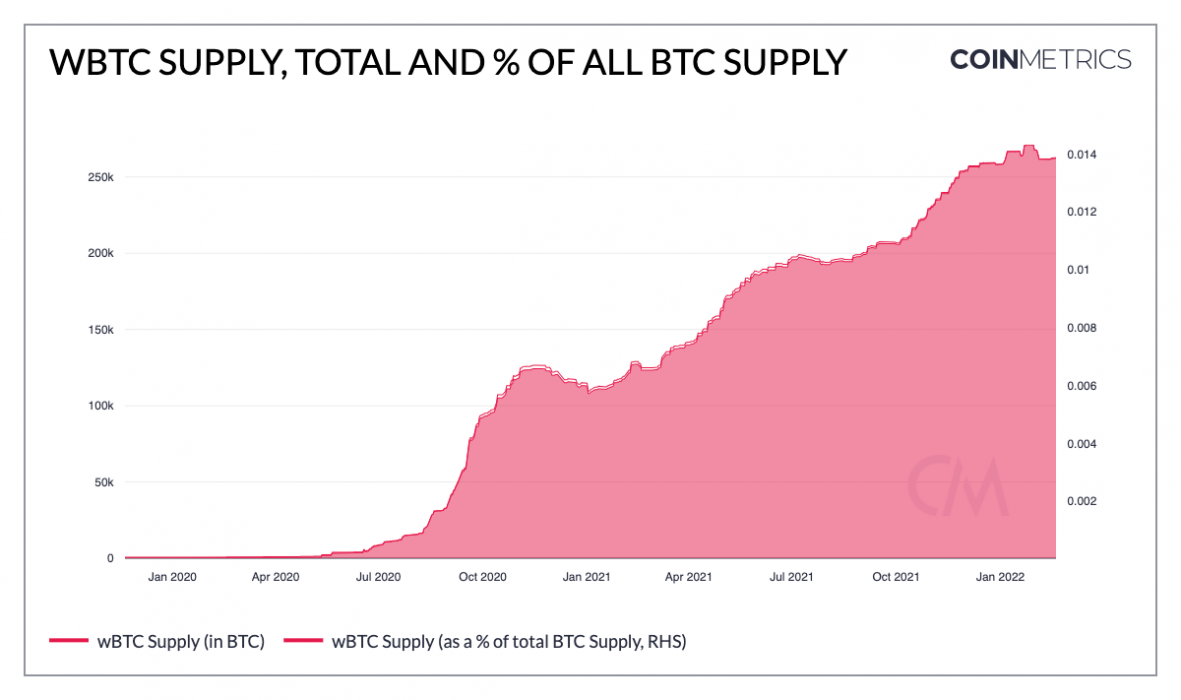

In further evidence of a cooling crypto market, flows of wrapped Bitcoin (wBTC) into Ethereum have flatlined since December 2021.

While wBTC circulation has grown rapidly since its launch in late 2018, it has stagnated so far this year due to weakened interest in DeFi.

Wrapped BTC Reflects HODLers’ Demand for DeFi

In essence, wBTC is an ERC-20 token used to represent BTC on the Ethereum network, which allows BTC holders to take advantage of decentralised finance (DeFi) opportunities on Ethereum without having to sell their BTC. Currently, 66 percent of all wBTC supply is held by smart contracts.

Similar to dollar-backed stablecoins like USDC, wBTC is backed 1:1 with actual BTC. The process of minting new wBTC involves real BTC being sent by the purchaser to a merchant, who in turn sends the BTC to a custodian (in this case, BitGo). The BTC is then held in a multi-sig by the custodian and a corresponding amount of wBTC is minted on the Ethereum network.

Calm After the Storm

Since its launch and until late last year, wBTC circulation grew rapidly, more than doubling between January and December 2021, eventually peaking at just over 260,000 tokens – approximately 1.4 percent of the total Bitcoin supply.

In the months since though, wBTC circulation has stagnated at around the 260,000 mark, reflecting a general weakening trend across the DeFi space. This is reflected in data from DeFiLlama, which shows the total value locked in DeFi protocols has declined to below US$200 billion, having peaked at over US$250 billion in late December.

The flattening of DeFi markets partially reflects the state of the broader market, with the total crypto market cap down some 40 percent since it peaked at nearly US$3 trillion in November 2021. It may also reflect a flight to safety after a series of high profile DeFi hacks and rugpulls, such as the US$326 million Wormhole hack and the ‘polite’ rugpull on the Avalanche network.