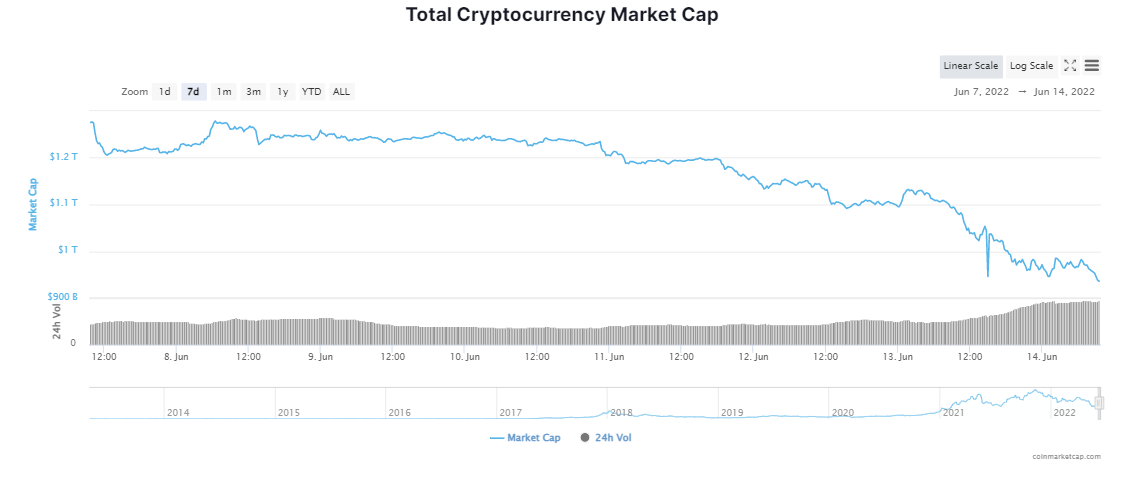

For the first time since December 2020, bitcoin dropped below US$20,000 as crypto markets tumbled this past weekend amid US$600 million being liquidated within 24 hours.

Despite some panicking, others took a more sanguine approach:

Macro-Led Meltdown

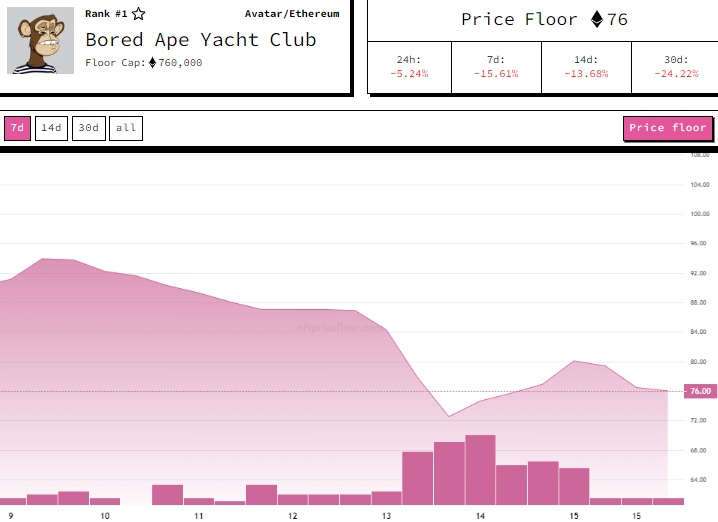

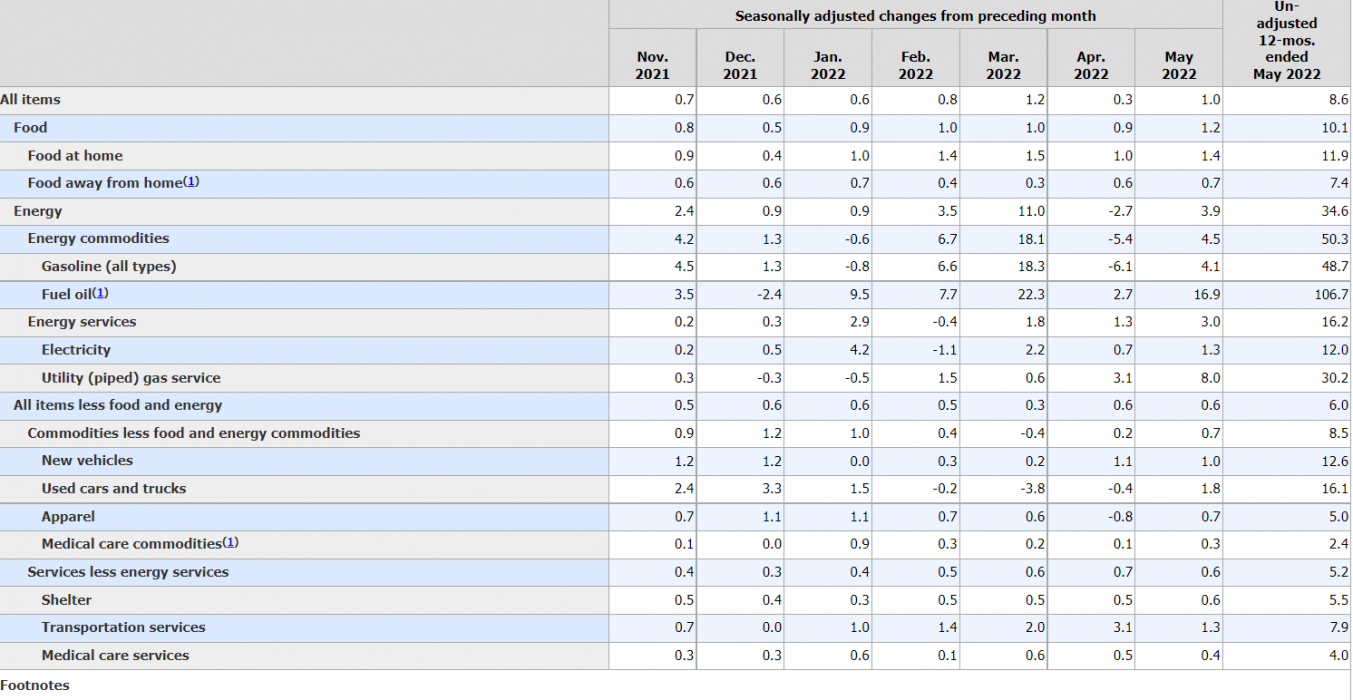

Unlike prior cycles, bitcoin is well and truly integrated within the broader global macroeconomy. Against a backdrop of US inflation hitting a 40-year high, coupled with an aggressive rates rise by the Fed, all risk assets were inevitably going to feel the pain.

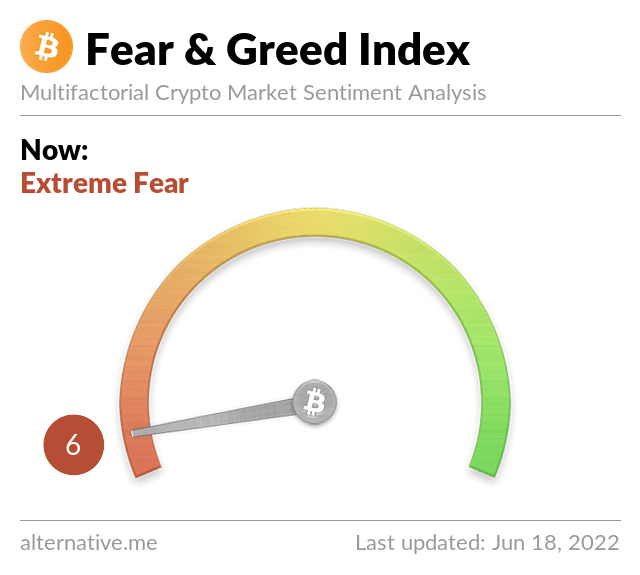

With the market in full fear mode, dialled up in part thanks to Celsius halting withdrawals, the broader crypto market was already well-poised for a breakdown. Fear, coupled with the sector’s affinity for leverage, and suddenly you had a situation where bitcoin and crypto fell off a cliff.

