Leading US crypto exchange Coinbase has announced the imminent launch of its new NFT marketplace, with a social spin to it – like Instagram – to help connect users and creators.

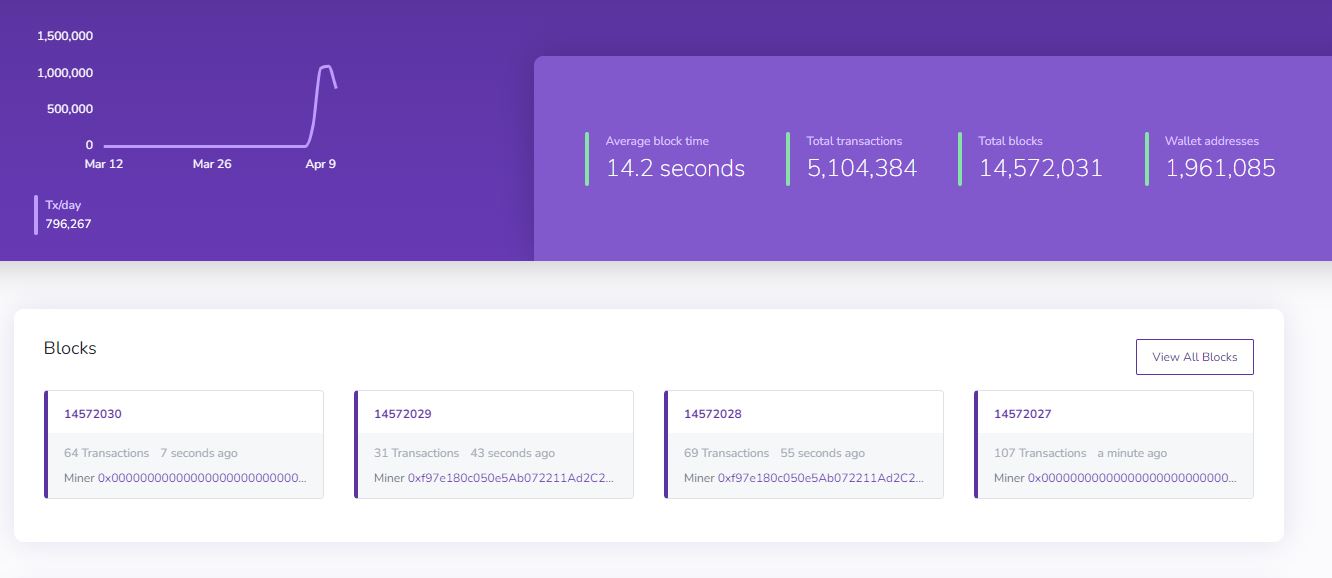

The NFT marketplace is now in beta after Coinbase unveiled its plans in October last year for a “Web3 social marketplace”. It is being built on the Ethereum (ETH) blockchain and reportedly “any NFT that’s for sale on the Ethereum blockchain will be searchable” on its platform.

Users who are interested in the beta and want to have a look at their collections can do it here. At launch, the exchange will allow its 43 million users to easily access NFTs through the platform. The marketplace will also be adding support for other blockchains in the near future.

For a limited time, the platform will incur zero transaction costs, except for Ethereum gas fees to process a transaction on the blockchain. The platform will also require users to use a self-custody wallet such as Metamask or the Coinbase wallet.

Social Platform to Build Engagement

The platform’s beta testers who join through the waitlist are encouraged to make use of all functions, including new social features. Having received over 8 million applications, the platform may well be in a position to compete with market leader OpenSea. This could be done by not only being an NFT marketplace, but also a platform where creators can build and engage with their communities.

According to the Coinbase announcement:

We learned that people don’t just want better tools to buy and sell NFTs – they want better ways to discover them, better ways to find the right communities, and better spaces in which they can feel connected with each other.

Sanchan Saxena, VP of product, ecosystem products, Coinbase

To create more of a community feel, the platform will add social feeds to facilitate browsing of other creators’ portfolios. In an Instagram-like approach, users will have profiles tied to their wallets so users can interact with each other. The marketplace will also incorporate a recommender based on buying history, who the user follows, and other metrics.

We’d like to make Coinbase NFT a little bit more like Instagram, as opposed to, say, an auction like eBay or something like that […] I think having people that you can follow, your favourite artists or creators, and having a feed of content that gets populated from those people you follow, could be really powerful.

Brian Armstrong, Coinbase CEO

NFT Marketplace to Become Decentralised in the Future

At this stage, the platform will operate on Coinbase’s centralised servers, but in time it will be moved to decentralised solutions. In that event, the platform will include functions such as airdrops, minting, and token-gated communities. The platform will also be used to host drops by some of its many launch partners.

Royalties play a very important part in keeping the creator economy alive and are therefore one of the major focus points of the new marketplace: