In this article we take a look at important Crypto dates and events happening in this month.

The selected events include Hard Forks, Partnerships, Announcements, Rebranding, Exchange Listings, Releases, Token Swaps, Important Airdrops, Conferences and more.

Crypto News Partner Events and Announcements

| Date | Event | Notes |

| 1 April | Coinjar adds new digital currencies | Aave, Curve, EOS, Sushiswap, Synthetix and 4 other new digital currencies are available for trading on CoinJar. |

| 30 April | Binance coin burn | 15th Burn of Binance Coin (BNB) |

| 16 April – 14 May | Crypto.com App Giveaway | Trade Dogecoins to Win $50k Cash and DOGE NFT Prizes on Crypto.com App |

Important Cryptocurrency Events

| Date | Coin | Event | Notes |

| 2 April | Ankr (ANKR) | PolkaPets NFT Launch | Ankr Launching Friday 2 April |

| 2 April | Curate (XCUR) | Kucoin Listing | Supported trading pairs are XCUR/USDT |

| 2 April | Vaiot (VAI) | Kucoin Listing | Supported trading pair is VAI/USDT |

| 5 April | Monetha (MTH) | New Road Map | New road map for this year to be published |

| 5 April | Drep (DREP) | Killer Product Launch | Official Launch of DREP Killer Product on 05.04.2021, RoadMap 2021 |

| 5 April | Crown (CRW) | Airdrop | A total of 2500 wCRW will be airdropped to the LP token holder addresses according to the percentage of the pool they hold. |

| 6 April | Enjin Coin (ENJ) | Jumpnet | JumpNet is a high-speed bridge network that will allow free, instant on-chain transactions of Enjin Coin, which includes NFT integration. |

| 7 April | Fetch.ai (FET) | ATMX Distribution | Get your $fet ready, $atmx distribution for $fet holders. |

| 7 April | DxSale Network (SALE) | ZIL Dx Locker Launch | @Zilliqa Dx Locker Launching on April 7th |

| 8 April | Kava.io (KAVA) | Kava 5 Launch | Proposed upgrade on the 8 April |

| 9 April | Elrond (EGLD) | First Defi 2.0 Module | The first module will go live on hypergrowth day 95. |

| 10 April | Pancake Swap (CAKE) | Token Burn | Next week will be the biggest #CAKE burn ever (so far)! |

