Gemini and Brave have partnered to make it easier for users to buy, sell, store and earn crypto when using the Brave browser. Together they are building a user-centric internet with the power of crypto.

The Gemini Trading Widget is now available in Brave’s Nightly version (the browser’s testing and development version of Brave) and will go live in Brave’s general release in coming weeks. This integration will allow Brave users to engage with crypto via the new Gemini Trading Widget in a simple and secure manner.

With the Brave browser’s Gemini Trading Widget, users can easily trade any crypto asset listed on the Gemini exchange without having to leave the browser. The Brave browser blocks ads and trackers and other identifying software used by websites to monitor visitors, thus providing a much faster (3-6x) and more private internet experience.

Brave also rewards users for participating: users can earn Basic Attention Tokens (BAT) by opting in to view privacy-preserving Brave ads and online creators can earn BAT with Brave Rewards through publishing online content.

Controlling Your Online Privacy

Brave has been praised as the browser of choice for those looking for more privacy and better security. An alternative browser such as Google Chrome individually identifies and constantly tracks users as they browse, installing cookies and gathering all sorts of private information, including keeping records of your browsing history. By using Brave, your data remains private and on your device – making it the browser of choice for many crypto enthusiasts.

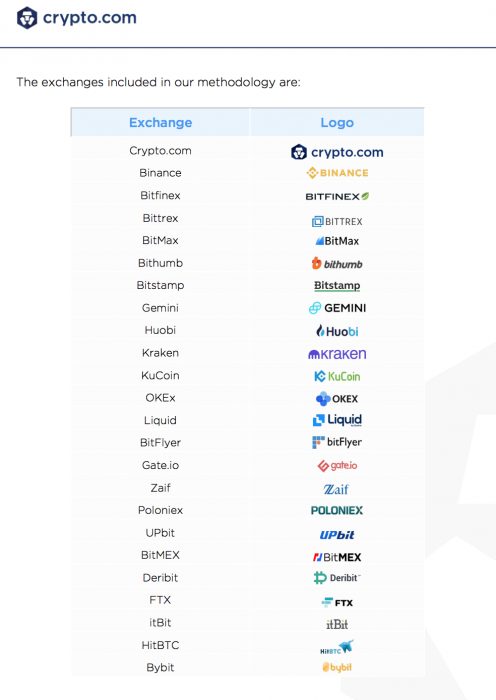

Meanwhile, Gemini has lately become a leader in the Asia Pacific crypto landscape, as Crypto News Australia reported in July, which can only help consolidate its new partnership with Brave.