A lot has changed in the cryptocurrency market over the past five years. There have been many coin ranking reshuffles, with massive growth in the global market capitalization as more people got to know and invest in digital currencies.

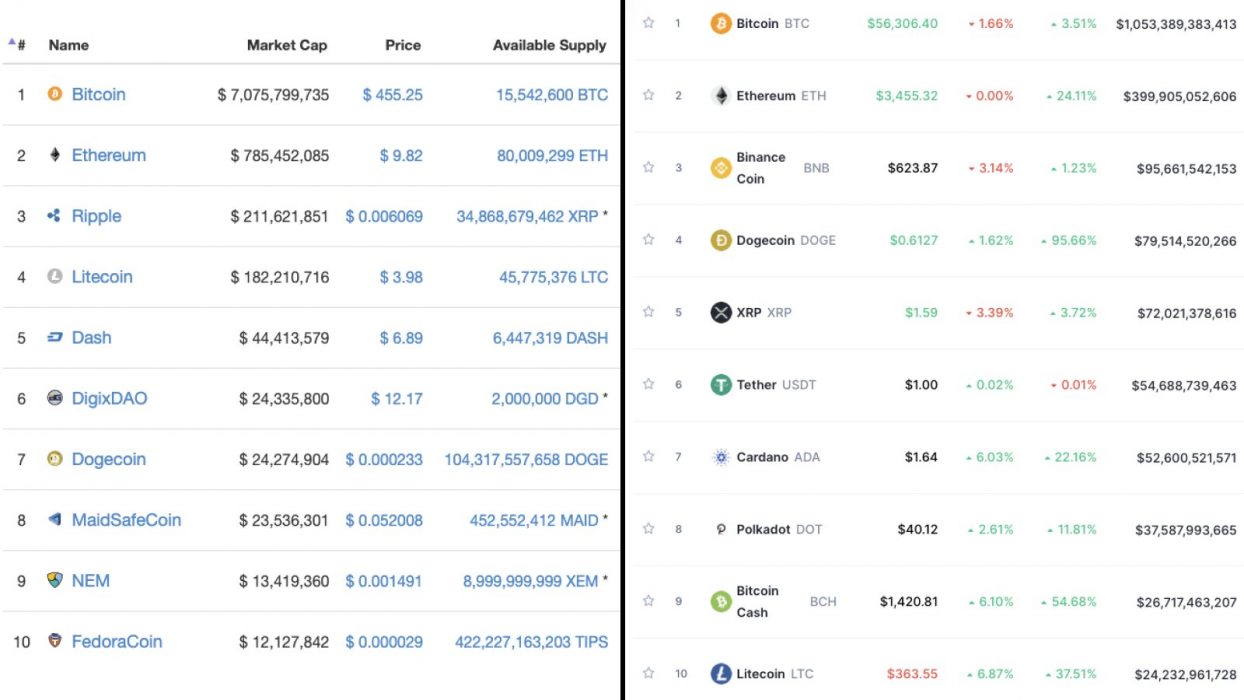

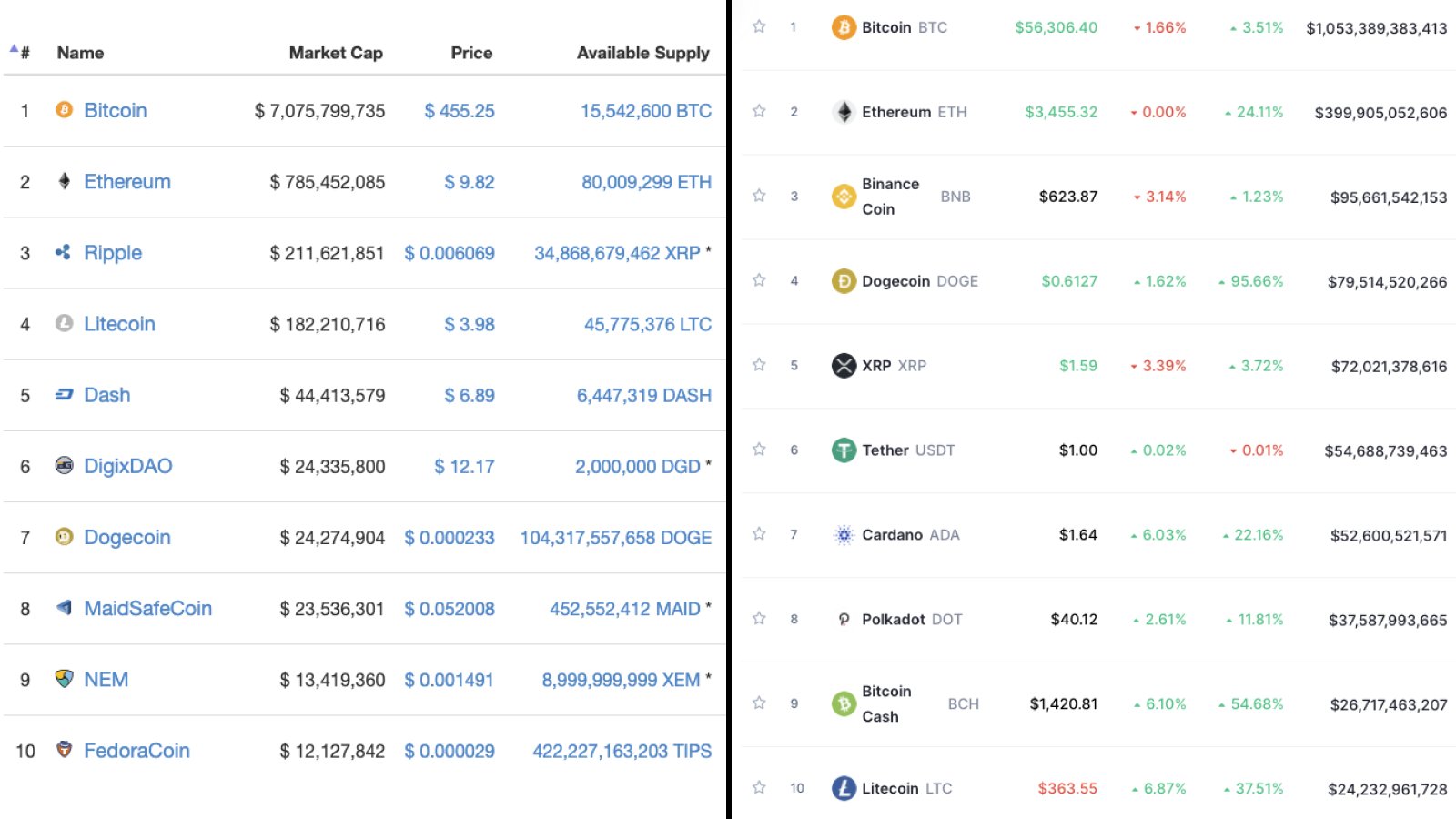

Back in 2016, the top-ten digital currencies by market capitalization (according to data from CoinMarketCap) and their corresponding prices were:

- Bitcoin (BTC) at $455.25 USD

- Ethereum (ETH) at $9.82 USD

- Ripple (XRP) at $0.006069 USD

- Litecoin (LTC) at $3.98 USD

