American businessman and real estate manager Rick Caruso will allow its tenants to rent his properties with Bitcoin, starting with the Grove shopping centre and other Los Angeles properties.

As reported by the LA Times, Caruso Properties has partnered with cryptocurrency exchange Gemini to handle all of its crypto payment operations and has invested 1% of its treasury in Bitcoin as part of the partnership.

Gemini Interview with Rick Caruso on CNBC

Elon Musk Could Be The First Visitor To Pay Rent with BTC

Caruso Properties is the first real estate company to accept bitcoin as payment, and Caruso also owns the property that houses the Tesla dealership in the Americana, at Brand centre in Glendale, California.

I haven’t talked to Elon about it. He may be the first, as a pioneer, to pay his rent in bitcoin.

Rick Caruso

Bitcoin Is Similar to Credit Cards in the 1950s

Surprisingly, Caruso added that there had not been demand from tenants to pay rent with bitcoin, but he sees a great opportunity in crypto assets and their technology, comparing them to credit cards in the 1950s when it was considered odd to use them but they soon became mainstream:

I believe bitcoin and blockchain are going to be doing the same in the future. We want to be ahead of the curve.

Rick Caruso

When Will Australia Follow Suit?

Some Australian businesses are now accepting cryptocurrencies as payment, but to our knowledge there are not yet any real estate companies accepting rent in bitcoin.

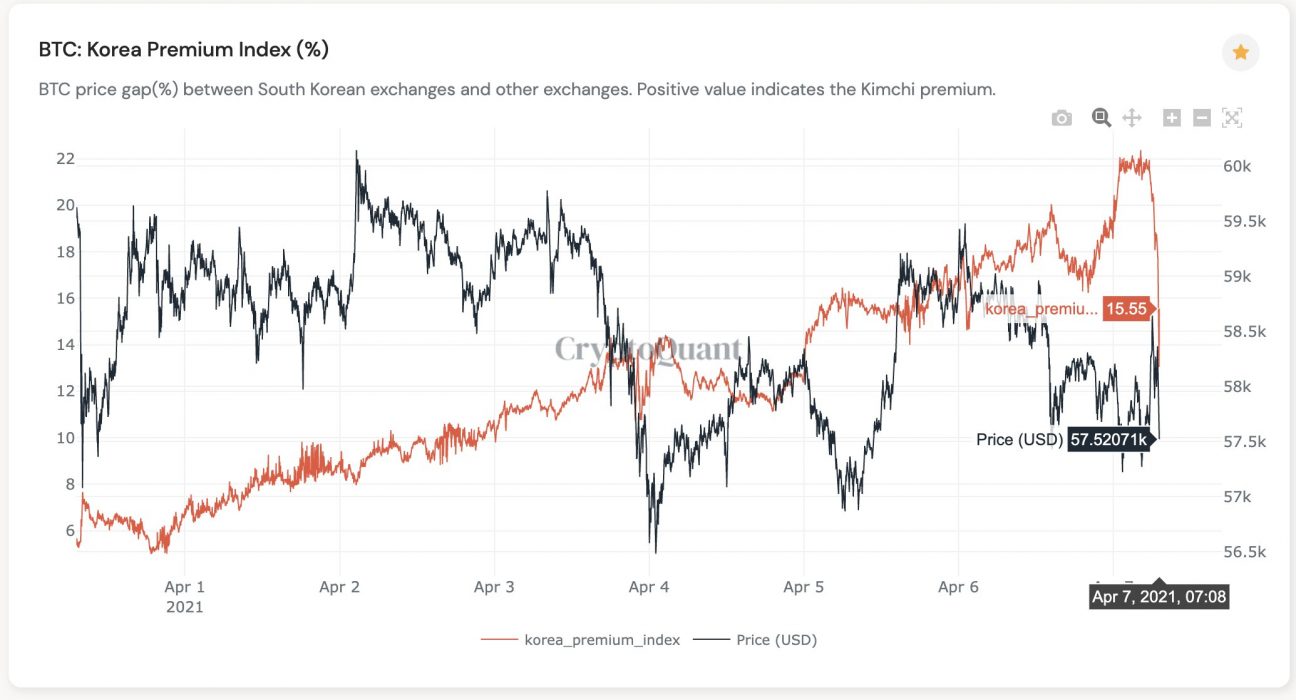

One thing for certain is that the institutional adoption of crypto assets has increased tremendously since payment companies such as PayPal allowed custody of digital assets and exchanging them for fiat to buy anywhere around the world.

Many in the crypto community believe expect that crypto payments and adoption will expand further as cryptocurrencies become better known and accepted in the mainstream.