Another decentralised autonomous organisation (DAO), Krause House, is hot on the heels of ConstitutionDAO, though aiming to buy something a little bit more extravagant – a National Basketball Association (NBA) franchise. The leaderless internet group is aiming to raise 1,000 ether (ETH) in the hopes to pool enough money to buy an NBA team, according to its website.

Only One Goal in Mind

Krause House, a community-run internet group named after late Chicago Bulls manager Jerry Krause, launched earlier this year and has only one goal in mind, that of buying an NBA team. The DAO began its funding drive last week by selling non-fungible tokens (NFTs). Thus far, the DAO has successfully raised 411 ETH, or about US$1.7 million. The group hit its goal of 200 ETH in the first 15 minutes of launching the sale via Mirror:

Krause House contributor Adam Soffer said: “I’ve been following the news around ConstitutionDAO, and it occurred to me there’s a high probability a DAO will attempt a bid on a professional sports team within the next 10 years.” He added: “I tweeted this and someone responded, ‘There’s a DAO for that’, and pointed me to Krause House DAO.”

DAOs offered them a solution. The co-creators have said they have both been involved in crypto since 2017 and were “very excited” by what DAOs could offer them. To date, more than 1,300 people have joined the Krause House Discord server. The duo is quoted in saying:

We decided to create a DAO focused on achieving our lifelong passion, and it turns out a lot of folks have the same dream too.

Krause House was co-created by friends Flex Chapman and Commodore (both opted for pseudonyms) who had dreams of playing in the NBA as children but were unable to do so. They later instead readjusted their dream to owning a team. It comes, however, at a notoriously astronomical price. In December 2020, the Utah Jazz team sold for US$1.6 billion and the Brooklyn Nets for US$2.35 billion in August 2019.

NFT Craze Drives Fundraising

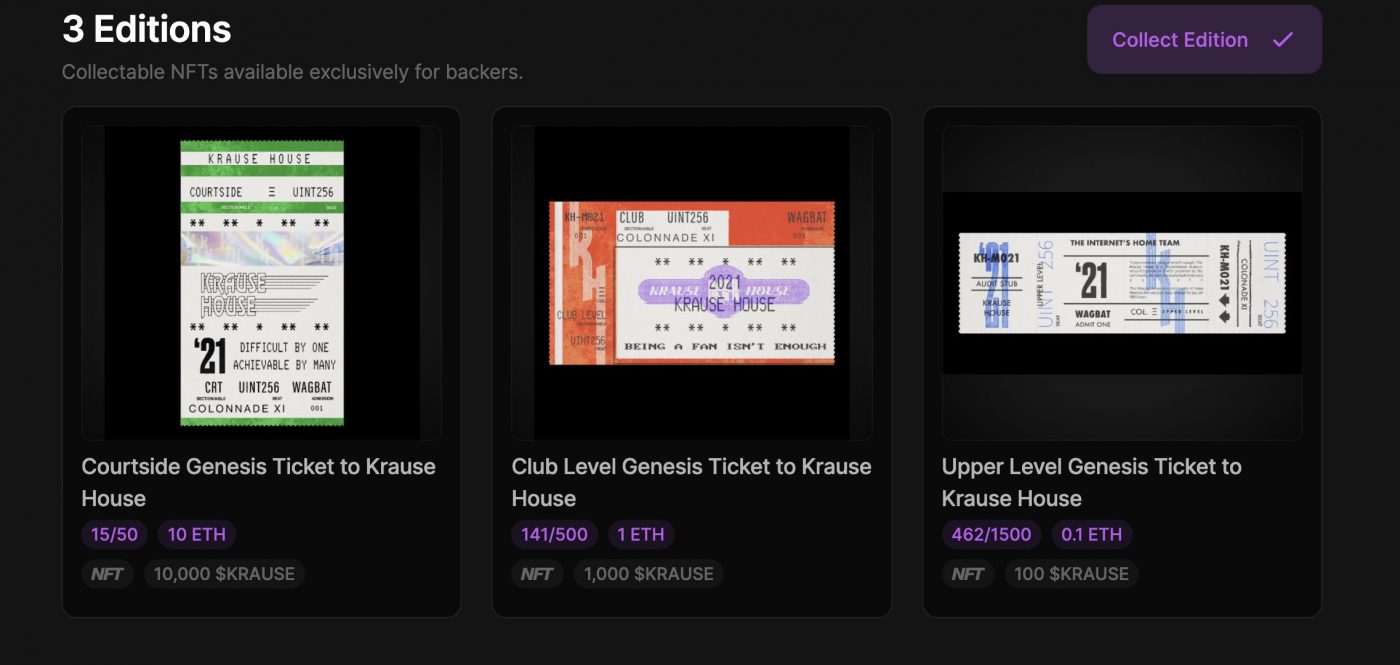

In order to raise the vast amounts of money needed to realise the dream, Krause House is selling NFTs in three membership tiers:

Courtside is selling at 10 ETH apiece, Club Level at 1.0 ETH and Upper Level at 0.1 ETH apiece. Each of the three different tiers grants different levels of access to $KRAUSE tokens. Additionally, a limited-edition NFT will be awarded to the top three donors of the campaign.

DAOs Generate Astronomical Amounts of Money

DAOs are showing us exactly what a community of people can do when they choose to achieve a collective goal. Krause House is on its way to raising some serious capital, following in the footsteps of ConstitutionDAO’s US$47 million.

Earlier this year, Australian trading platform Tracer DAO managed to raise US$4.5 million in a strategic round of funding, backed by various cryptocurrency companies. Tracer is an Ethereum-based decentralised finance (DeFi) protocol that introduces a derivatives marketplace, which is owned by a DAO.