- Dash (DASH) at $6.89 USD

- DigixDAO (DGD) at $12.17 USD

- Dogecoin (DOGE) at $0.000233 USD

- MaidSafeCoin (MAID) at $0.052008 USD

- NEM (XEM) at $0.001491 USD

- FedoraCoin (TIPS) at $0.000029 USD

At the time, Bitcoin was only a three-digit price cryptocurrency ($455 USD), with a total market valuation of $7.075 billion USD. Also, Ethereum was less than $10 USD, while XRP traded around $0.006 USD, according to data from CoinMarketCap.

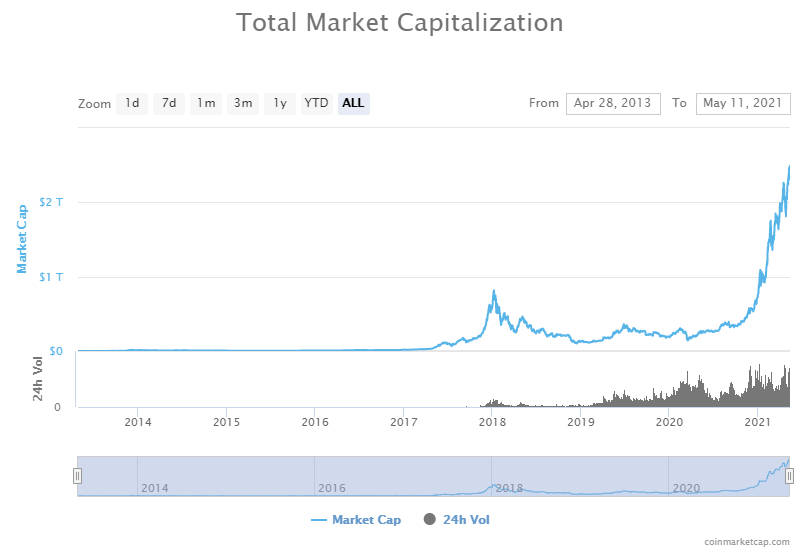

As of May 2016, the global cryptocurrency market capitalization was $8.449 billion USD.

The Crypto Market is up by Over 29,000% Since 2016

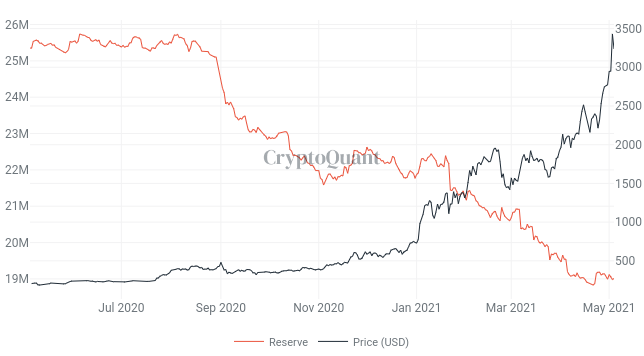

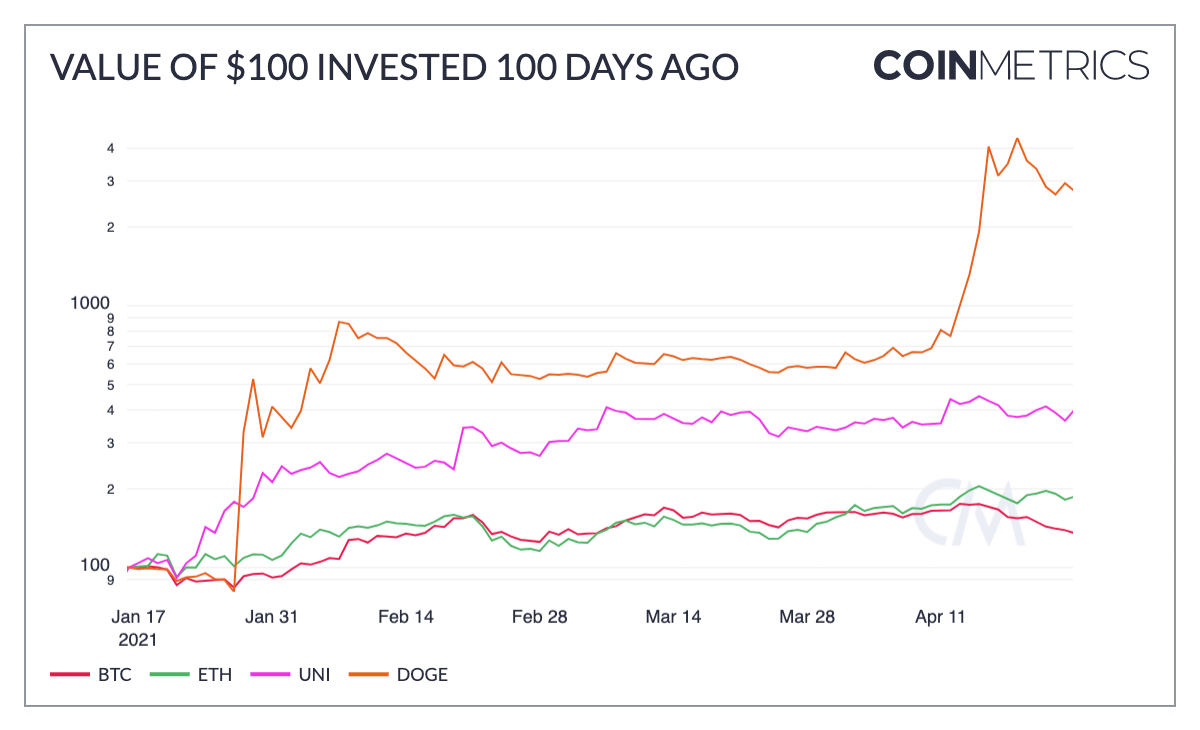

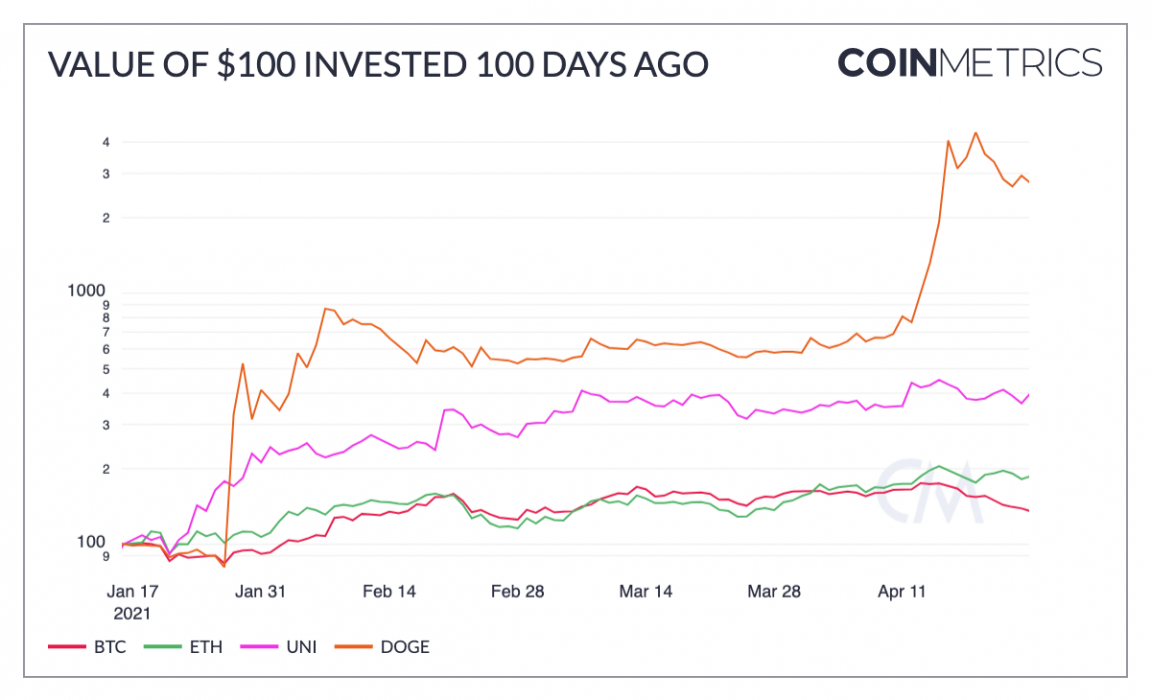

Fast forward to today, the crypto market has seen immense growth of over 29,000 percent in the market cap – in other words, more than 290 times. The total valuation of global cryptocurrencies now sits around $2.47 trillion USD compared to $8.4 billion USD cap in the past five years. This follows the wake of more retail and institutional investors.

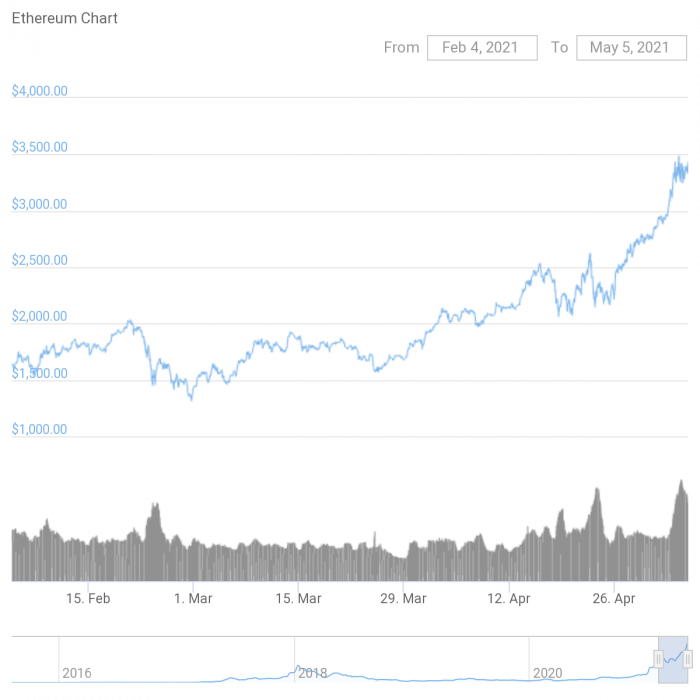

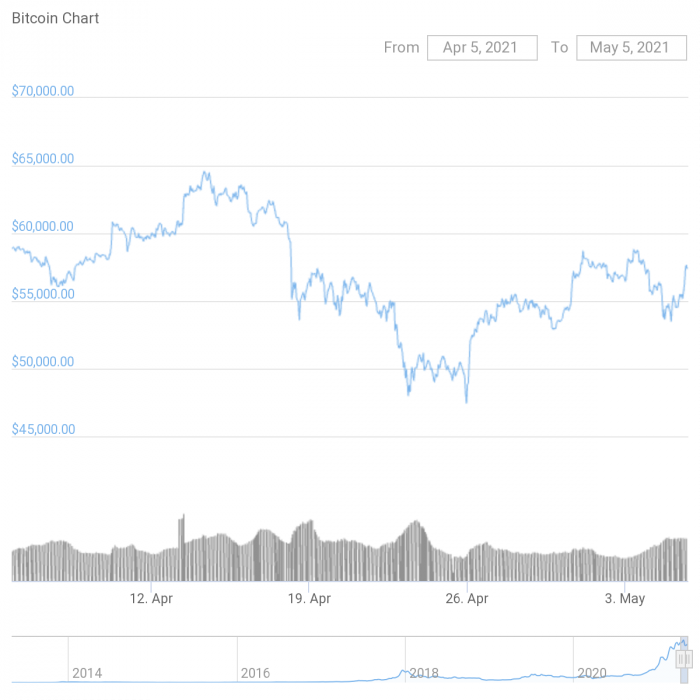

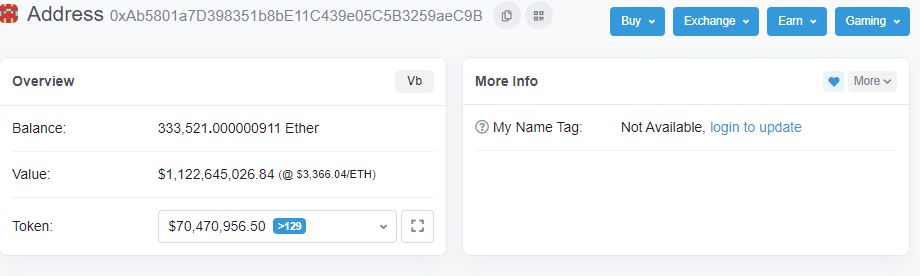

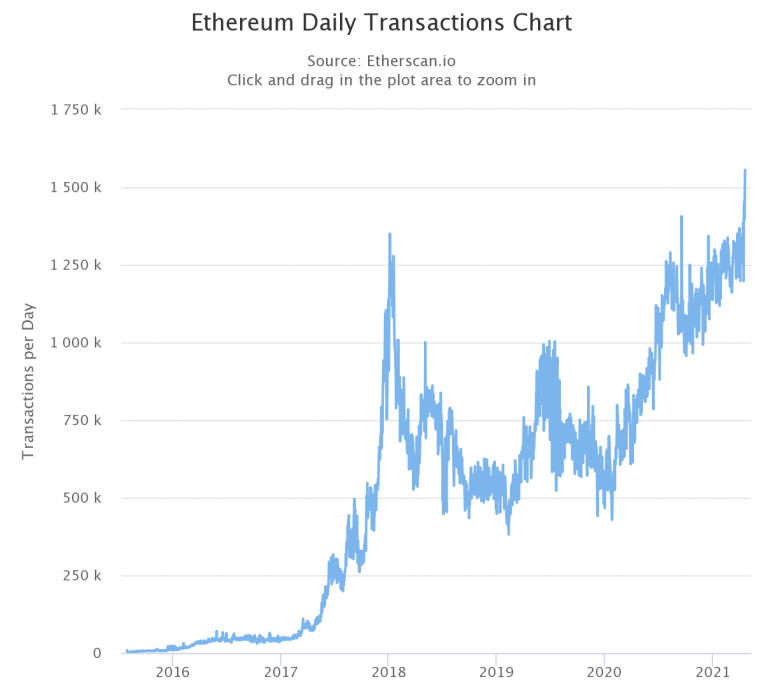

The leading cryptocurrency Bitcoin (BTC) saw over a 12,300 percent increase from 2016 to date, with a market capitalization of over $1 trillion USD. This means that a $100 USD investment in BTC over the past five years would be worth more than $12,000 USD in today’s value. At the same time, the second-largest cryptocurrency Ethereum (ETH) surged by over 41,000 percent, which is a much higher return compared to Bitcoin.

Some of the top-ten coins in 2016 are no longer ranking high on the list today, including DigixDAO and FedoraCoin. It remains to be seen how the list will change in the next five years. Do you think Bitcoin and Ethereum can be overthrown by the likes of Binance Coin (BNB) or even Dogecoin (DOGE)?

![Crypto Total Market Capitalization, 10 May 2021 [CoinMarketCap]](https://content.cryptonews.com.au/wp-content/uploads/2021/05/20210510-marketcap-1400x536.png)