The massive social media and news forum Reddit has announced a partnership with the Ethereum Foundation for the creation of scalable blockchain-based applications. The collaboration represents Reddit’s first-ever blockchain partnership and further solidifies its growing commitment to the technology.

According to the announcement posted by Reddit admin u/jarins on the r/Cryptocurrency subreddit, blockchain technology will allow Reddit to provide decentralized applications to its users, helping them to “create, govern, and grow their own communities.”

“Through this partnership, we will be increasing our commitment to blockchain, accelerating scaling and resources for the Ethereum ecosystem, and bringing the value and independence of blockchain technology to millions of Redditors,” states the post.

Reddit initially collaborated with the Ethereum Foundation in June last year when it hosted an Ethereum “Scaling Bake-Off“. The event invited Ethereum-based scaling projects to put forward proposals for how they could help the r/Cryptocurrency community ‘scale’. The scaling in question involves bringing Reddit’s Community Points onto a blockchain-based network, with the eventual goal of scaling to fit all of Reddit’s 430 million monthly users. Unlike traditional, centralized computer networks, the decentralized nature of blockchain makes scaling a particularly troublesome task.

The new partnership will help to further this goal and bring a wealth of new features to the platform. Further to the new partnership, Reddit is already hiring backend engineers and blockchain developers to help build the network and its applications.

Reddit’s Ethereum-based Moon Tokens

Reddit has long been a vocal support of blockchain and cryptocurrencies, with its popular r/Cryptocurrency subreddit recently introducing ‘Moon’ token rewards on the platform. Moon (RCP) tokens are built on the Ethereum blockchain and are now the official cryptocurrency of the r/Cryptocurrency subreddit. Users are rewarded with tradeable Moon tokens when they receive ‘Karma’ for posting unique and insightful content on the subreddit.

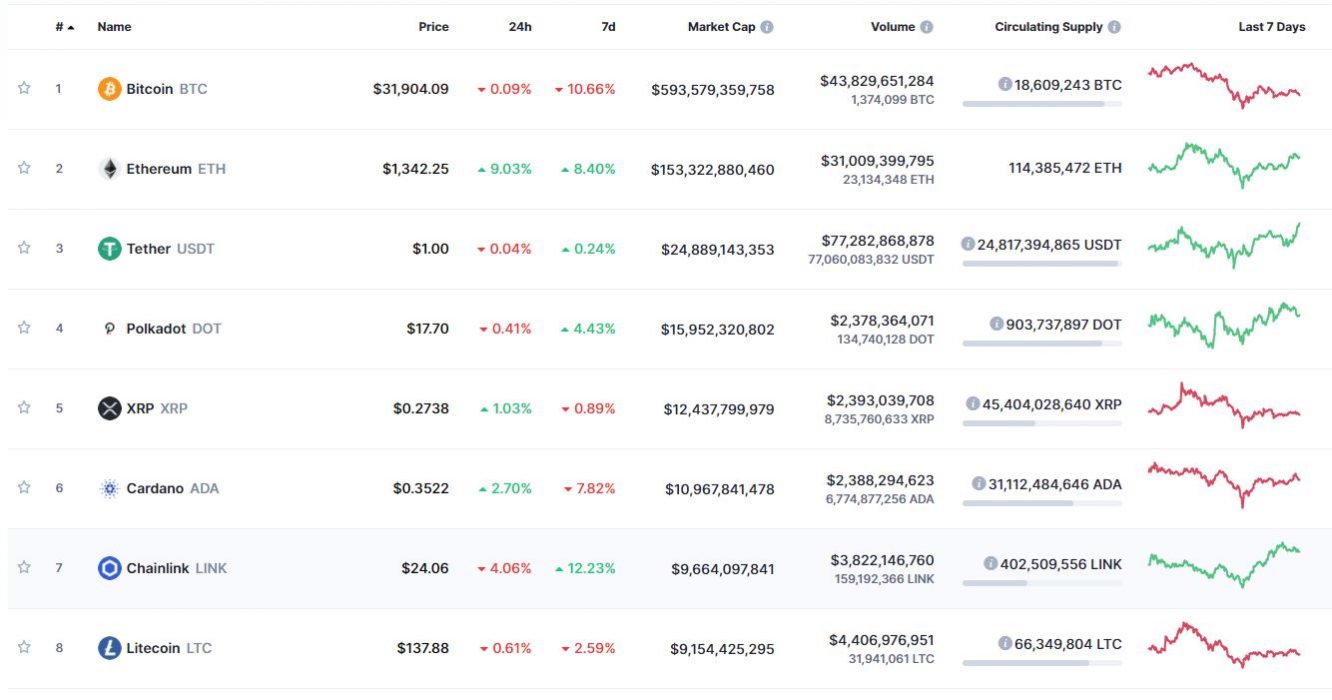

Ethereum Price Action

The good news has helped to push the price of Ethereum (ETH) tokens up by a considerable amount in the past 24 hours, although the cryptocurrency remains slightly down over the past 7 days. It’s been a tough few weeks for cryptocurrencies after Bitcoin (BTC) suffered a rejection at $42,000 earlier this month. Along with most other coins, Bitcoin has been steadily dropping since, hitting a low of $29,300 last week.