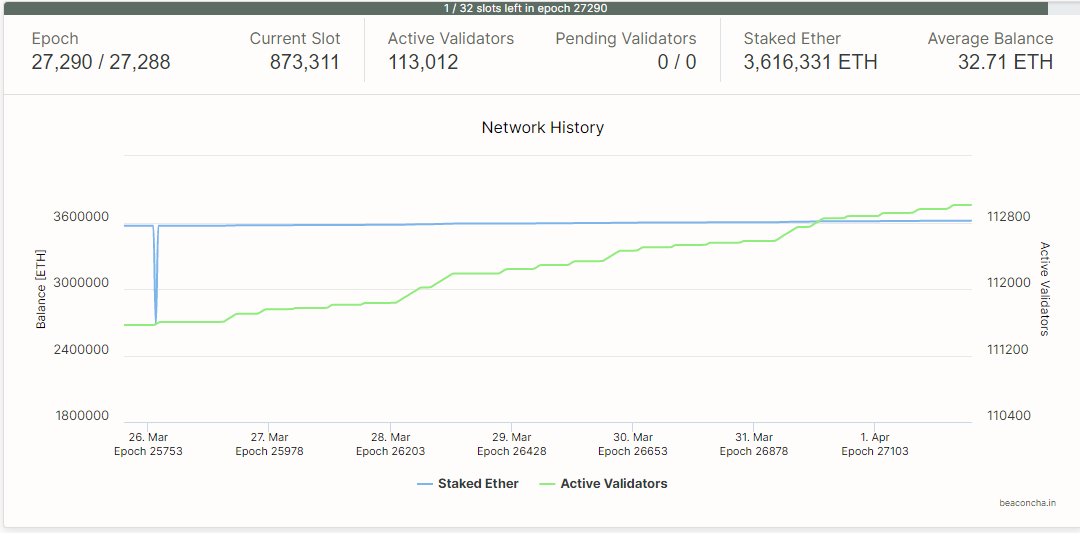

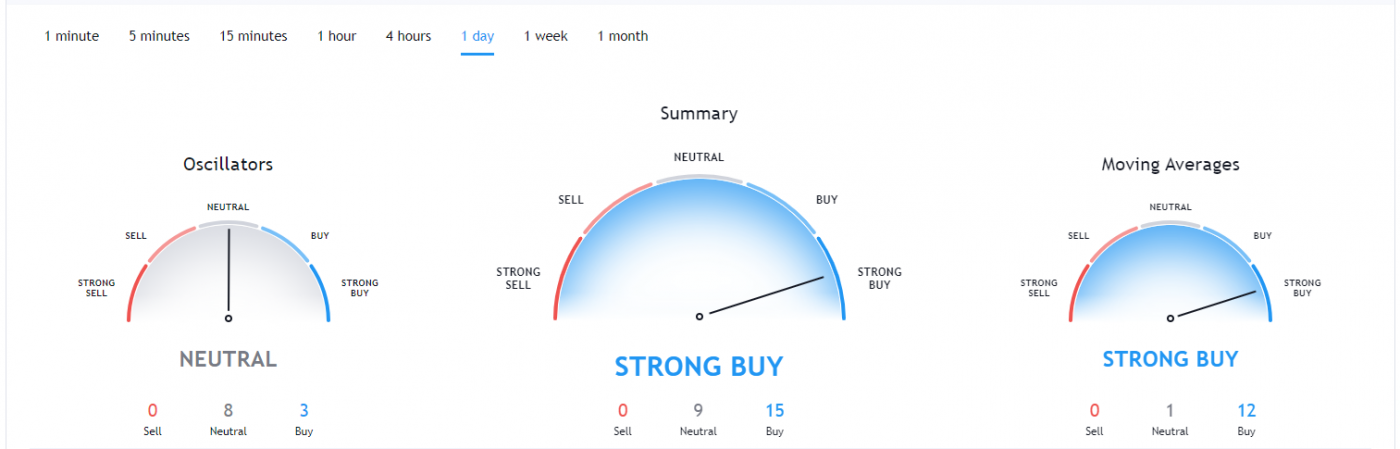

| 14 April | Ethereum (ETH) | Berlin Hard Fork | Ethereum developers have scheduled the Berlin hard fork for April 14 at block height 12,244,000 |

| 15 April | Pundix (NPXS) | Pundix Token Removal | Pundi X (old) is going to announce the token removal amount in the 1st week of April, and execute it in the 2nd one. |

| 15 April | Measurable Data Token (MDT) | Airdrop | Every 10 MDT deposited into @TheRewardMe app (snapshot by mid April), you will get 1 ME token. |

| 21 April | IOTA (MIOTA) | Chrysalis Migration | The official start date of the Chrysalis network migration |

| 30 April | ICON (ICX) | Balanced Defi Launch | Mainnet launch for Balanced, “A DAO on the ICON Network that creates tokens pegged to real-world assets. |

| 30 April | KardiaChain (KAI) | Mainnet 2.0 | Launch Mainnet 2.0 |

| 30 April | IoTeX (IOTX) | Mainnet V1.2 | The next evolution of IoTeX blockchain is almost here — get ready for Mainnet v1.2 |

Upcoming Crypto & Blockchain Conferences

| Date | Event | Location | Notes |

| April 12 – 16 | European Blockchain Convention 2021 Online Edition | Online | The meeting point of the Blockchain industry in Europe. |

| April 15 – 16 | BlockDown 4.0 | Online | The goal of bringing the blockchain and crypto communities together from all corners of the globe. |

| April 19 – 22 | AUSTRALIAN BLOCKCHAIN WEEK | Online and Physical | Australia’s Blockchain launch, roundtables, live panels, fireside chats, a makers day |

| April 28 – 29 | Blockchain Finance Forum: Europe 2021 | Online | Explores the effects that this new disruptive technology has on the European financial sector. |

| April 30 – May 1 | Incrypted Asia 2021 | Online and Physical | The purpose of connecting, communicating, collaborating for business beyond boundaries… |