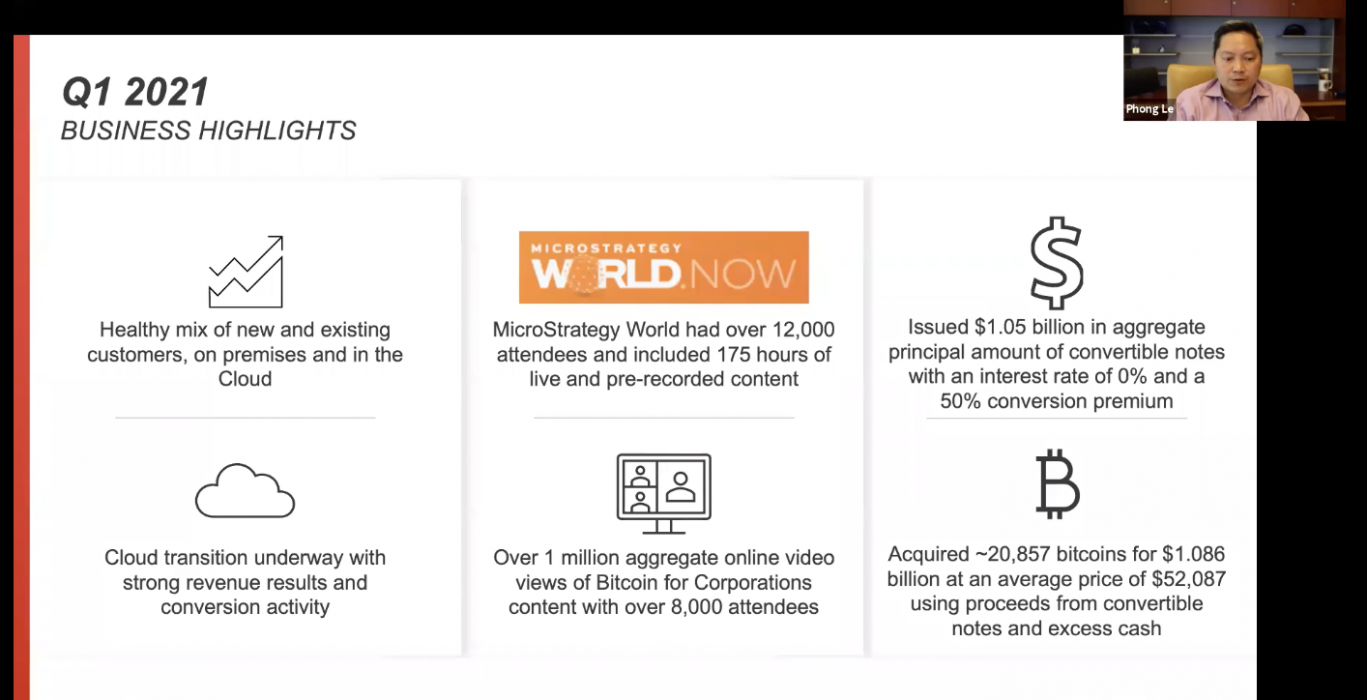

Michael Saylor’s big Bitcoin moves have delivered profitable returns for MicroStrategy investors as the company announced a 10% growth in revenue for Q1 2021.

