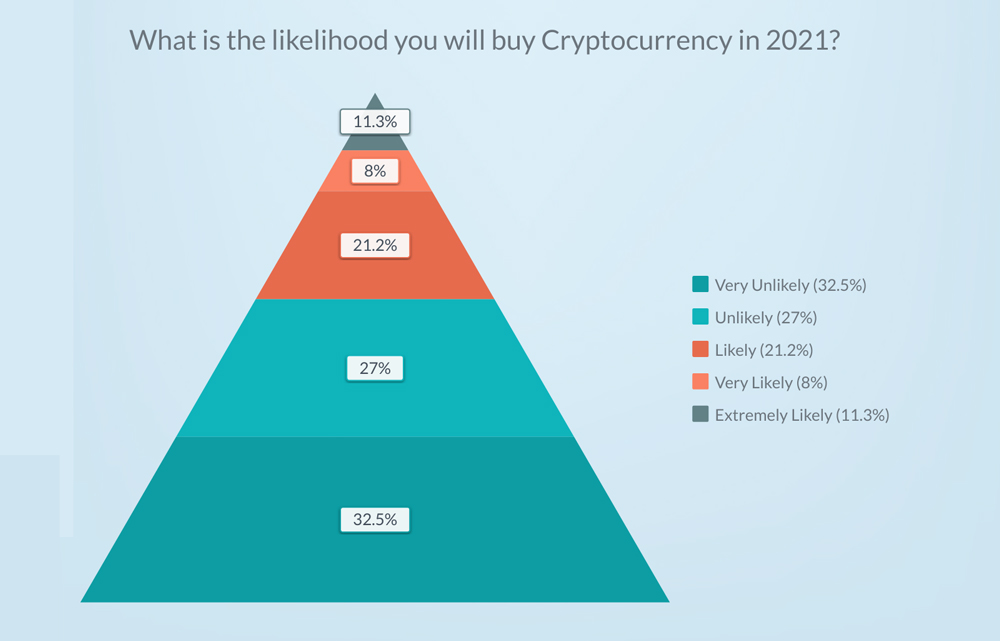

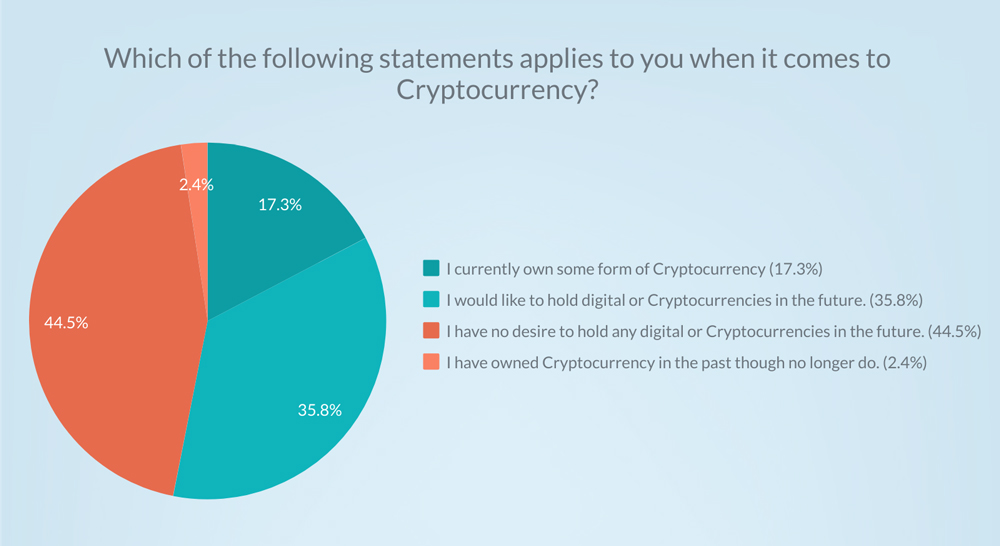

For the fifth time, the “Puell Multiple” indicator has signalled another buying opportunity for Bitcoin, which raises traders’ hopes that the leading cryptocurrency may be set for another rally.

