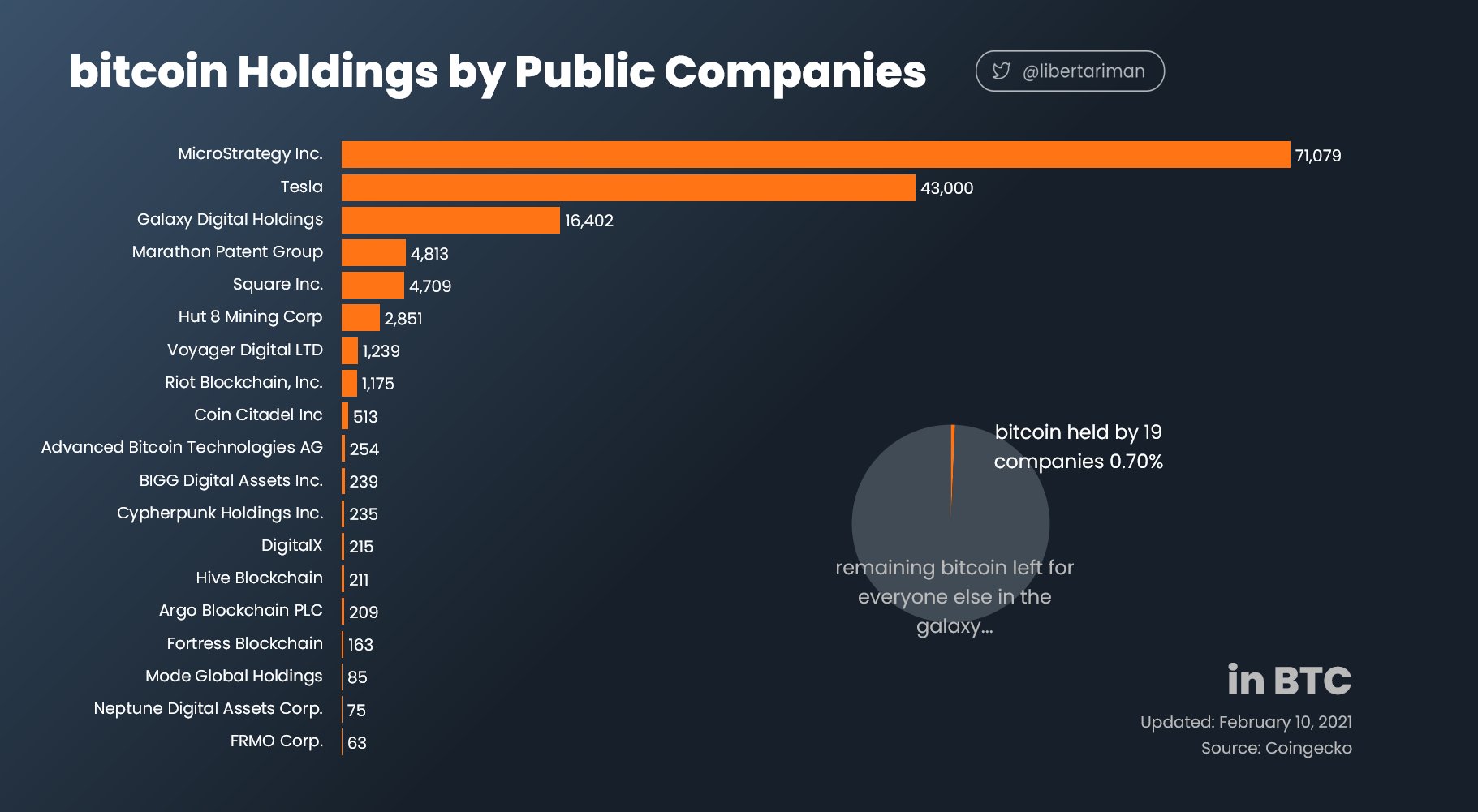

It’s no longer news that the demand for the largest cryptocurrency, Bitcoin (BTC), has significantly increased among institutions and corporate investors. This was predicted by many industry experts after MicroStrategy, a publicly-listed business intelligence company, announced its first BTC acquisition. Many other public companies have joined the bandwagon, with the recent being Tesla, which added $1.5 billion worth of Bitcoin to its balance sheet.

19 Public Companies are Holding Bitcoin

According to information from CoinGecko, there are presently 19 known public companies holding Bitcoin in their balance sheet. Judging by the total number of BTC held by these companies, MicroStrategy lead the pace with a total of 71,079 BTC, which will be worth US$3.2 billion following Bitcoin’s price of US$45,250 on February 10. However, the company bought the cryptocurrencies at a total cost of US$1.14 billion, per Coingecko.

Tesla joins the list as the second-largest public company. The electric-car manufacturer is expected to be holding at least 42,500, which is worth $1.9 billion at the time of writing. Note that the company’s entry price was US$1.5 billion. So, Tesla’s BTC holding is already up by over US$400 million, as Bitcoin spiked after the announcement.

Other public firms with at least 1,000 BTC include Galaxy Digital (16,402 BTC), Marathon (4,813 BTC), Square (4,709 BTC), Hut 8 Mining (2,851 BTC), Voyager (1,239), and Riot Blockchain (1,175 BTC). About 11 others on the list don’t have up to 600 BTC.

The Herds are Coming

As many experts have opined, Tesla’s move to BTC is very significant to raising more corporate Bitcoin investors. As an S&P 500-traded company, industry players like Mike Novogratz, the CEO of Galaxy Digital, believes that many other popular companies, CEOs, and CFOs, will join Tesla in holding Bitcoin. Based on this, Novogratz predicted that BTC is likely to surpass US$100,000 this year.