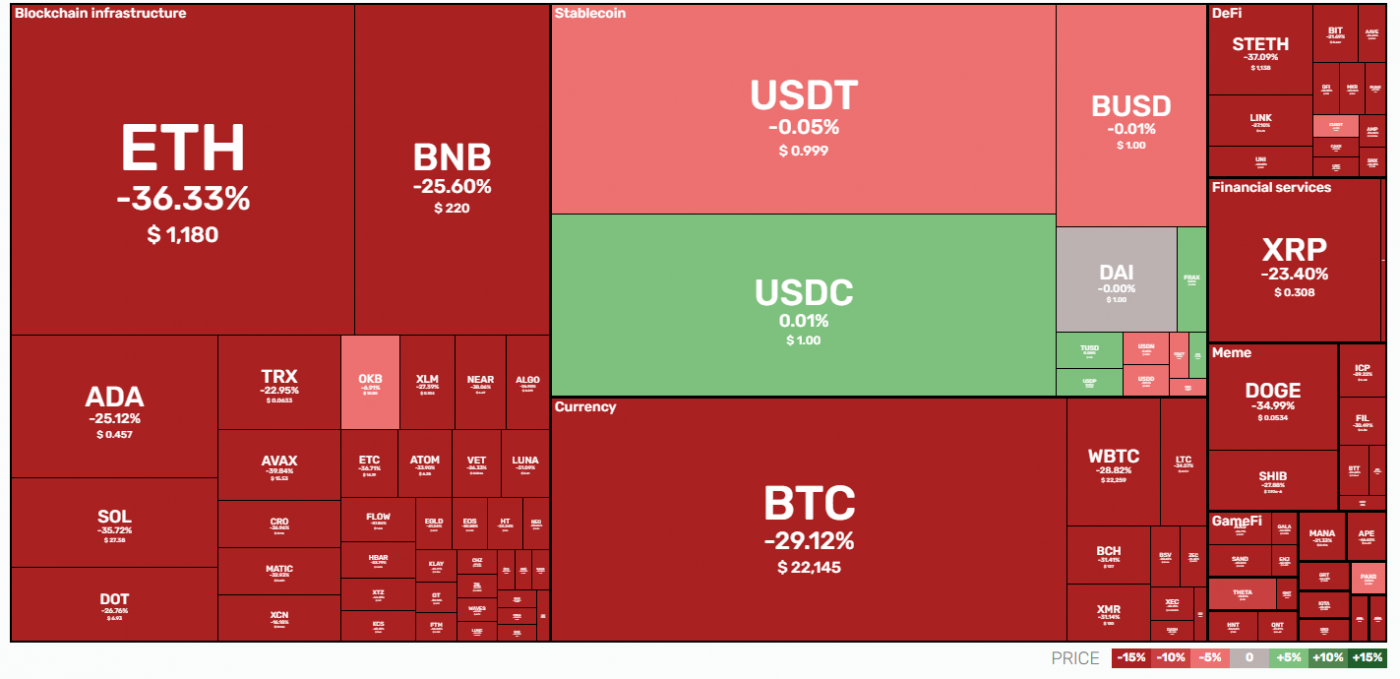

ETH dropped below US$950 and BTC broke the previous cycle’s all-time high, collapsing to US$17,500. All over Twitter, commentators spoke how it was now official that “all models are broken”:

Some even took to ridiculing Bitcoin’s laser-eyed chief protagonist, Michael Saylor:

Slight Recovery

As bitcoin slid below US$19,000, commentators were left wondering when the carnage would end. Glassnode’s on-chain analyst Checkmate highlighted bitcoin’s difficulty regression model being priced at US$17,600, that being the cost to mine BTC, as a possible bottom.

Not long after, BTC bounced off the difficulty regression model, providing some temporary relief:

BTC has since regained some of the losses, clawing its way back up above US$20,000, however it remains almost 25 percent down over the past week.

ETH has similarly recovered somewhat, following in BTC’s steps, and at the time of writing was trading at just over US$1,100, close to 24 percent down on the week:

For long-term holders with high levels of conviction, now may be as good a time as ever to gain exposure. However, the market remains riddled with fear, suggesting that few are likely to dive in. Market psychology is indeed a strange thing …