Q1 2021 MicroStrategy Business Highlights

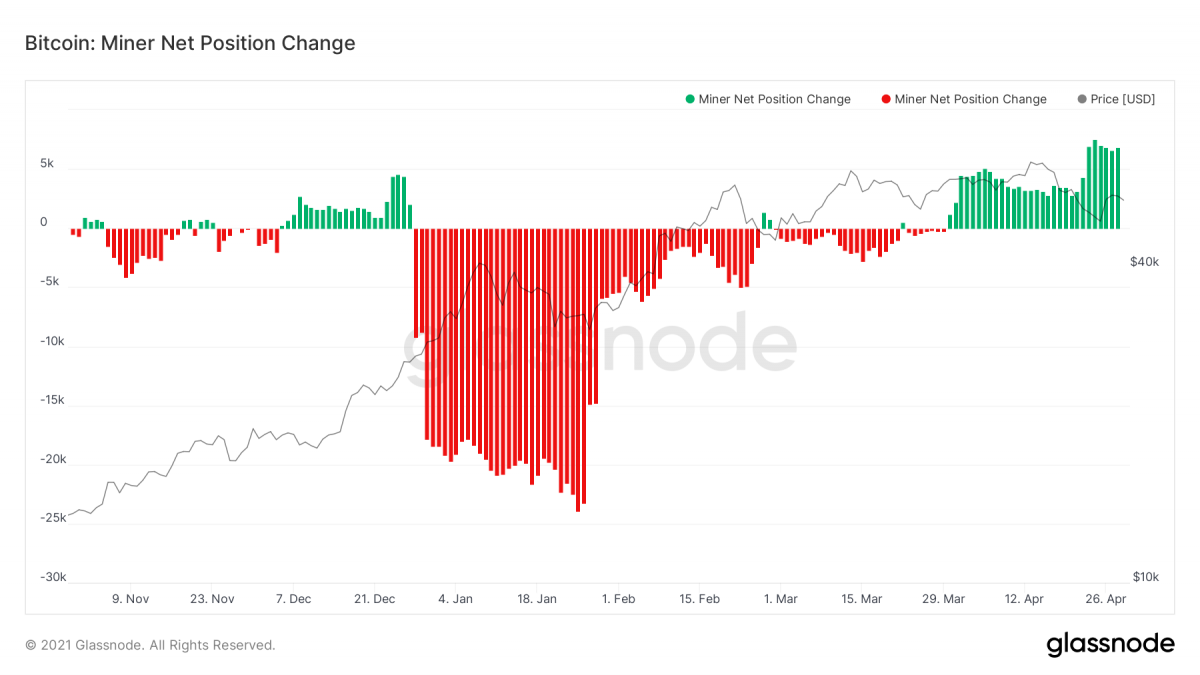

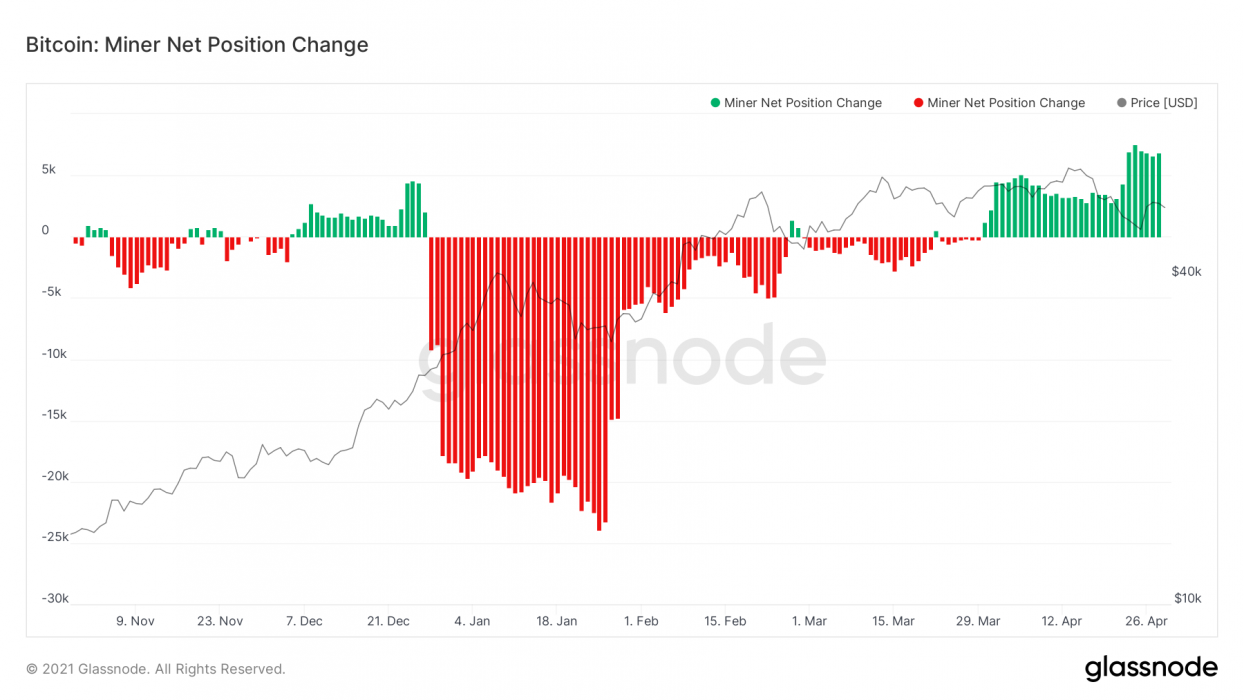

The MicroStrategy First Quarter webinar shows the company acquired 20,857 BTC for and average buying price of $52,087, using proceeds from convertible notes and excess cash.

Michael Saylor is Corporate America’s Poster Boy for Bitcoin

He is the man who became the first CEO of a publicly listed company to purchase Bitcoin for MicroStrategy shareholders, in August 2020. Following Saylor’s lead, other major institutions have jumped on the bandwagon of acquiring Bitcoin, including: Greyscale, Goldman Sachs, Tesla, PayPal, and Visa.

