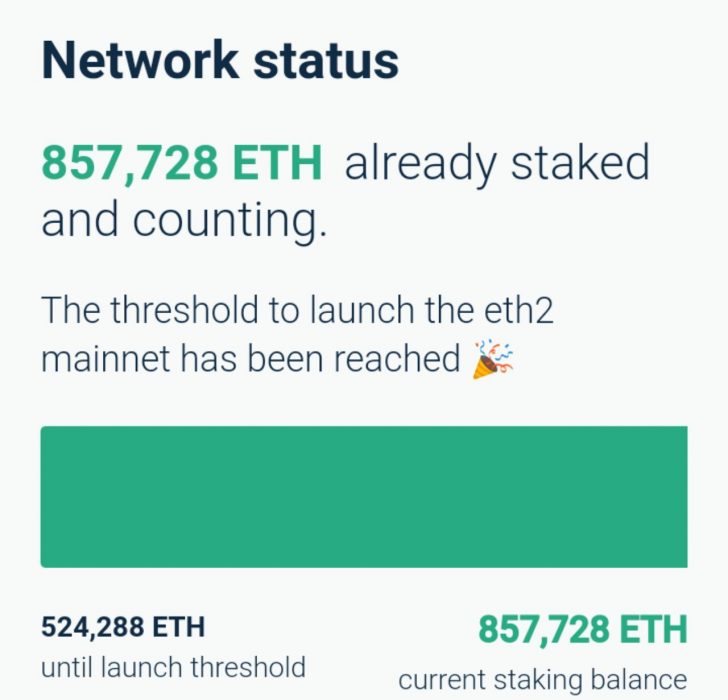

Before the launching of the Ethereum 2.0 Beacon Chain on December 1, a few Ethereum protocols, including Lido Finance, had revealed plans to work on solving the “illiquidity” issue with Ether (ETH) staked on the network. Today, Lido is pushing towards this development, as a tweet confirmed that Lido raised millions of dollars from prominent companies in preparation for its Eth2 staking mainnet.

Illiquidity Issue With Eth2 Staking

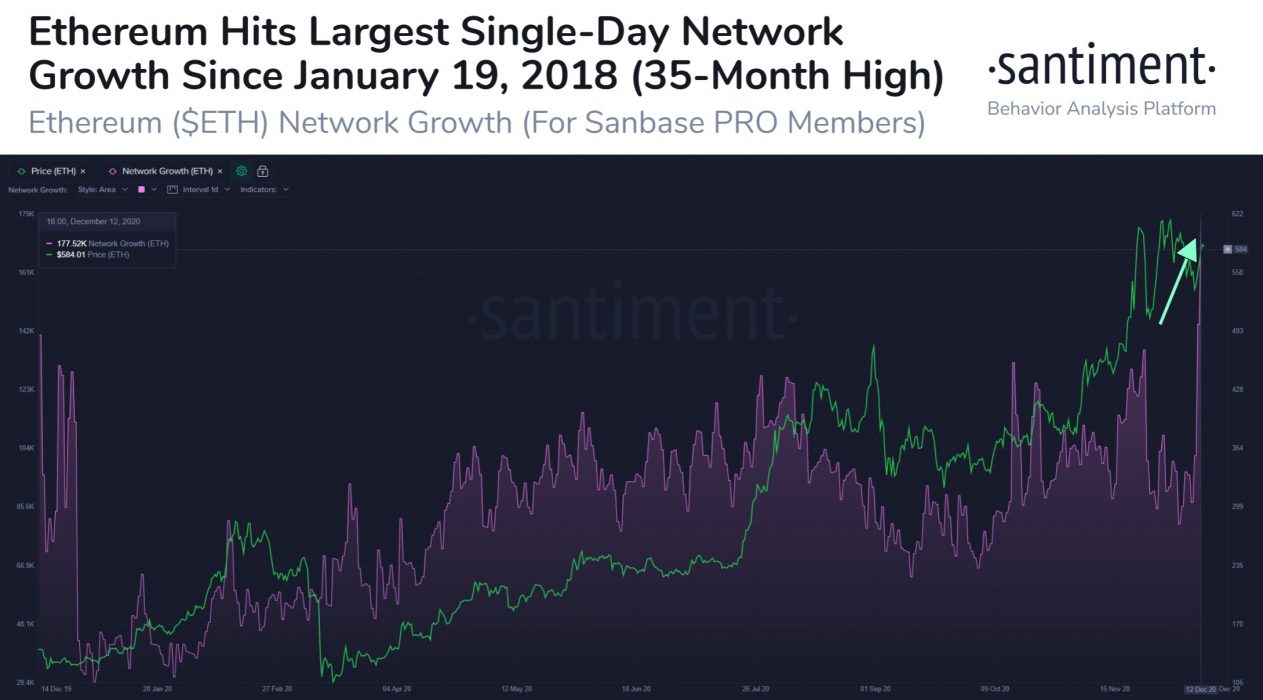

Notably, the current Ethereum network is moving to a proof-of-stake (PoS) model with Ethereum 2.0. This transition is expected to be completed in four phases, one of which has been launched already. Although users can stake ETH on the network, these coins are considered illiquid due to the fact that it can’t be withdrawn, at least till the next Eth2 development phase launches.

