Instagram CEO Adam Mosseri has revealed the social network giant could possibly integrate NFT features to its platform, as per a Q&A posted on his Stories.

Nothing Official … Yet

During the Q&A, a user asked Mosseri his thoughts about NFTs and if there was any chance they would soon be integrated into Instagram. Messari tweeted that while there’s nothing official yet, the platform is “actively exploring” NFTs and how to take the best out of the space.

Nothing to announce yet but we are definitely actively exploring NFTs and how we can make them more accessible to a broader audience. I think it’s an interesting place that we can play … and also a way to hopefully help creators.

Instagram CEO Adam Mosseri

Instagram Has Been Working Quietly on NFT Collectibles

Rumours of the Meta-owned photo-sharing giant exploring the NFT market started in early 2021 when digital artist Sean Williams posted a Twitter thread claiming that the app was building an NFT platform and reaching out to digital artists in the community.

It wouldn’t come as a surprise if Instagram announced support for NFTs anytime soon, considering the extant NFT boom and the rapid expansion of the Metaverse, propelled by Facebook’s decision to rebrand itself to Meta.

On top of that, app developer Alessandro Paluzzi has stated numerous times that Instagram was already working towards the integration of digital wallets such as MetaMask, Coinbase and Novi.

Social Media Giants Moving Toward Crypto

The crypto community is witnessing social media giants embracing crypto and blockchain technology, with Jack Dorsey’s Twitter one of the biggest advocates. Twitter Crypto is the name of the recently created team in charge of bringing blockchain, DApps (decentralised applications), and all things crypto to the platform for a variety of use cases.

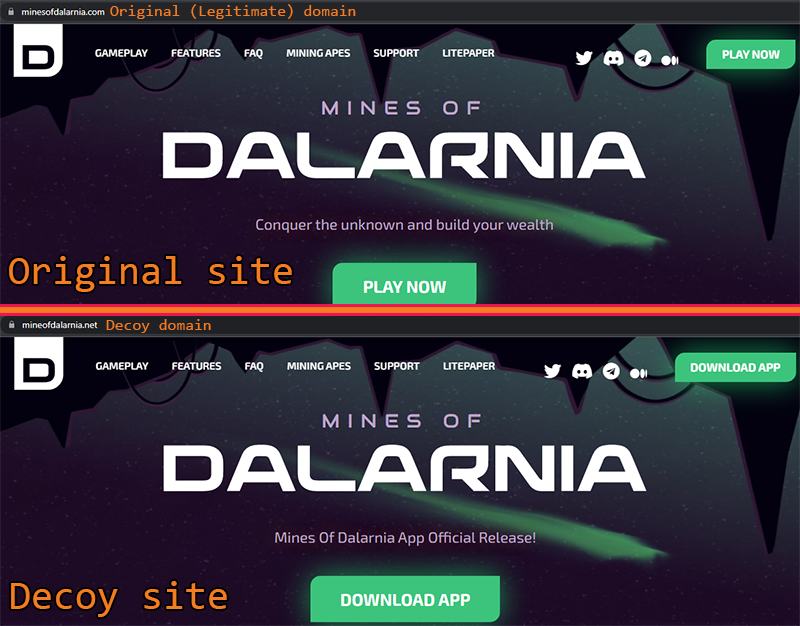

The NFT space is expanding fast, but of course not everybody is an expert on the topic, a reason why so many scammers are taking advantage of boom to fool naive investors. To help fight theft, Adobe is preparing a tool that will assist users in proving that the person selling an NFT is the actual owner.