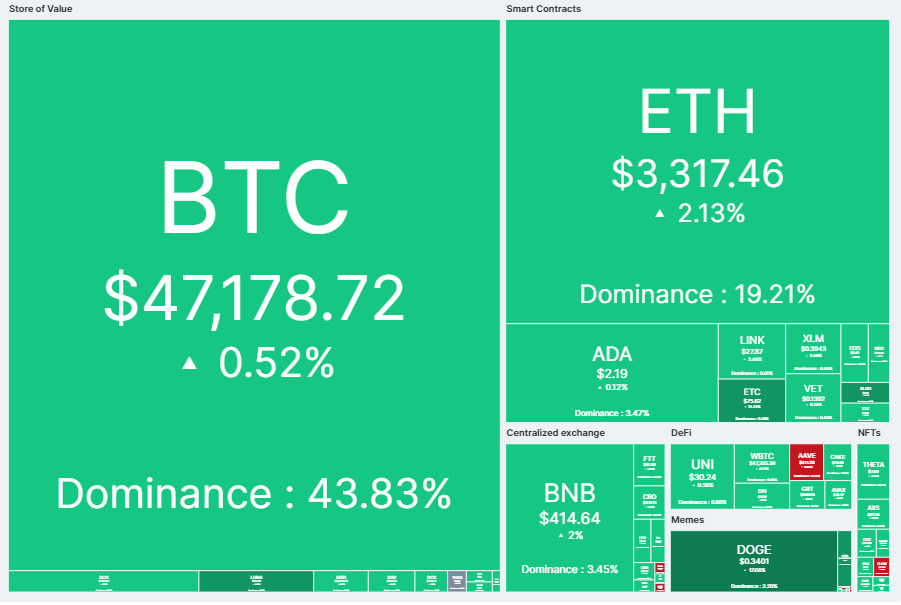

It’s good news for the crypto community as the market recovers positively after months of constant price corrections, once again crossing the US$2 trillion threshold.

Ethereum Up 18%, ADA Surges 40%

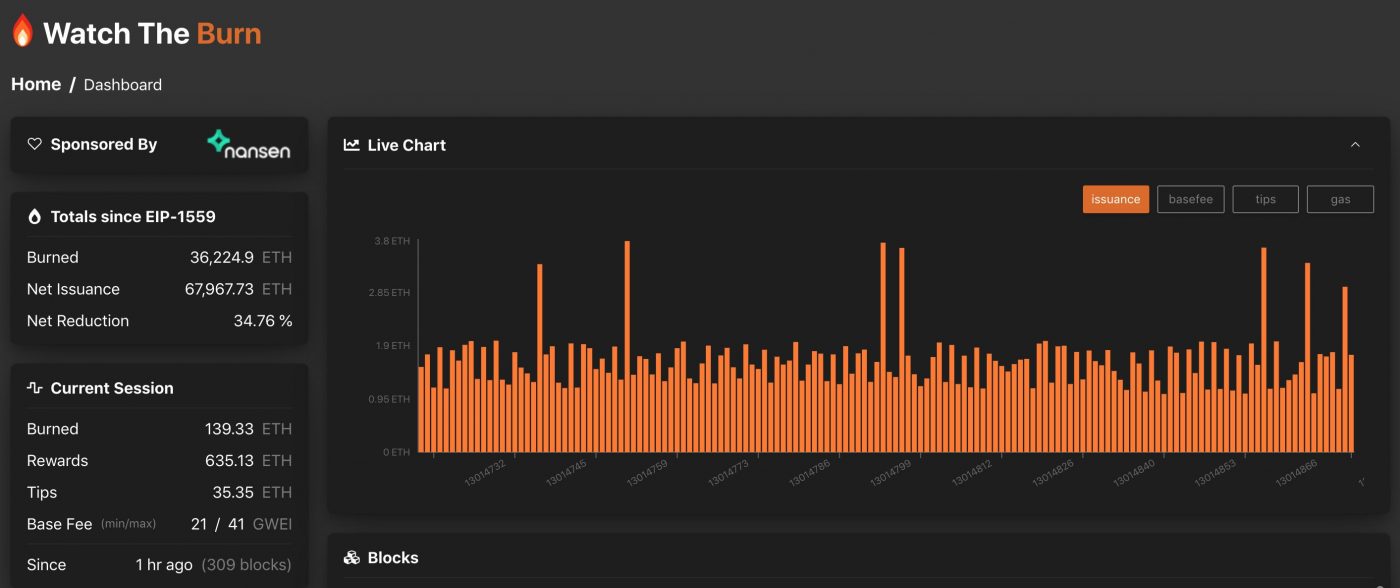

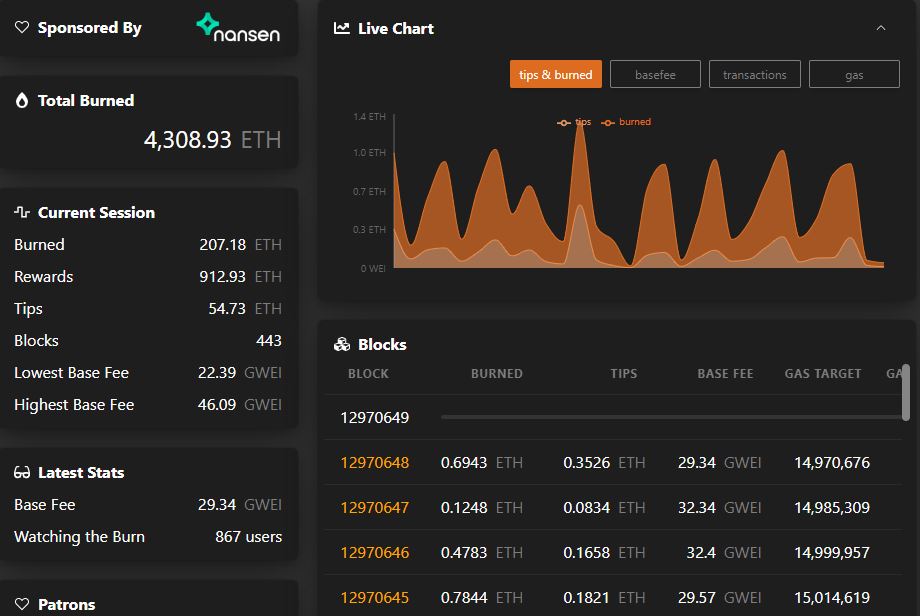

On August 11, the overall crypto market retook its $2 trillion peak following months of massive price corrections that wiped $1 trillion from the market. Bitcoin and most cryptocurrencies were on the green, especially Ethereum, which has been up over 18 percent following the activation of the London hard fork.

Throughout last week, BTC surged 14%, currently priced at US $47,239 as per data from Coinmarketcap. BNB is up 17%, Ripple by 39%, and the one that surprised everyone is ADA, which performed extremely well in the market – up by 40% – after Cardano founder Charles Hoskinson announced that the Alonzo hard fork is imminent. DOGE almost took the protagonism of ADA by surging 39% in the market.

Market Thrives Despite Regulatory Hurdles

The crypto market is ignoring global regulatory uncertainties. Many thought the recent bipartisan infrastructure bill imposed by American authorities would tumble the market, yet it didn’t have as strong an effect as expected.

As Crypto News Australia has reported, the battle for crypto amendments in the US sparked a heated discussion between politicians and industry leaders on Twitter, many calling for proper, revised amendments to change the bill’s outdated and poorly written language. There might be a light at the end of the tunnel with Democrat Senator Anna Eshoo urging House of Representatives Speaker Nancy Pelosi to amend some of the flaws in that bill.

Despite the regulatory uncertainty, bulls are taking the upper hand, and the Bitcoin Fear & Greed Index is finally showing extreme greed after three months. We could also have a new wave of SMSFs approaching the market, as happened on April 8 this year.