A recent report shows what cryptocurrencies Australians are holding in their portfolios. Over 1,000 Australians were interviewed, interesting revealed that the northern territory is the largest holder of digital assets compared to the other states.

What Coins Are Aussies Hodling?

Not surprisingly, the most popular asset held is Bitcoin (BTC). One surprise though was although Ethereum (ETH) is the second most popular crypto by market cap, more Australians are holding Ripple (XRP).

- Bitcoin: 74%.

- XRP (Ripple): 28%

- Ethereum: 27%.

- Bitcoin Cash: 17%

- Litecoin: 15%

- Chainlink: 5.2%

- Others 8.5%

While these are currently the most popular in the average Aussie portfolio, other tokens amounted to a total of 8.5%. Interestingly, the crypto held by Australians mostly resembled the actual order by market cap, similar to that of a “crypto index”.

Millennials Are Making The Most Out Of Crypto

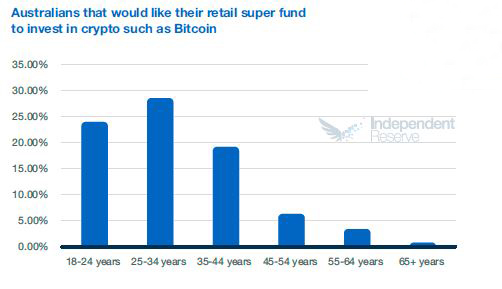

The report also suggests, adults between the ages of 25 and 45 consider cryptocurrencies as savings for their future. At least 18 % of Australians own some token, and 2 out of 5 consider it a good investment.

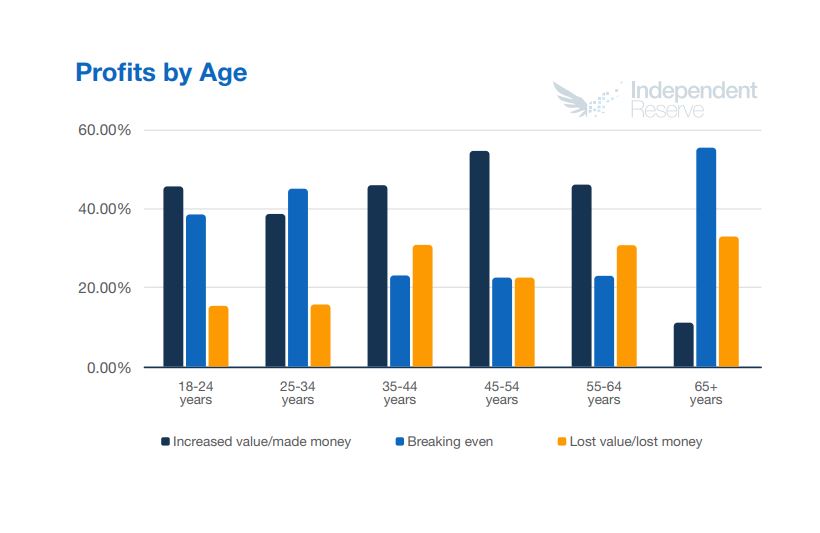

About 42.7% of those interviewed said they increased their capital by making successful investments in the cryptocurrency market. In contrast, only 20% have lost money. Last year, only 35% of those surveyed increased their wealth.

Cryptocurrencies in Australia are more popular among the youth. However, Australians who have increased their wealth the most are adults between 45 to 50 years old.

Australians Are More Positive About Crypto in 2020

Above all, the survey has reflected a more positive attitude towards digital assets in Australia for 2020. Bitcoin has gained more attention in these last few months, breaking all time highs. This marks a milestone in the history of BTC — which could attract more people looking for more diversity in their financial investment portfolios.