In the world of crypto, 2021 has been a watershed year – from bitcoin becoming legal tender to NFT mania and then, of course, the absolute explosion in DeFi. Traditional finance is scrambling to keep up with the pace of innovation. ING, the Dutch financial services giant, is the latest wanting to get in on the act.

ING Dips Toes into DeFi

ING, with US$1 trillion under management, made a presentation at the Singapore Fintech Festival where it announced that it was working on a trial of its DeFi, peer-to-peer lending protocol with the Netherlands Authority for the Financial Markets.

We are looking into peer-to-peer lending in a DeFi kind of setup. But then not on bitcoins. What is interesting to us is how you can probably create peer-to-peer lending or open up lending capabilities with different kinds of collateral. So with different ways of doing this rather than with volatile bitcoin.

Annerie Vreugdenhil, chief innovation officer, ING

In a white paper published earlier this year, ING outlined how lending protocol Aave, built atop the Ethereum blockchain, was one of the more promising examples of innovation in the industry. Leveraging smart contracts, Aave would enable borrowers to deposit crypto as collateral and take out stablecoin loans.

Despite recognising the benefits of DeFi (borderless payments, 24/7 operations and speed of transactions), the white paper noted several material drawbacks.

One main drawback highlighted by ING was that since borrowing and lending required collateral, it would not enable the creation of new money that could otherwise be used for financing entrepreneurial activities.

In short, ING’s objection appears to be that the very notion of DeFi runs counter to the foundation of fractional reserve banking, on which its entire business is founded. This concern from a legacy company is of course unsurprising, and time will tell how it reconciles current operations with DeFi.

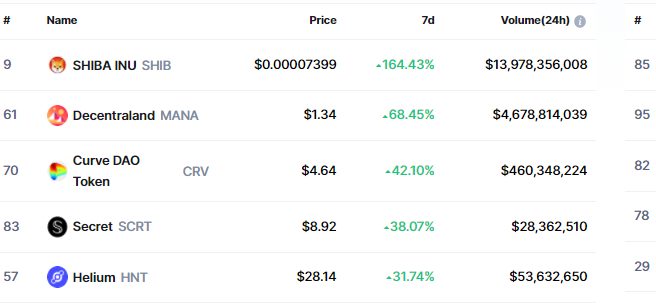

DeFi Adoption Goes Parabolic in 2021

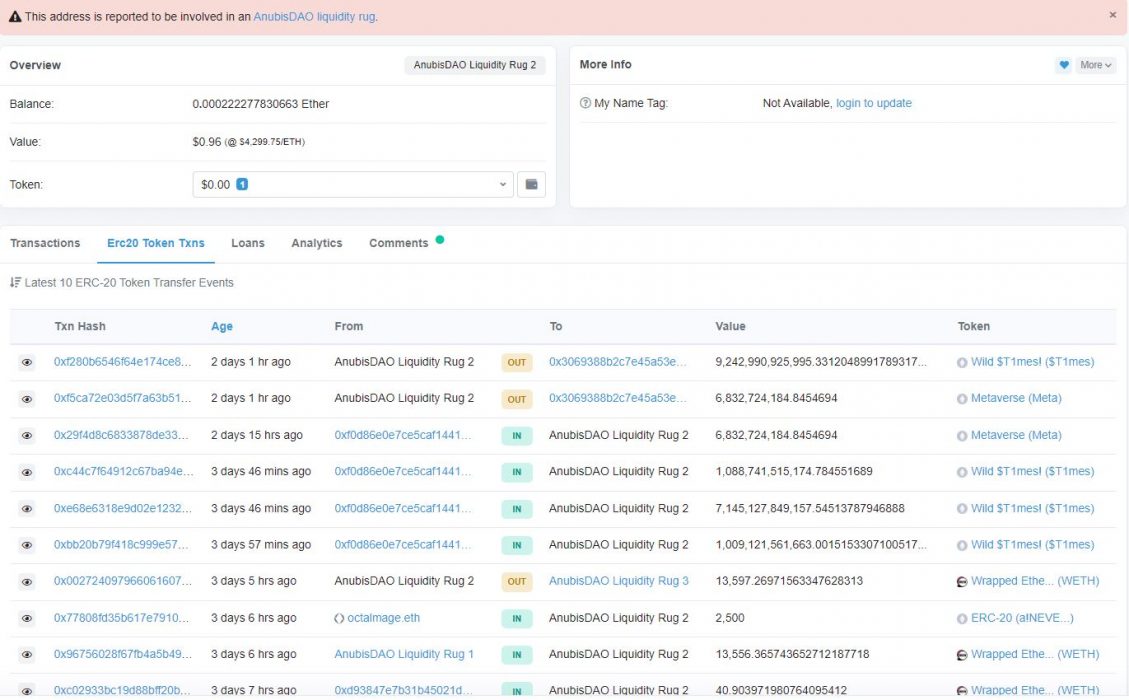

Since the beginning of the year, the total value locked in DeFi has increased more than tenfold. That said, there have been innumerable instances of hacks, leaks and breaches in 2021 – some of the higher-profile instances included Indexed Finance, Zabu Finance and C.R.E.A.M Finance.

While these hacks may serve to slow down adoption in the short run, traditional financial institutions would be well advised to keep their eye on the ball to ensure they are not left behind in the wake of unprecedented innovation.

As an example of an institution that doesn’t want to be left behind, consider Australia’s Commonwealth Bank, which last week announced that its customers would be able to buy crypto natively through its banking interface. If you can’t beat them, join them.