Michael explains:

Conventional treasury strategies are broken… What are you gonna do? Look at the last 12 months: ROI; Bitcoin is up 461%. S&P is up 25%. If you invested all of your treasury assest in the S&P, you’d’ve kept up with the price of Capital… Gold: up 9%. It’s a disaster; it’s not keeping up with the cost of Capital.

Michael Saylor

As the value of the dollar is becoming more and more inflated, and BTC and other cryptocurrencies out perform traditional stocks, big money is now looking to Bitcoin as a better store of value.

So Why Bitcoin? … I have to manage shareholder value and if you want to maintain or grow shareholder value, you’re gonna have to grow your assets at a rate faster than the cost of Capital.

Michael Saylor

Michael is an enthusiastic evangelist and a pioneer for the movement of mass adoption into investing in Bitcoin. He tweets regularly on the topic and shares his knowledge and opinions freely in interviews, on why he believes Bitcoin to be a superior asset.

Bitcoin as a Store of Value

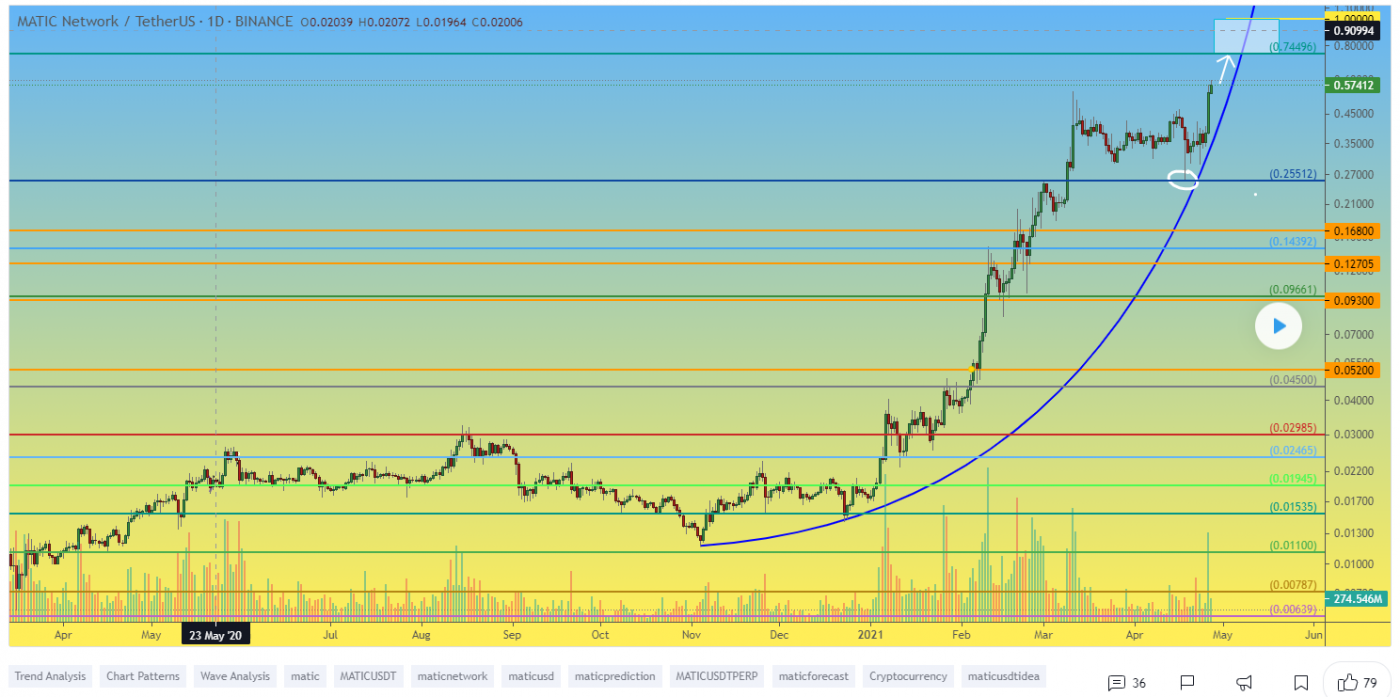

We’ve heard enthusiasts say over and over that “Bitcoin is a store of value“. It’s “better than gold”. It’s “The Best performing asset”, like, ever. The proof is in the pudding. Actually it’s in Michael Saylor’s MicroStrategy End of Financial Quarter Results report.

Caitlin Carey – Crypto News Guest Author