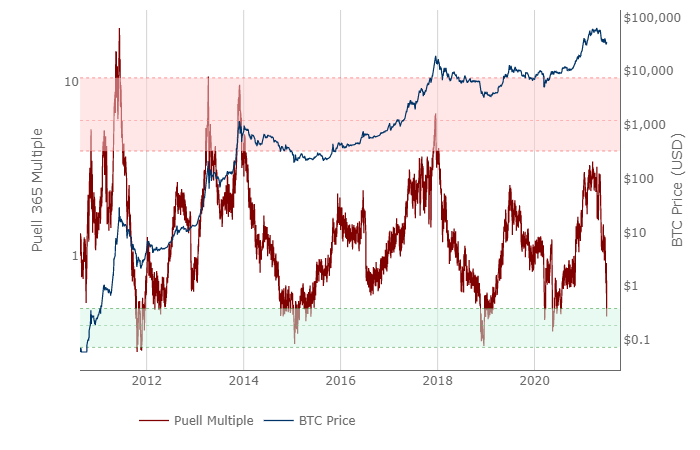

The Puell Multiple indicator calculates the ratio of daily coin issuance (in USD) and the 365 moving average of daily coin issuance. It examines the fundamentals of mining profitability on the view that the revenue miners generate can influence price over time.

Puell Multiple Flags a “Buy Signal”

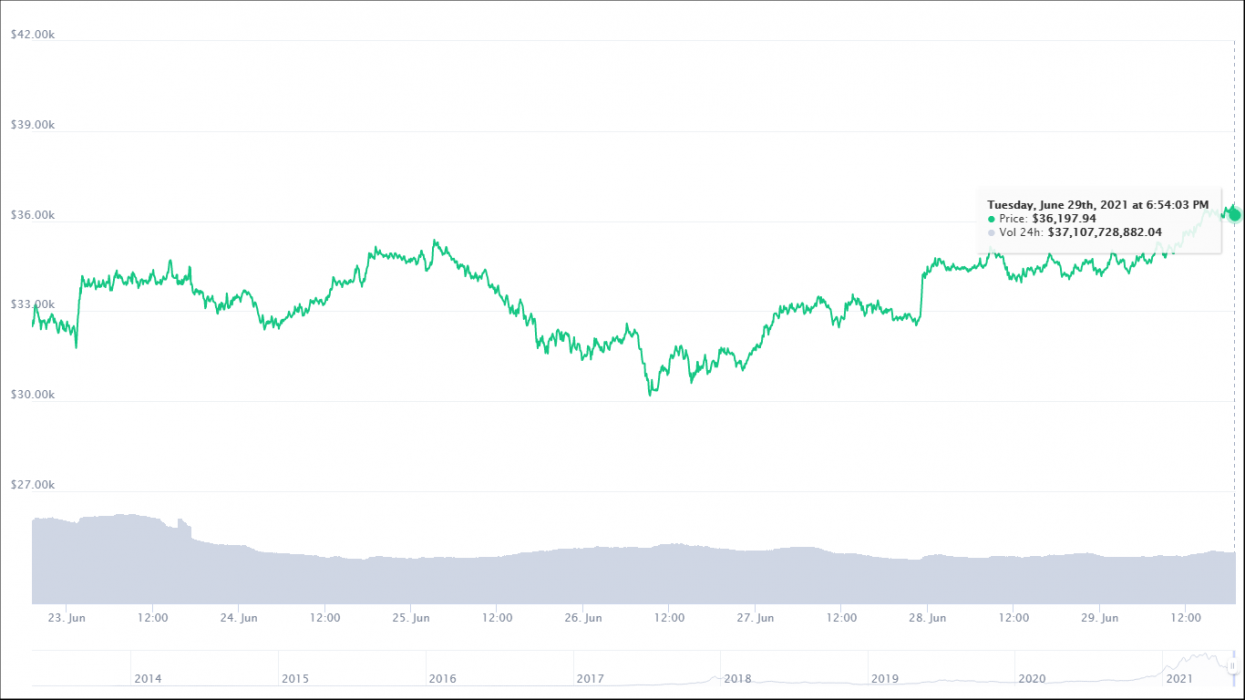

As seen in the chart, this is the fifth time “the value of Bitcoins issued on a daily basis has historically been extremely low” . This indicates a buying opportunity for Bitcoin investors and traders. The indicator may be another bullish signal to hold on this week; however, the creator of the indicator, analyst David Puell, also warns investors to be wary due to the Bitcoin hashrate.

The last time the Puell Multiple signalled investors to buy Bitcoin was after the Covid 19-led market crash last year.

More Factors Suggesting Bitcoin Recovery

Bitcoin has shed a lot of value since hitting an all-time high in April. This is bearish to the extent that this current quarter will be the worst ever recorded over the past eight years. However, there have been factors that suggest the leading crypto won’t be in this state for long.

Crypto News Australia recently reported that the number of stablecoins on all exchanges has been increasing, which suggests investors may be positioning themselves for another pump. These bullish indicators are becoming easier to believe, as Bitcoin has been holding on pretty well since the beginning of this week.

Bitcoin was trading at US$36,258 on CoinMarketCap, which accounts for a 5.87 percent hike over the past 24 hours leading up to time of publication. This is the highest level Bitcoin has reached in the past seven days.