Dogecoin is trading in an active uptrend and strong trading volume today, like many other altcoins. The cryptocurrency DOGE just went up +90% in a single day and surges over +125% in a week and +6450% in a year. Let’s take a quick look at the Dogecoin price analysis and possible reasons for the recent breakout.

What is Dogecoin?

Dogecoin (DOGE) is based on the popular “Doge” Internet meme and features a Shiba Inu on its logo. The open-source digital currency was created by Billy Markus from Portland, Oregon, and Jackson Palmer from Sydney, Australia, and was forked from Litecoin in December 2013.

Dogecoin’s creators envisaged it as a fun, light-hearted cryptocurrency that would have greater appeal beyond the core Bitcoin audience since it was based on a dog meme. Tesla CEO Elon Musk posted several tweets on social media that Dogecoin is his favourite coin.

DOGE Price Analysis

At the time of writing, DOGE is ranked 10th cryptocurrency globally and the current price is $0.1716 AUD. This is a +125% increase since 7 April 2021 (a week ago) as shown in the chart below.

After looking at the above 1-day candle chart, we can clearly see that Dogecoin was trading sideways on a DOGE/USDT pair. The first resistance was on the $0.0954 AUD price levels which DOGE broke with a strong bullish trend buying volume and is now heading towards current resistance at $0.1705 AUD after making a new all-time high price today. As other altcoins are waking up bullish today, DOGE might continue the uptrend with its hype going around.

The two green lines that appear in the graph represent the previous resistance and support levels of DOGE/USDT relate to previous bull run from early February.

What do the Technical Indicators say?

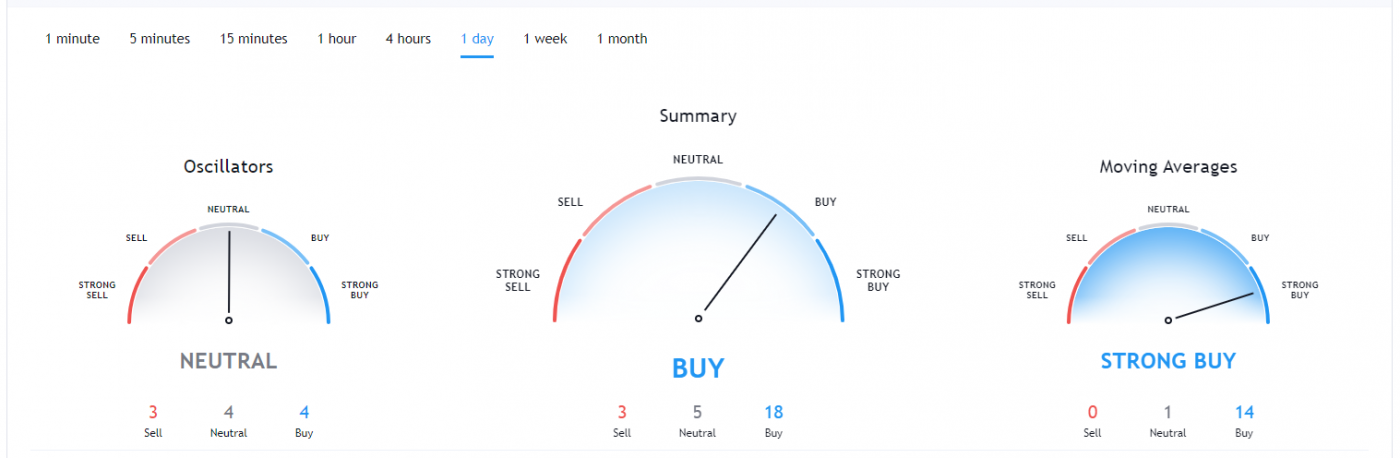

The Dogecoin TradingView indicators (on a 1 day window) mainly indicate DOGE as a buy, except the Oscillators which indicate DOGE as a neutral.

So Why did DOGE Breakout?

General market sentiment seems to suggest cryptos are in the middle of the bull run season, which could have contributed to the recent breakout. Another reason for this sudden pump in price could be whales secretly buying Dogecoin for the next altcoins rally.

Also, a Miami nightclub recently announced they accept Dogecoin enabling payments in crypto. E11EVEN MIAMI, the award-winning 24/7 ultra club located in the heart of Downtown Miami, is one of the first major nightclubs in the USA to accept cryptocurrencies as a form of payment and Dogecoin is also into the list.

Recent DOGE News & Events:

- 8 February 2020 – 4-Way Fork

- 28 April 2020 – Tidex Delisting

- 10 July 2020 – Bitfinex Listing

- 08 September 2020 – Dogecoin Listed in WhiteBIT

Where to Buy or Trade Dogecoin?

Dogecoin has the highest liquidity on Binance Exchange so that could help for trading DOGE/USDT or DOGE/BTC pairs. However, if you’re just looking at buying some then Swyftx Exchange is a popular choice in Australia.