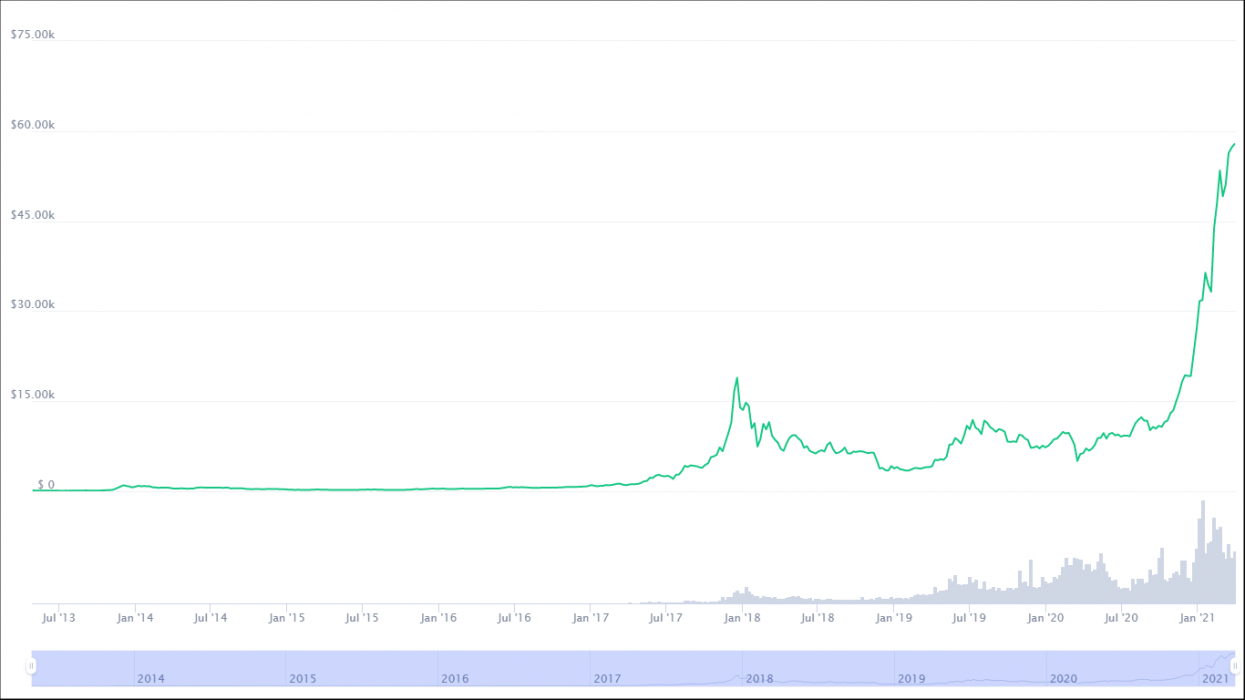

Several world-renowned financial companies are gradually preparing to offer Bitcoin and cryptocurrency services amid the growing interest for the emerging asset class amongst their clients. Multinational investment bank Goldman Sachs has been reported by CNBC to have plans to debut a Bitcoin investment offering for its wealth management clients.

Morgan Stanley made a similar move recently – meaning that two of the world’s most prominent investment banks are looking at offering their clients access to Bitcoin and digital assets.

Clients in Goldman’s Private Wealth Management Group will Access Bitcoin

As CNBC learned from Mary Rich, global Head of Digital Assets for Goldman Sachs’s private wealth management division, the investment bank is looking to begin offering its first-ever Bitcoin investment vehicles for clients in its private wealth management group in the second quarter of 2021.

Rich said the bank wants to offer a “full-spectrum” of investments of the crypto, either as “physical bitcoin, derivatives or traditional investment vehicles.”

The bank’s decision to offer Bitcoin services comes amid the increase in demand for such an offering amongst the private wealth clients, according to Rich, who added:

There’s a contingent of clients who are looking to this asset as a hedge against inflation, and the macro backdrop over the past year has certainly played into that. […] There is also a large contingent of clients who feel like we’re sitting at the dawn of a new Internet in some ways and are looking for ways to participate in this space.

Mary Rich, Head of Digital Assets at Goldman Sachs

Goldman Sachs is currently seeking approval for the service with the US Securities and Exchange Commission (SEC) and the New York Department of Financial Services.

Only a few weeks ago, Goldman Sachs joined the list of companies that filed for a Bitcoin Exchange-Traded Fund (ETF) in the United States.