For today’s trading news, we’re looking at three Altcoins that might breakout this week by showing bullish trends in the charts.

1. Crypto Coin (CRO)

Crypto.com Coin (CRO) is the native cryptocurrency token of Crypto.com Chain — a decentralized, open-source blockchain developed by the Crypto.com payment, trading, and financial services company. Crypto.com Chain is one of the products in Crypto.com’s lineup of solutions designed to accelerate the global adoption of cryptocurrencies as a means of increasing personal control over money, safeguarding user data, and protecting users’ identities. The CRO blockchain serves primarily as a vehicle that powers the Crypto.com Pay mobile payments app.

CRO Price Analysis

At the time of writing, CRO is ranked 24th cryptocurrency globally and the current price is $0.1214 AUD. Let’s take a look at the chart below for price analysis.

CRO’s +44% January rally could be setting up a more significant bullish move for the rest of the quarter.

Last week, the support beginning near $0.0829 AUD launched a move to the resistance starting near $0.0954. This move failed to close below the previous swing high. However, it did create probable support underneath the high near a monthly level around $0.0715 AUD.

Aggressive bulls could enter near this recently formed support. The last swing high at $0.1086 AUD gives a first reasonable target. Bulls could hold for the second target at the set of relatively equal daily highs near $0.1104 AUD, just below the previous major down moves EQ.

A daily close above the resistance from $0.0915 AUD to $0.0995 AUD could signal an extended move. Resistance at the EQ near $0.1192 AUD, a small price range near $0.1211 AUD, and probable resistance beginning at $0.1516 AUD give potential take profit or turning points before the equal highs forming the primary objective at $0.1677 AUD.

2. Near Protocol (NEAR)

NEAR Protocol is a decentralized application platform designed to make apps usable on the web. The network runs on a Proof-of-Stake (PoS) consensus mechanism called Nightshade, which aims to offer scalability and stable fees.

NEAR Price Analysis

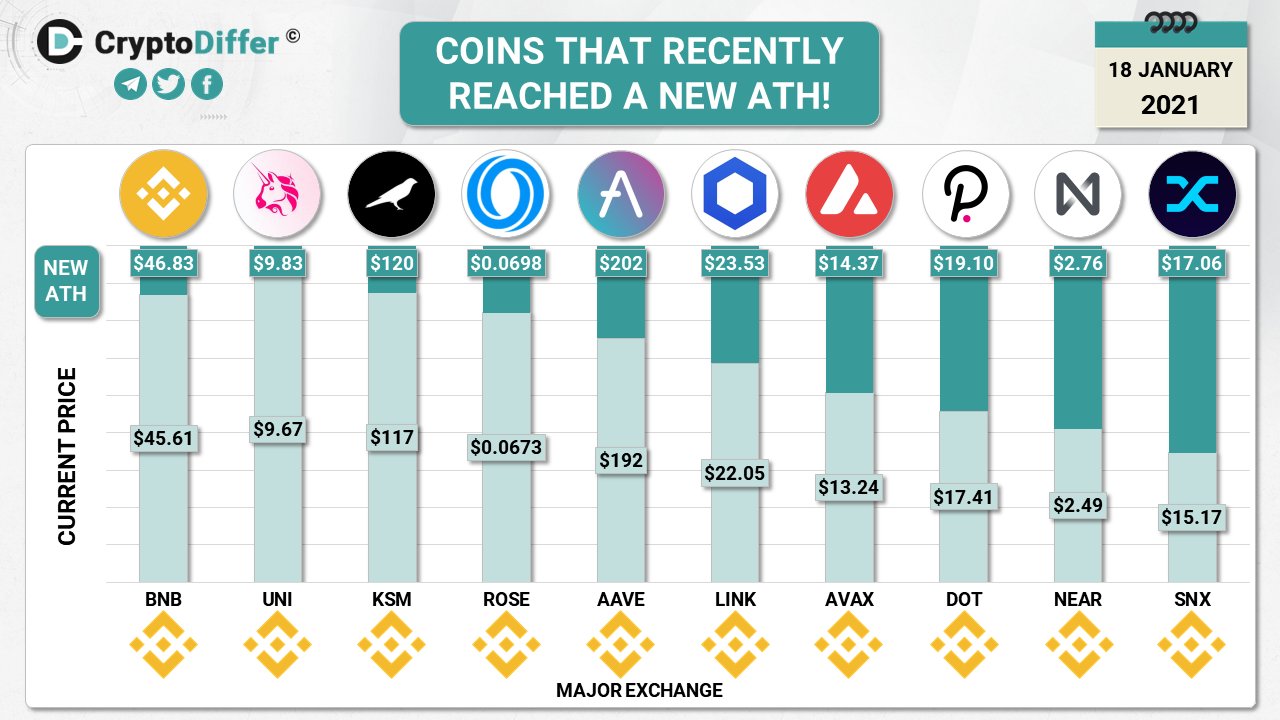

At the time of writing, NEAR is ranked 64th cryptocurrency globally and the current price is $2.97 AUD. Let’s take a look at the chart below for price analysis.

NEAR tore upward into price discovery last week before pausing at resistance near the main move’s 0.68 extension.

The price range beginning at $2.17 AUD provides the first potential support for an early-week dip. Just below this range, the previous swing high and accumulation near $1.94 AUD could provide more substantial support.

A significant market drop could reach as low as the consolidation range beginning at $1.59 AUD, supported by the January monthly open.

It’s impossible to predict where the price in discovery will go, but the last high at $2.89 AUD provides the first probable target. Extensions from the primary move hint at $3.15, AUD, and $3.85 AUD as probable take-profit zones.

3. Neo (NEO)

Neo bills itself as a “rapidly growing and developing” ecosystem that has the goal of becoming the foundation for the next generation of the internet — a new economy where digitized payments, identities, and assets come together. Initially known as Antshares, this project was believed to be China’s first-ever public blockchain when it was launched in February 2014. The open-source platform subsequently rebranded to Neo three years later.

NEO Price Analysis

At the time of writing, NEO is ranked 23rd cryptocurrency globally and the current price is $35.82 AUD. Let’s take a look at the chart below for price analysis.

January saw a +91% spike in price into the resistance beginning near $28.14 AUD. This move swept September’s swing high, which might set the stage for retracement and reaccumulation.

The previous high and brief reaccumulation near $25.29 AUD has so far provided support, making it a reasonable place for bulls to begin building positions.

A deeper drop to run stops and test the daily gap beginning at $22.52 AUD is likely to meet support. This area has confluence with a monthly level and a consolidation zone.

Bulls could target the most recent swing high near $34.71 AUD. A break of this resistance zone is likely to reach near the old monthly high at $45 AUD.

Resistance near $36.15 AUD could cause the price to pause. However, a break of this level is likely to proceed to resistance under the next monthly high, near $55.24 AUD.

Where to Buy or Trade Altcoins?

These 3 Altcoins have the highest liquidity on Binance Exchange so that would help for trading on USDT or BTC pairs. However, if you’re just looking at buying some quick and hodling then Swyftx Exchange is a popular choice in Australia.