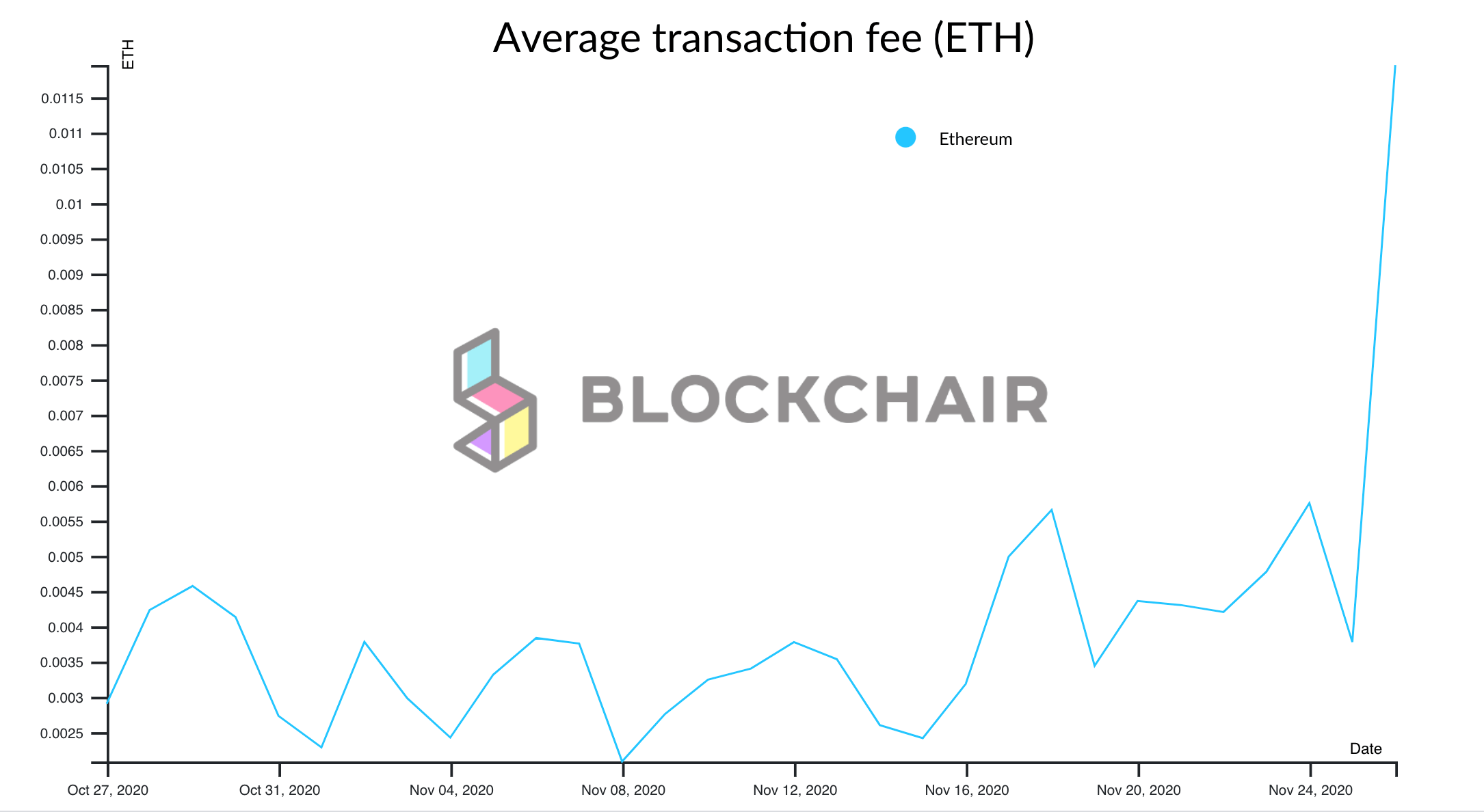

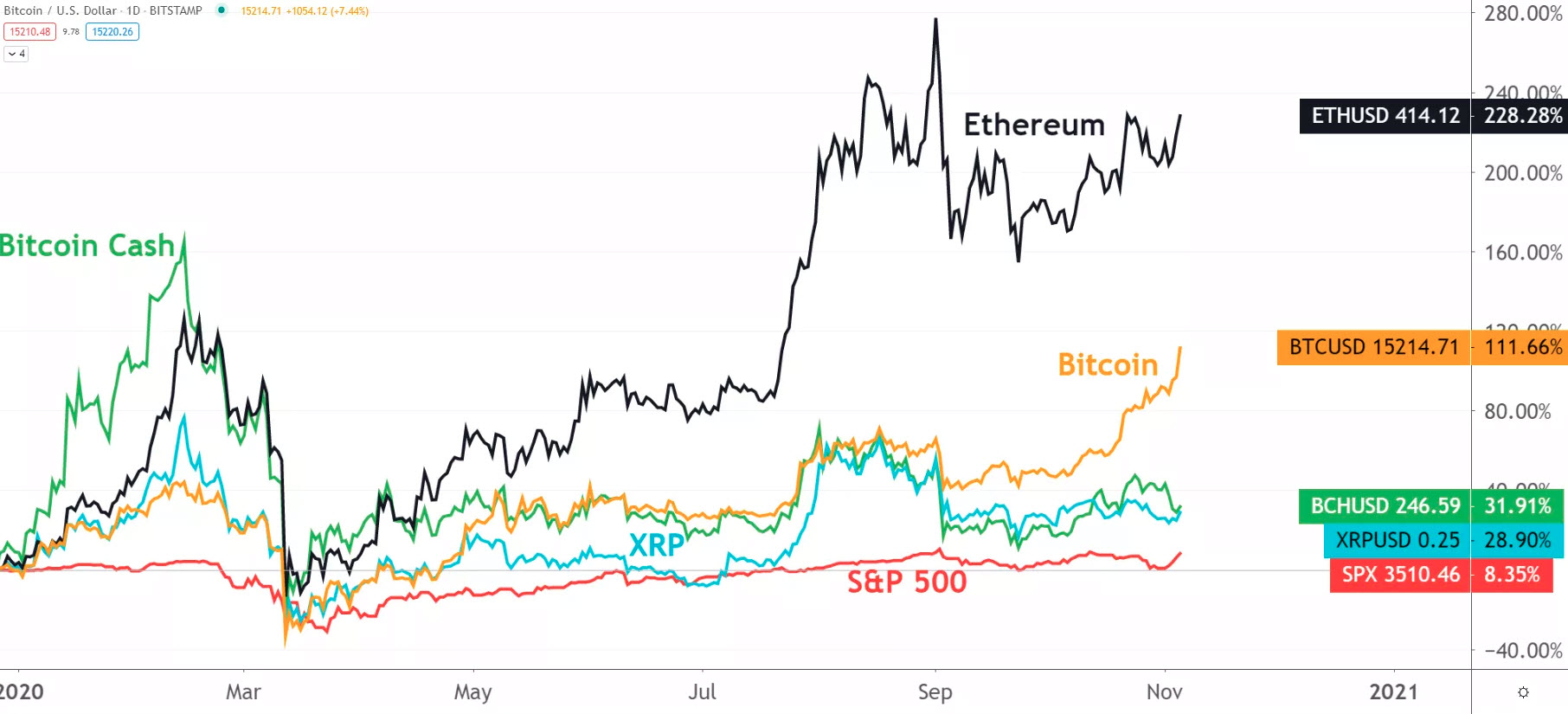

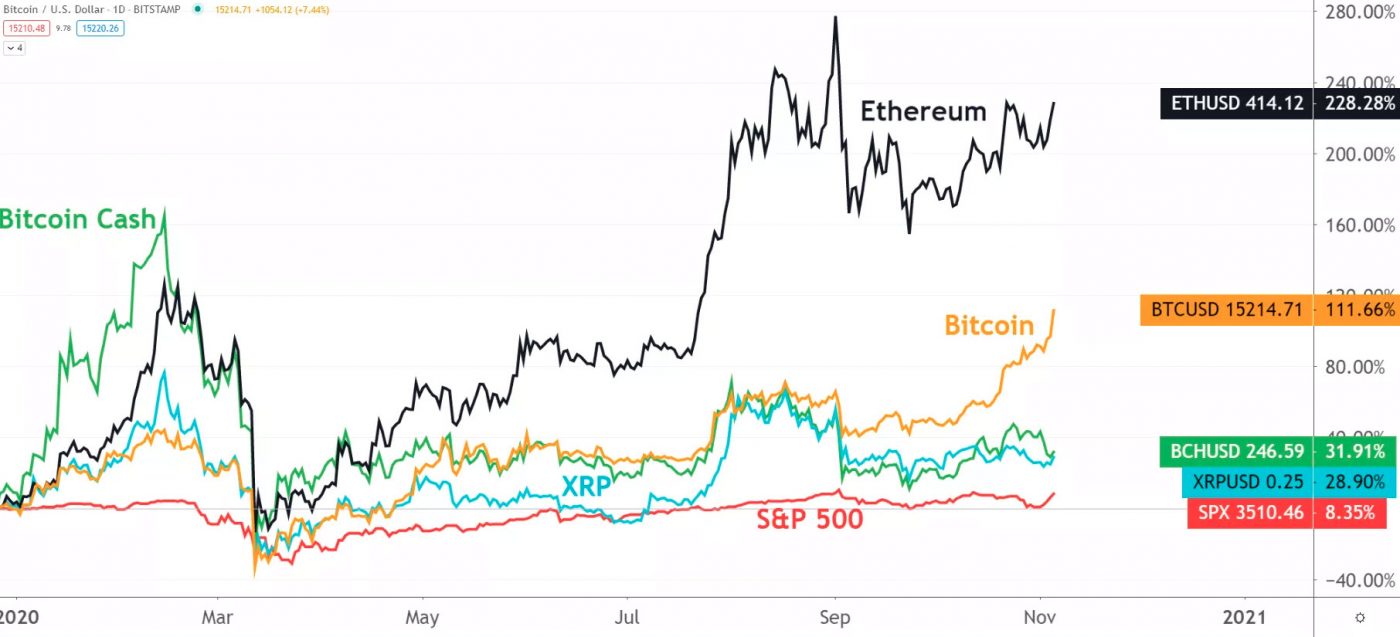

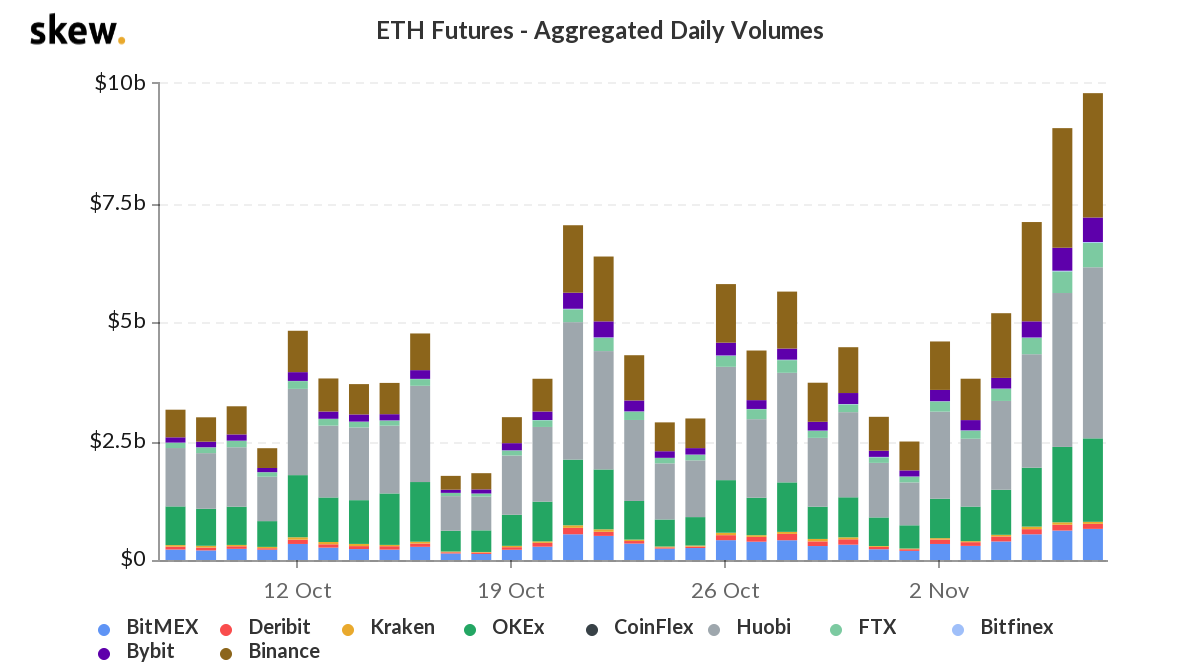

Judging by this, many industry experts raise concerns that this might slow down the rate of ETH staking on the network. This is because many people would prefer to lock their coins in crypto exchanges for trading or in decentralized finance (DeFi) yield farming protocols to make even more profit than staking. Besides, they can choose to withdraw these coins anytime, anywhere, unlike when they are staked.

For this reason, Lido planned to introduce a liquid staking service for Ethereum 2.0.

Lido Prepares for Mainnet Launch

The Eth2 staking service provider intends to achieve this liquidity by issuing an ERC-20 token, stETH, for any ETH staked on the network. This will serve as the tokenized version of the coins staked, as well as in value. Lido noted that stETH could be traded on exchanges and also used in DeFi protocols for yield farming. In this way, the Ethereum users have nothing to lose, as they will receive an equivalent token for any coin they stake.

With the US$2 million fundraise, Lido is preparing to debut the Eth2 liquid staking mainnet later this month. There are possibilities that this service will go mainstream in the coming year.