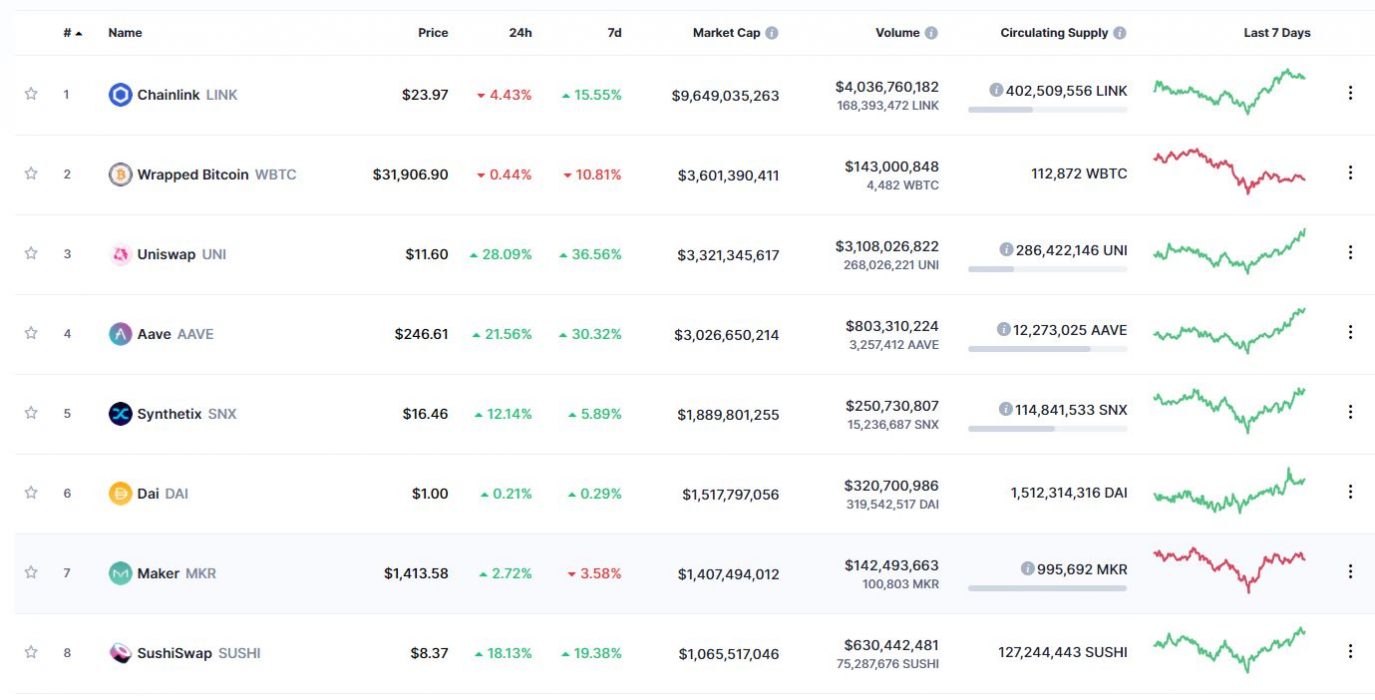

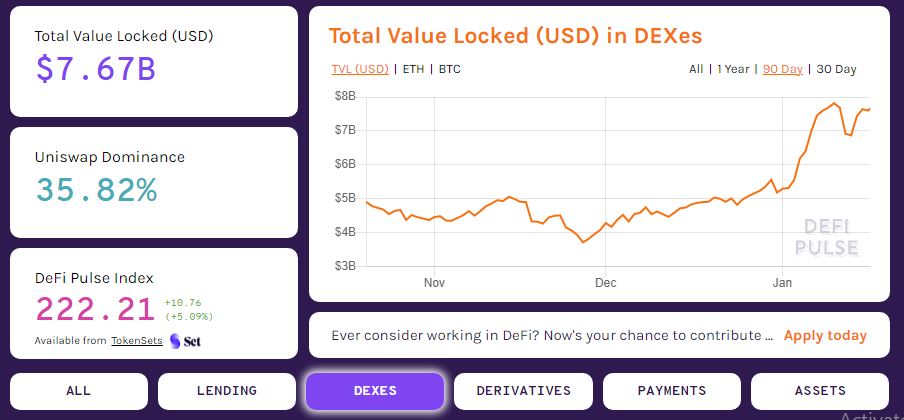

Some altcoins have managed to weather the storm though, particularly in the Defi market. Defi Oracles network Chainlink (LINK) is up 10% in the past week, with Defi protocols Uniswap (UNI) and AAVE up by 60% and 48% respectively.