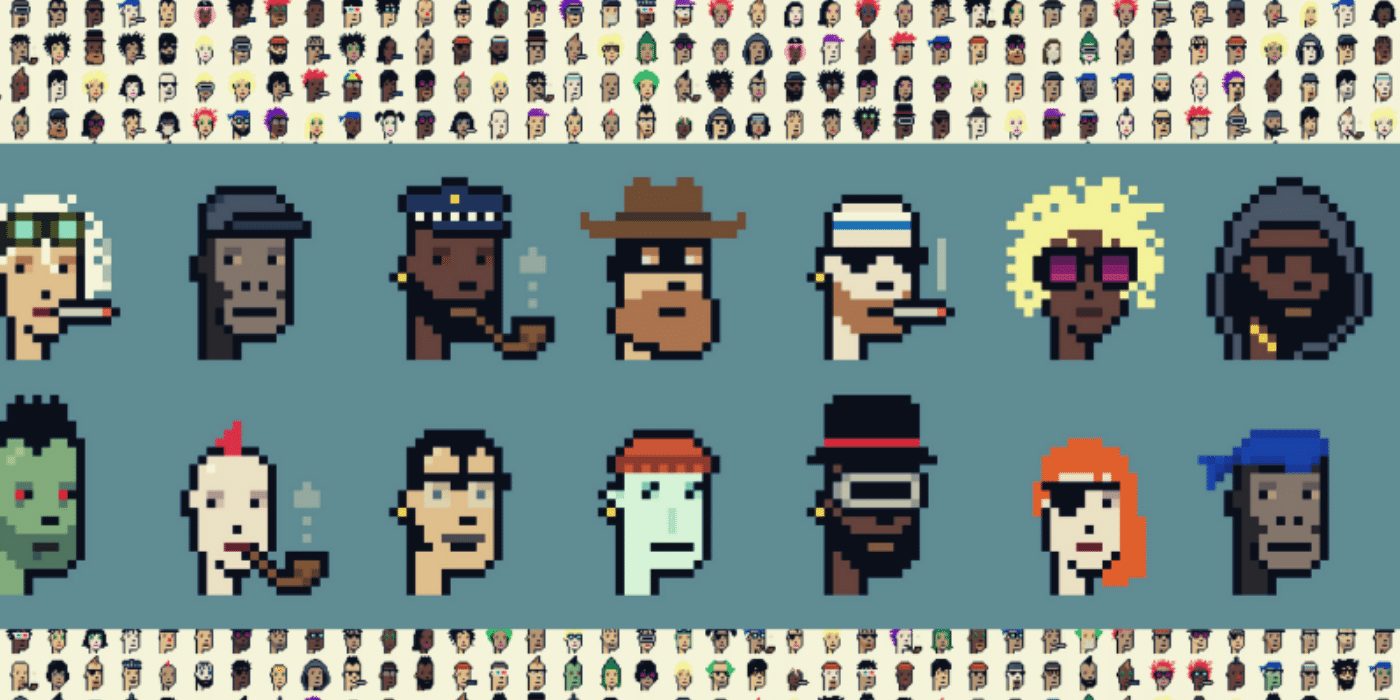

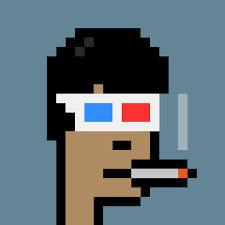

CryptoPunks have gone way beyond cult status with multimillion-dollar price tags and diehard collectors who refuse to part with these exuberant pieces of digital art, no matter what the cost or inducement.

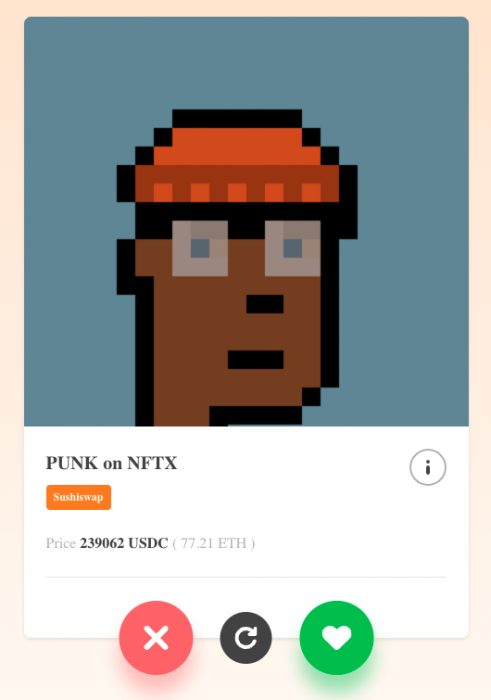

Canadian Punk collector Richerd bought CryptoPunk #6046 for 45 ETH (US$83,209) on Mar 31, 2021. Just over six months later he refused an offer for the same Punk, turning down a record-breaking on-chain bid of almost US$10 million, with a potential 11,500 percent return.

Richerd owns three other Crypto Punks: male punk #3936, which is basically the same as #6046 but without the cigarette, as well as two female Punks – #1032 and #1042 – and a variety of other, equally expensive NFTs, including Bored Apes.

@Richerd took to Twitter with his priceless punk #6046 featured as his profile picture, declaring that he will never sell his Punk.

He further explained that his CryptoPunks are deeply tied to the identity of his business’s branding, therefore selling ownership of the image would not be something he would consider.

My identity along with identity of other iconic Punks and apes have value beyond the NFT itself. We have our own brands similar to any other brand and that has value. Because I value my personal brand and identity, this was an easy rejection for me.

Richerd Chen, co-founder, Manifold

Richerd is otherwise known as Richerd Chen, the co-founder of NFT smart contract developer Manifold, a studio behind some of the most inventive NFT projects yet seen. Manifold Creator includes a powerful extension framework that allows creators to install blockchain “apps” into their creator contract, allowing them to create products beyond just visual and audio NFTs and support features beyond simply minting.

Chen added via Twitter: “I have huge conviction in the NFT space and in Punks. When it comes to [the] NFTs space, I think very long-term … To me, my brand, identity, and what I’m building in the NFT space will be way more valuable in the long run.”

See the below CryptoPunk image branding a truck wrapped with Spottie the CryptoPunk Rapper: