Chainlink (LINK) Oracles have now been integrated onto the Origin Protocol’s mainnet as well as becoming the sole provider of real-time price data for OUSD.

According to a press release from Origin Protocol, the integration of Chainlink price oracles are a “big deal” for the growth and security of the only stablecoin that earns a yield while still in your wallet.

What Does The Integration Mean for Origin Protocol?

By going all-in on Chainlink, we ensure that our users have the highest quality data and most secure oracle infrastructure every time they mint or redeem OUSD. Importantly, Chainlink has given Origin the flexibility to interact directly with oracles built specifically to price certain stablecoin trading pairs, leading to decreased on-chain costs and a more accurate minting/redeeming process.

Matthew Liu, Origin Protocol Co-founder

Additionally, the first Chainlink Price Feed for Origin Tokens (OGN-ETH) is now live and available for use by other DeFi protocols wanting to quickly and safely launch support for OGN markets. The OGN-ETH Price Feed is already being used and supported by the C.R.E.A.M. lending platform.

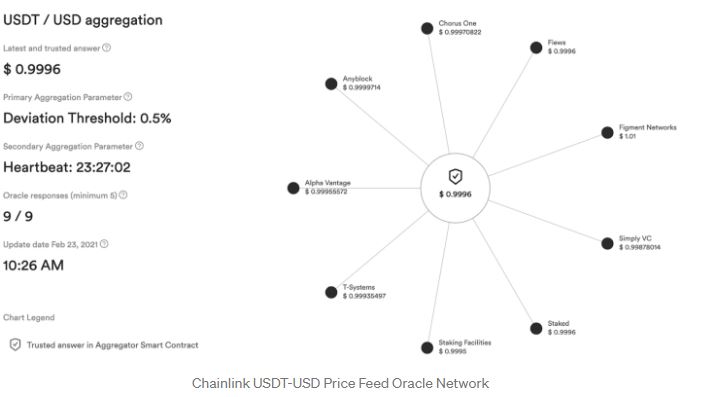

Since the DeFi boom, it has become increasingly important to use the most accurate price data, making Chainlink tech more valuable to companies working in the DeFi space. Today, Chainlink oracles are one of the most important linchpins to the security of DeFi, securing billions of dollars in on-chain value. Demand is only growing as DeFi gains more widespread adoption and protocols opt for the highest standards of data quality and reliability.

These Chainlink nodes collectively source price data from numerous off-chain data aggregators like BraveNewCoin and Amberdata, ensuring each price point has volume-adjusted market coverage across all trading environments.

Slow Price Data can Lead to Losses

Traditionally when origin was using a mixture of oracle providers:

[…] prices had to be calculated by first fetching the price of ETH and then calculating the exchange rate using ETH oracles. This increased the chance of prices being outdated, causing users to receive less OUSD than they reasonably expected. It also increased the gas costs due to additional on-chain transactions.

Josh Fraser, Co-founder Origin Protocol

One benefit of having these direct price feeds is that it simplifies smart contract code. In the Ethereum world, simpler code also means gas savings, which is now roughly 15% cheaper when minting or redeeming OUSD, thanks to this direct price feed integration.

But since they now rely on numerous secure nodes and premium data sources, OUSD users receive highly accurate, available, and tamperproof price data, which is also inherently resistant to various data manipulation attacks such as those carried out via flash loans.