According to a report, Morgan Stanley is currently negotiating with South Korean top crypto-exchange, Bithumb, by investing approximately $254 million to $441 million to acquire 10% of shares.

Asiae, local Korean media, published an article about the negotiation between both giants, which appeared on Naver, a local search engine.

The Bank Could Acquire Bithumb for $2B

According to an anonymous source familiar with the matter, the bank approached Bident, the largest shareholder of Bithumb Korea. The firm holds 10.6% of Bithumb Holdings. Hence, to sell or transfer shares, Bident’s consent is required.

The reason Morgan Stanley used Bident is because it understood that Bident has the right to negotiate a preferred sale to acquire Bithumb Holdings

Bident, a KOSDAQ firm, soared in valuation after the announcement. Shares surged 16% in just a few hours. Moreover, according to analyst Joseph Young, Morgan Stanley may bid $2 billion to acquire Bithumb.

Institutions Entering the Crypto Market

Morgan Stanley is the latest American private bank to enter the crypto market. The giant now offers three Bitcoin Funds to wealthy investors, and the minimum investment is $5 million. Only wealthy and accredited investors with high-risk tolerance are eligible.

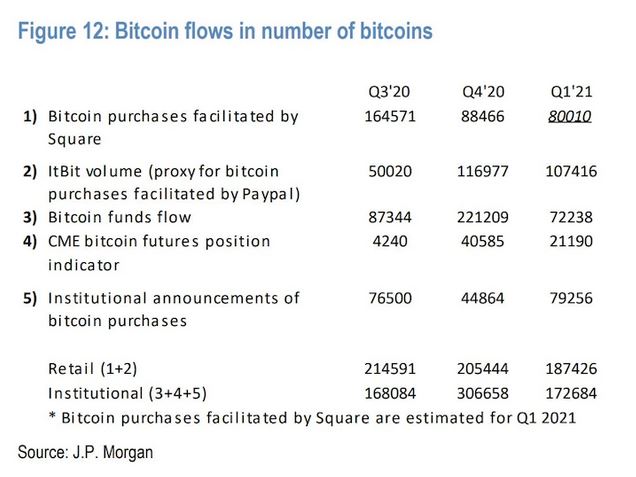

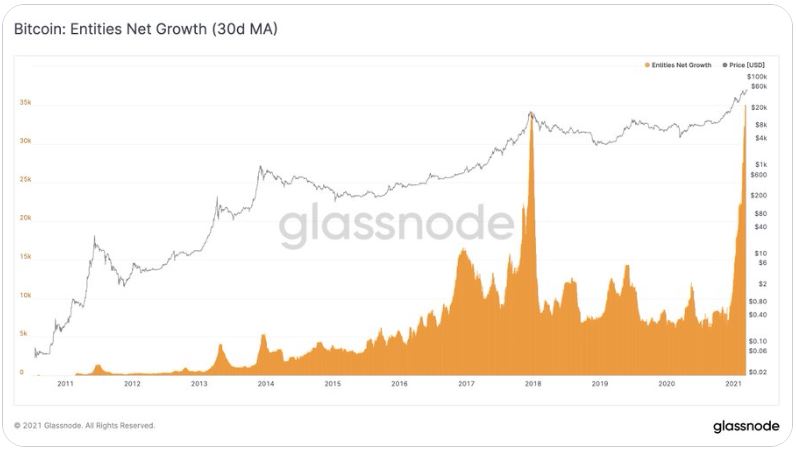

The institutional interest in digital assets is increasing every day. Goldman Sachs, another investment bank, recently saw heavy demand from investors seeking exposure to Bitcoin and other crypto-assets just days after re-opening its crypto-trading desk.